Offer status

Wells Fargo Attune℠ Card and Wells Fargo Signify Business Cash® Card are unavailable on Motley Fool Money. All information was collected independently and not reviewed for accuracy or provided by the credit card issuer. Some items may be out of date.

Wells Fargo's credit card rewards program, called simply "Wells Fargo Rewards," is ideal if you want straightforward cash rewards or travel rewards.

As someone who's been writing about credit cards for years -- and is a frequent user of the Wells Fargo Active Cash® Card (rates and fees) -- I can speak for the simple pleasures of Wells Fargo and its rewards program.

I'll walk you through how to get you started, including how to earn, redeem, and maximize value from your Wells Fargo credit cards.

How Wells Fargo Rewards work

What are Wells Fargo Rewards?

Wells Fargo Rewards are the currency you earn when you use qualifying Wells Fargo credit cards. You're essentially being rewarded for your loyalty every time you use your Wells Fargo card. Wells Fargo in particular is known for its simple, straightforward rewards redemption options.

Cards that earn Wells Fargo Rewards

|

|

| Wells Fargo Active Cash® Card | Wells Fargo Autograph Journey℠ Card |

|

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

4.80/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

4.80/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. $200 cash rewards |

Welcome Offer: Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip 60,000 bonus points |

|

Rewards Program: Earn unlimited 2% cash rewards on purchases. 2% cash rewards |

Rewards Program: Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases. 1X-5X points |

|

Intro APR: 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers Purchases: 0% intro APR for 12 months from account opening on purchases Balance Transfers: 0% intro APR for 12 months from account opening on qualifying balance transfers |

Intro APR: Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 18.49%, 24.49%, or 28.49% Variable APR |

Regular APR: 19.49%, 25.49%, or 28.49% Variable APR |

|

Annual Fee: $0 |

Annual Fee: $95 |

|

Highlights:

|

Highlights:

|

Show More

Show Less

Show Less

|

|

At Motley Fool Money, every credit card we review is rated on a 5-star scale, scored to a tenth of a point. Our ratings weigh the features that matter most: rewards rates, 0% intro APR offers, welcome bonuses, fees, and perks like travel credits and purchase protections.

We score cards within four primary categories:

- 0% intro APR cards for paying down balances or financing purchases

- Travel cards for maximizing points, miles, and perks on the road

- Cash back and rewards cards for everyday spending value

- Business cards designed to fit company expenses and growth

Top-rated cards typically combine strong long-term value, attainable bonuses, low fees, and standout protections or perks.

We combine these factors with an evaluation of brand reputation and customer satisfaction to ensure you're getting the best credit card recommendations. Our aim is to maintain a balanced best-of list featuring top-scoring credit cards from reputable brands. 'Best for' category selections on this page are determined by our editors, and a single card may be recognized in multiple categories.

Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates credit cards.

At Motley Fool Money, every credit card we review is rated on a 5-star scale, scored to a tenth of a point. Our ratings weigh the features that matter most: rewards rates, 0% intro APR offers, welcome bonuses, fees, and perks like travel credits and purchase protections.

We score cards within four primary categories:

- 0% intro APR cards for paying down balances or financing purchases

- Travel cards for maximizing points, miles, and perks on the road

- Cash back and rewards cards for everyday spending value

- Business cards designed to fit company expenses and growth

Top-rated cards typically combine strong long-term value, attainable bonuses, low fees, and standout protections or perks.

We combine these factors with an evaluation of brand reputation and customer satisfaction to ensure you're getting the best credit card recommendations. Our aim is to maintain a balanced best-of list featuring top-scoring credit cards from reputable brands. 'Best for' category selections on this page are determined by our editors, and a single card may be recognized in multiple categories.

Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates credit cards.

Other Wells Fargo card options include:

- Wells Fargo Signify Business Cash® Card: 2% cash rewards on purchases made for your business

- Wells Fargo Attune℠ Card: 4% cash rewards in niche categories like self-care, entertainment, and eco-friendly spending

- Wells Fargo Autograph® Card (rates and fees): Earn up to 3X points without paying an annual fee

Can you have more than one of these cards?

Absolutely -- if you have multiple Wells Fargo cards, you can even pool your rewards for increased value and flexibility, like pairing a cash back card like the Wells Fargo Active Cash® Card with a travel card like the Wells Fargo Autograph® Card.

Ways to earn Wells Fargo Rewards

You can rack up Wells Fargo Rewards by using your eligible Wells Fargo credit card. Each card has its own earnings rates, like:

- Wells Fargo Active Cash® Card: Unlimited 2% cash rewards on all purchases, with no bonus categories or limits to track. I value the versatility and flexibility of my Wells Fargo Active Cash® Card -- I can swipe it no matter where I'm at and feel confident that I'm getting a solid return.

- Wells Fargo Autograph® Card: 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans, and 1X points on other purchases

- Wells Fargo Autograph Journey℠ Card (rates and fees): 5X points on hotels, 4X points with airlines, 3X points on restaurants and other travel, and 1X points on other purchases

- Wells Fargo Signify Business Cash® Card: 2% cash rewards on purchases made for your business

- Wells Fargo Attune℠ Card: 4% cash rewards in niche categories like self-care with gym memberships, at spas, and salons, select sports, entertainment, and recreation, and EV charging stations, riding public transportation, and purchasing select second hand and vintage, and 1% cash rewards on other purchases

You'll also get rewards by earning the welcome bonuses on these cards, which will require that you spend a certain amount on the card in your first few months of card ownership (i.e., $200 cash rewards on the Wells Fargo Active Cash® Card by spending $500 in 3 months).

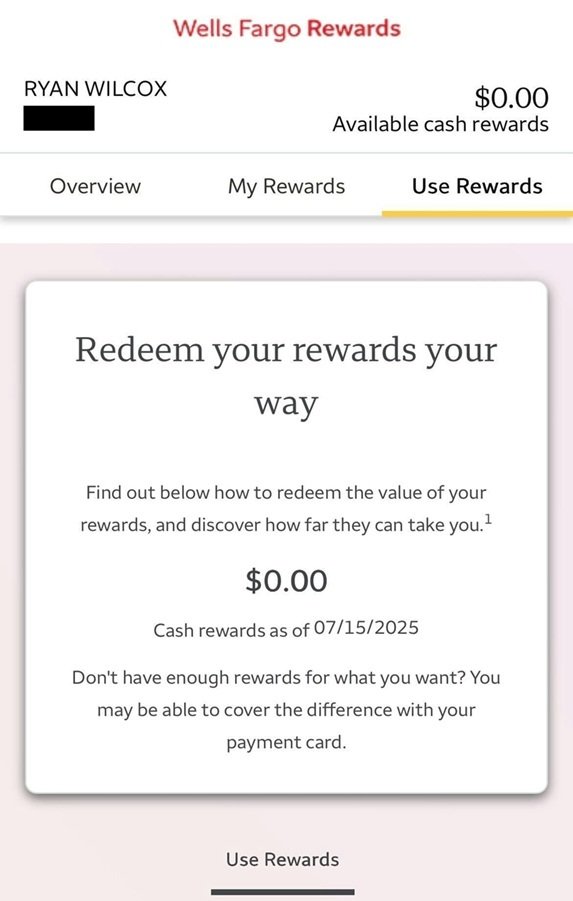

Best ways to redeem Wells Fargo rewards

Cash rewards

You can redeem your Wells Fargo Rewards for a statement credit, direct deposit into a Wells Fargo account, or ATM withdrawal in $20 increments (if you have a Wells Fargo debit or ATM card). Cash rewards are my go-to -- I love the thrill of putting money right back into my checking account, like another mini-paycheck just for using my Wells Fargo Active Cash® Card.

Just last month, I moved $150 in hard-earned rewards right back to my Wells Fargo account before hitting the mall for some new clothes. It was a simple, easy way to take advantage of my rewards, and I was able to put the purchases on my card itself, then pay it off with my rewards.

Travel

With Wells Fargo travel cards, you can also use rewards to book flights, hotels, and more through the Wells Fargo Rewards portal.

Wells Fargo Autograph® Card and Wells Fargo Autograph Journey℠ Card have access to a select list of transfer partners for their points. Wells Fargo Active Cash® Card holders can also transfer cash rewards to one of the Autograph cards in order to utilize this option. Transfer partners include:

- Choice Privileges®

- Flying Blue (Air France-KLM)

- British Airways Executive Club

- Virgin Red / Virgin Atlantic

- Iberia Plus, AerClub, Avianca LifeMiles

Gift cards, merchandise and more

You can also redeem your rewards for:

- Gift cards: Options from dozens of retailers, often starting at $25

- Merchandise: Redeem points for items like electronics or home goods.

- Charitable donations: Donate your points to eligible nonprofit organizations.

Another upside: there are no caps or expiration dates on Wells Fargo Rewards as long as your account remains open and in good standing.

How to maximize your Wells Fargo Rewards

Use the right card for each purchase to maximize bonus categories

If you have a card like the Wells Fargo Autograph® Card, make the most of it by focusing your spending in the bonus categories, such as dining, travel, and gas. You can rack up rewards more quickly by using different cards for different bonus categories.

Combine rewards across cards to unlock more redemption options

Pooling your rewards can also give you more flexibility when it's time to cash in. Wells Fargo also makes it easy to combine points if you hold multiple cards, meaning you can use rewards earned on a card like the Wells Fargo Active Cash® Card for travel rewards if that's more your bag.

Check the rewards portal regularly for deals and discounts

The Wells Fargo Rewards portal sometimes features limited-time offers like discounted gift cards or travel deals. Checking in now and then can help you stretch your points even further.

Who should get a Wells Fargo Rewards card?

Wells Fargo Rewards cards are a great fit for people who want simple, flexible rewards without a lot of effort. They're also ideal for people who already bank with Wells Fargo and want the convenience of managing rewards and finances in one place.

Why Wells Fargo Rewards are worth it

Wells Fargo Rewards stand out for their simplicity and flexibility. With no annual fees on popular cards like the Wells Fargo Active Cash® Card, I've already earned hundreds in easy rewards without having to worry about additional cost.

Whether you're new to credit card rewards or just want a no-fuss program, Wells Fargo delivers solid everyday value with minimal hassle.

-

Article sources

- https://creditcards.wellsfargo.com/

- https://www.wellsfargo.com/rewards/

- https://creditcards.wellsfargo.com/cards/business-credit-cards/signify-business-cash-credit-card/

- https://creditcards.wellsfargo.com/attune-credit-card/

- https://creditcards.wellsfargo.com/cards/active-cash-credit-card/

- https://creditcards.wellsfargo.com/cards/wells-fargo-autograph-visa-credit-cards/

FAQs

-

Yes, especially if you want simple, flexible cash rewards. Cards like the Wells Fargo Active Cash® Card offer flat rewards with no annual fee, making them easy to use and valuable for most people.

-

No, rewards won't expire as long as your account stays open and in good standing.

-

For cash redemptions, the minimum is usually $25 (or 2,500 points). ATM redemptions require $20 minimums in $20 increments.

The Motley Fool owns shares of and recommends Mastercard and Visa.