How Much Time Does the Average American Spend on Personal Finance?

KEY POINTS

- PLANNING DECLINES: Only 2.6% of Americans engaged in financial planning daily in 2023, a decrease from previous years.

- AGE MATTERS: Financial planning engagement increases with age, with those 65 and older being the most involved.

- CRISIS RESPONSE: One in four Americans surveyed by Motley Fool Money primarily start financial planning in response to unexpected expenses or income loss.

Many Americans consider being financially organized and prepared a top priority: a 2019 study from Northwestern Mutual found that 92% of Americans age 18 and over agreed with the statement "Nothing makes me happier or more confident in life than feeling like my finances are in order."

It takes time and effort to make that feeling of financial organization a reality, but data from the Bureau of Labor Statistics suggests that fewer Americans are regularly engaging in financial planning.

On top of that, 1 in 4 respondents to a Motley Fool Motley Fool Money survey said that they primarily engage in financial planning in response to a large unexpected expense or loss of income -- what we describe as "crisis budgeting."

Read on for a breakdown of how many Americans are spending time on financial planning.

Fewer Americans are spending time on financial planning

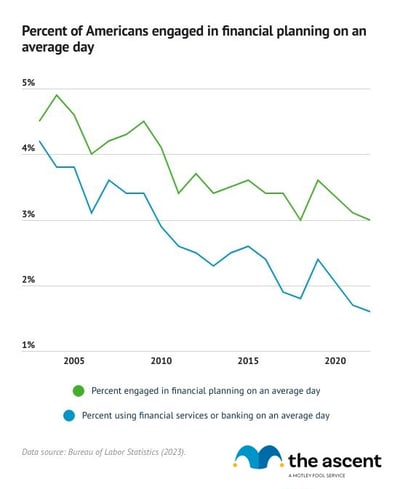

2.6% of Americans engaged in financial planning on an average day in 2023, down from 3.4% in 2012 and 4.5% in 2003.

The percent of Americans doing financial planning on any given day has generally declined since the early 2000s, according to data from the Bureau of Labor Statistics.

In the 2000s, 4% or more Americans worked on financial planning on an average day. That fell to 3% or more in the 2010s and early 2020s.

The same trend is more pronounced for the percent of Americans using professional financial services or banking on an average day. That percentage has steadily declined from 4.2% in 2003 to 1.6% in 2022.

Financial planning engagement by age and gender

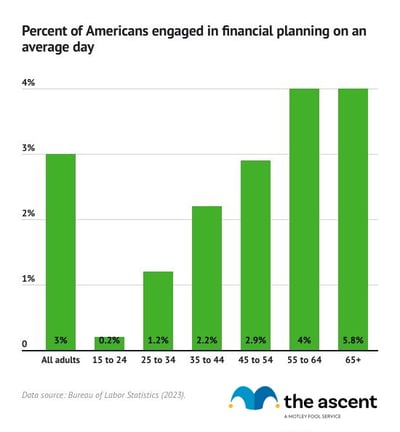

The percentage of Americans engaged in financial planning on an average day increases with age.

That’s not shocking, given that with age comes more financial responsibility and more products, accounts, bills, and more that need attention and organization.

Just 0.2% of Americans aged 15 to 24 do some financial planning on a given day, compared to 6.8% of those 65 and older.

Retirement age Americans have reason to more regularly engage in financial planning. They are likely on a fixed income with bills to pay and other financial obligations. That means attention to detail and organization are key to making their retirement savings last.

A slightly higher percentage of women engage in financial planning on an average day than men, per the Bureau of Labor Statistics. Other research has found that women investors are more conservative than men, but to also outperform them in the stock market.

How much time do Americans spend on financial planning?

Among the Americans that do engage in financial planning on an average day, they usually spend 59 minutes managing their money, according to data collected from the Bureau of Labor Statistics.

The amount of time the 2.6% of Americans that financially plan on an average day spend on financial management has hovered between 45 minutes and just over an hour over the last 20 years.

Among all Americans, the average amount of time spent on financial management per day is just 1.8 minutes, a number dragged down due to 97% of Americans spending no time on money management on any given day.

What causes Americans to financially plan?

To better understand what primarily drives Americans to financially plan, Motley Fool Money surveyed 2,000 adults:

- Forty-six percent of respondents said they engage in financial planning on a regular basis.

- Thirty percent said they engage in financial planning when making a large purchase or investment.

- Twenty-four percent said they engage in "crisis budgeting" -- financial planning when faced with an unexpected expense or loss of income.

Crisis budgeting being the main driver of financial planning for roughly a quarter of respondents isn't ideal, but does align with data which shows Americans under increasing financial stress:

- The median savings account balance in 2023 was $1,200 among respondents surveyed by Motley Fool Money, down from $4,500 in 2022.

- Fifty-four percent of Americans have three months of emergency savings, down from 59%, data from the Federal Reserve shows.

- Sixty-three percent of Americans can cover an unexpected $400 expense with cash on hand, down from 68%, according to the Federal Reserve.

- Thirty-five percent of Americans in 2022 said they were doing worse off financially compared to 2021, a 20% increase and the highest since at least 2014, per the Federal Reserve.

- Average monthly expenses grew roughly $600 from 2021 to 2022. And average household debt continues to rise.

Baby boomers were more likely than any other generation to say they manage their money regularly, which aligns with data from the Bureau of Labor Statistics indicating that older Americans are more likely than younger Americans to financially plan on any given day.

Under what circumstances do you engage in financial planning?

| On a regularly scheduled basis | When planning or making a large purchase or investment | When faced with an unexpected expense or loss of income | |

|---|---|---|---|

| Gen Z | 42% | 37% | 21% |

| Millennial | 45% | 34% | 21% |

| Gen X | 43% | 26% | 30% |

| Baby boomer | 50% | 24% | 25% |

| All respondents | 46% | 30% | 24% |

How to make the most of financial planning

It may be surprising that just 3% of Americans engage in financial planning on an average day -- but done right, managing money isn't something that should need daily attention.

Still, financial planning is as broad as it is important. The Motley Fool breaks financial planning down into eight components:

- Defining goals

- Setting a budget

- Saving for retirement

- Making an estate plan

- Managing debt

- Preparing for emergencies

- Planning for taxes

- Investing for the long term

Each person will come up with their individual financial plan, there's no one-size-fits all approach.

If you feel as though you don't have enough time to devote to financial planning or need help managing a complex financial situation, hiring a financial advisor is a solid option. There are plenty of financial advisors on the market, so make sure to research the qualifications and fee structure of prospects before diving in.

Financial planning can seem overwhelming at first, but the vast majority of Americans agree that getting their finances in order makes them happier and more confident. In this case, the juice is worth the squeeze.

-

Sources

- Bureau of Labor Statistics (2024). "American Time Use Survey."

- Northwestern Mutual (2019). "Planning & Progress Study."

-

Methodology

Motley Fool Money surveyed 2,000 American adults via Pollfish on Nov. 7, 2023. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a statistical method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.