The Average Cost of Car Insurance

The average cost of car insurance is $2,875 per year, according to a 2022 rate analysis by Motley Fool Money.

That's the overall average, but it can change quite a bit depending on a variety of factors, including a driver's age, driving record, and location. Keep reading for a detailed look at auto insurance rates across the nation.

Key findings

- Drivers pay an average of $2,875 per year for car insurance.

- Standard coverage ($3,137) costs four times as much as minimum coverage ($783).

- Michigan has the most expensive auto insurance, with drivers paying an average of $5,377 in annual premiums.

- The average car insurance rate is lowest in Hawaii ($1,571) overall and for standard coverage ($1,716), but Iowa has the cheapest minimum coverage ($354).

- Drivers with poor credit pay over twice as much for car insurance as drivers with excellent credit in states that allow carriers to use credit history when setting rates.

- Young drivers pay much higher rates, with an average annual cost of $6,087 for 18-year-olds.

- USAA, American Family, and GEICO have the cheapest car insurance rates among the major providers.

National average cost of car insurance

| National average car insurance paid annually | National average car insurance paid twice per year | National average car insurance paid monthly |

|---|---|---|

| $2,875 | $1,438 | $240 |

Americans pay an average of about $240 per month for car insurance. Since that's an overall average, it includes everyone, from drivers with spotless records to those with accidents, a poor credit history, or other issues.

Drivers with good credit and clean driving records can often qualify for cheap car insurance. It also helps to shop with the best car insurance companies, as they tend to offer lower prices.

National average cost of car insurance by coverage type

| Coverage type | Average annual auto insurance premium | Average monthly auto insurance premium |

|---|---|---|

| Minimum coverage | $783 | $65 |

| Standard coverage | $3,137 | $261 |

It's much more expensive for drivers who want to be completely covered. Standard coverage costs about four times as much as minimum coverage.

To clarify what these terms mean, minimum coverage provides insurance equal to the minimum amount required by the state where the driver lives. Each state has its own requirements. Most states only require liability coverage.

There are two states, New Hampshire and Virginia, where drivers aren't required to have car insurance. They do have minimum coverage requirements for drivers who choose to purchase insurance.

Standard coverage normally includes three different types of car insurance coverage:

- Liability coverage for medical and repair costs sustained by other parties if the driver is responsible for an accident.

- Collision coverage for the cost of repairing or replacing the driver's vehicle in the event of a collision with another vehicle or an object.

- Comprehensive coverage for repair or replacement costs that aren't related to a collision.

Regional average cost of car insurance

| Region | Average annual rate | Average monthly rate |

|---|---|---|

| Mid-Atlantic (DC, DE, MD, NJ, NY, PA, VA, WV) | $3,264 | $272 |

| Southeast (AL, AR, FL, GA, LA, MS, NC, SC, TC) | $3,007 | $251 |

| Southwest (AZ, CO, NM, OK, TX, UT) | $2,896 | $241 |

| Midwest (IA, IL, IN, KS, KY, MI, MN, MO, ND, NE, OH, SD, WI) | $2,722 | $227 |

| West (CA, NV) | $2,722 | $227 |

| Northeast (CT, MA, ME, NH, RI, VT) | $2,542 | $212 |

| Northwest (ID, MT, OR, WA, WY) | $2,242 | $187 |

| Non-mainland (AK, HI) | $1,774 | $148 |

The Mid-Atlantic has the most expensive car insurance rates, followed by the Southeast. Car insurance is much more affordable in the non-mainland states of Alaska and Hawaii. In the other lower 48 states, the Northwest is the region with the lowest prices on car insurance.

State car insurance cost averages

| State | Average annual car insurance rate | Average monthly car insurance rate |

|---|---|---|

| Alabama | $2,933 | $244 |

| Alaska | $1,823 | $152 |

| Arizona | $3,254 | $271 |

| Arkansas | $2,927 | $244 |

| California | $2,647 | $221 |

| Colorado | $2,931 | $244 |

| Connecticut | $3,579 | $298 |

| Delaware | $3,474 | $290 |

| District of Columbia | $3,127 | $261 |

| Florida | $4,055 | $338 |

| Georgia | $2,858 | $238 |

| Hawaii | $1,571 | $131 |

| Idaho | $1,984 | $165 |

| Illinois | $2,466 | $206 |

| Indiana | $1,884 | $157 |

| Iowa | $1,854 | $155 |

| Kansas | $2,663 | $222 |

| Kentucky | $3,742 | $312 |

| Louisiana | $4,374 | $365 |

| Maine | $2,264 | $189 |

| Maryland | $3,069 | $256 |

| Massachusetts | $2,199 | $183 |

| Michigan | $5,377 | $448 |

| Minnesota | $2,754 | $230 |

| Mississippi | $2,592 | $216 |

| Missouri | $2,722 | $227 |

| Montana | $2,843 | $237 |

| Nebraska | $2,864 | $239 |

| Nevada | $3,098 | $258 |

| New Hampshire | $2,469 | $206 |

| New Jersey | $4,229 | $352 |

| New Mexico | $2,191 | $183 |

| New York | $3,953 | $329 |

| North Carolina | $2,099 | $175 |

| North Dakota | $2,478 | $207 |

| Ohio | $1,733 | $144 |

| Oklahoma | $2,839 | $237 |

| Oregon | $2,271 | $189 |

| Pennsylvania | $2,816 | $235 |

| Rhode Island | $3,428 | $286 |

| South Carolina | $2,939 | $245 |

| South Dakota | $2,753 | $229 |

| Tennessee | $2,502 | $209 |

| Texas | $2,968 | $247 |

| Utah | $2,589 | $216 |

| Vermont | $2,212 | $184 |

| Virginia | $2,460 | $205 |

| Washington | $1,839 | $153 |

| West Virginia | $2,970 | $248 |

| Wisconsin | $2,250 | $188 |

| Wyoming | $2,642 | $220 |

Michigan has the most expensive auto insurance by a wide margin. At $5,377, its average rate is over $1,000 higher than second-place Louisiana. New Jersey, Florida, and New York round out the top five.

On the other end of the list, Hawaii has the cheapest cost of car insurance at $1,571. It's followed by Ohio, Alaska, Washington, and Iowa.

Why do average car insurance rates by state vary so much? Here are the main factors that cause car insurance to cost more or less in certain areas:

- Accident rates

- Crime rates

- Percentage of uninsured drivers

- Population density

State average car insurance cost by coverage type

| State | Average annual (monthly) rate for minimum coverage | Average annual (monthly) rate for standard coverage |

|---|---|---|

| Alabama | $689 ($57) | $3,213 ($268) |

| Alaska | $479 ($40) | $1,990 ($166) |

| Arizona | $1,010 ($84) | $3,535 ($295) |

| Arkansas | $624 ($52) | $3,214 ($268) |

| California | $638 ($53) | $2,898 ($242) |

| Colorado | $666 ($56) | $3,214 ($268) |

| Connecticut | $1,222 ($102) | $3,873 ($323) |

| Delaware | $1,195 ($100) | $3,759 ($313) |

| District of Columbia | $845 ($70) | $3,412 ($284) |

| Florida | $1,403 ($117) | $4,386 ($366) |

| Georgia | $897 ($75) | $3,103 ($259) |

| Hawaii | $411 ($34) | $1,716 ($143) |

| Idaho | $478 ($40) | $2,172 ($181) |

| Illinois | $669 ($56) | $2,690 ($224) |

| Indiana | $477 ($40) | $2,060 ($172) |

| Iowa | $354 ($30) | $2,042 ($170) |

| Kansas | $556 ($46) | $2,927 ($244) |

| Kentucky | $1,108 ($92) | $4,071 ($339) |

| Louisiana | $1,263 ($105) | $4,761 ($397) |

| Maine | $567 ($47) | $2,476 ($206) |

| Maryland | $1,027 ($86) | $3,325 ($277) |

| Massachusetts | $553 ($46) | $2,404 ($200) |

| Michigan | $1,881 ($157) | $5,814 ($485) |

| Minnesota | $828 ($69) | $2,995 ($250) |

| Mississippi | $617 ($51) | $2,839 ($237) |

| Missouri | $714 ($60) | $2,973 ($248) |

| Montana | $499 ($42) | $3,136 ($261) |

| Nebraska | $495 ($41) | $3,160 ($263) |

| Nevada | $1,071 ($89) | $3,351 ($279) |

| New Hampshire | $610 ($51) | $2,702 ($225) |

| New Jersey | $1,566 ($131) | $4,562 ($380) |

| New Mexico | $512 ($43) | $2,401 ($200) |

| New York | $1,346 ($112) | $4,279 ($357) |

| North Carolina | $475 ($40) | $2,302 ($192) |

| North Dakota | $459 ($38) | $2,730 ($228) |

| Ohio | $429 ($36) | $1,896 ($158) |

| Oklahoma | $547 ($46) | $3,125 ($260) |

| Oregon | $853 ($71) | $2,449 ($204) |

| Pennsylvania | $594 ($50) | $3,094 ($258) |

| Rhode Island | $1,083 ($90) | $3,721 ($310) |

| South Carolina | $953 ($79) | $3,187 ($266) |

| South Dakota | $404 ($34) | $3,047 ($254) |

| Tennessee | $570 ($48) | $2,744 ($229) |

| Texas | $792 ($66) | $3,240 ($270) |

| Utah | $766 ($64) | $2,817 ($235) |

| Vermont | $447 ($37) | $2,433 ($203) |

| Virginia | $671 ($56) | $2,684 ($224) |

| Washington | $559 ($47) | $2,000 ($167) |

| West Virginia | $713 ($59) | $3,252 ($271) |

| Wisconsin | $453 ($38) | $2,475 ($206) |

| Wyoming | $372 ($31) | $2,925 ($244) |

In addition to having the highest overall average car insurance, Michigan is also the most expensive state for both minimum coverage and standard coverage.

For the most part, minimum and standard coverage costs fell in line with a state's overall average. There were a few states that differed from the norm, with Wyoming and South Dakota being the most notable examples. They had the second- and third-cheapest minimum coverage, despite neither making the top 20 for cheapest car insurance overall.

National average cost of car insurance by credit history

| Credit history | Average annual rate | Average monthly rate |

|---|---|---|

| Excellent credit | $1,846 | $154 |

| Poor credit | $3,955 | $330 |

Most states allow car insurance providers to use a driver's credit history when determining their car insurance rates, although it's a controversial practice. When this is allowed, drivers with excellent credit save a lot of money. They pay less than half of what drivers with poor credit pay for car insurance.

Here are the states that don't allow car insurance companies to base rates on a driver's credit score and history:

- California

- Hawaii

- Massachusetts

- Michigan

National average cost of car insurance by gender

| Gender | Average annual rate | Average monthly rate |

|---|---|---|

| Female (with clean driving record) | $2,239 | $187 |

| Male (with clean driving record) | $2,260 | $188 |

Female drivers pay a little less than male drivers for car insurance because they're a lower risk. Statistics show that male drivers are more likely to speed, drive under the influence of alcohol, and not wear seatbelts. They're also often involved in more severe crashes.

These averages are taken from drivers with a clean driving history. They don't include drivers with tickets or accidents, which is why both of them are less than the overall national average.

National average cost of car insurance for younger and older drivers

| Age | Average annual rate | Average monthly rate |

|---|---|---|

| 18 years old | $6,087 | $507 |

| 65 years old | $2,017 | $168 |

Younger drivers have much higher car insurance rates than any other group due to the risk they present. Because they're inexperienced and more likely to drive recklessly, they're also more likely to be involved in accidents.

The good news for young drivers is that insurance rates drop considerably every year for a few decades -- at least for those who avoid negative marks on their driving records. There are also providers that offer relatively cheap car insurance for teens and young drivers.

The fifties and sixties tend to be when drivers pay the lowest car insurance rates. By that point, most people have decades of driving experience.

Insurance rates can start to rise once drivers hit their seventies. Slower reaction times, vision loss, and hearing loss are all common among senior citizens and lead to an uptick in insurance rates.

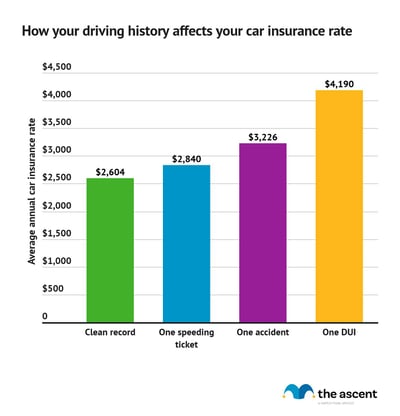

National average cost of car insurance by driving record

| Driving record | Average annual rate | Average monthly rate |

|---|---|---|

| Clean record | $2,604 | $217 |

| One speeding ticket | $2,840 | $237 |

| One accident | $3,226 | $269 |

| One DUI | $4,190 | $349 |

It pays to have a clean driving record. Those who do score rates about $20 per month less than drivers with a speeding ticket, $52 per month less than drivers who have been in an accident, and $132 less than drivers with a DUI.

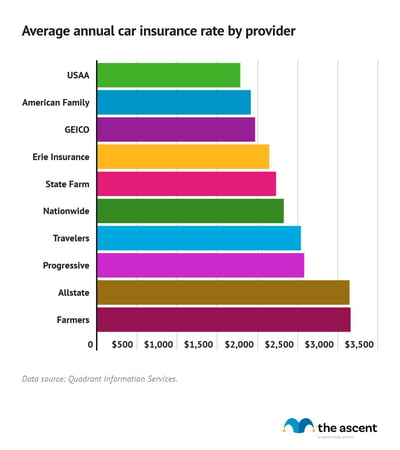

National average cost of car insurance by provider

It's important to get your own car insurance quotes, but seeing which insurers generally provide affordable insurance is a good place to start.

| Insurance company | Average annual rate | Average monthly rate |

|---|---|---|

| Allstate | $3,143 | $262 |

| American Family | $1,912 | $159 |

| Erie Insurance | $2,142 | $179 |

| Farmers | $3,156 | $263 |

| GEICO | $1,966 | $164 |

| Nationwide | $2,323 | $194 |

| Progressive | $2,578 | $215 |

| State Farm | $2,227 | $186 |

| Travelers | $2,537 | $211 |

| USAA | $1,781 | $148 |

USAA has the best car insurance rates and consistently records excellent customer satisfaction scores. That makes it a popular choice, but it's only available to military members and their families. American Family and GEICO also offer low prices compared to other insurers.

Price is clearly one of the key factors drivers consider when choosing a car insurance provider. Our data included average rates for dozens of companies. To see what the most popular carriers charge, we picked out 10 of the largest auto insurance companies in the country for this sample. All but two of them came in below the national average.

How to reduce your car insurance premium

There are several ways to cut your car insurance premiums. Here are some tips that can help you save:

- Shop around at least once per year to compare car insurance rates. Most providers let you get a quote online.

- Check for car insurance discounts. There are quite a few ways to save money, including safe driving discounts, low-mileage discounts, and vehicle safety feature discounts.

- See if you can pay less by bundling your homeowner's insurance and your car insurance.

- Think about how much car insurance you need and consider adjusting your coverage. It may be worth reducing coverage if you have an older vehicle or raising your deductible if you have a solid emergency fund.

- Take steps to increase your credit score. A high credit score can get you cheaper car insurance in most states.

Most importantly, practice safe, defensive driving habits. If you have a clean driving history, it can help you qualify for the lowest insurance rates for your age group and location.

Sources

The data found on this page is a combination of publicly available quote data obtained directly from the carrier as well as insurance rate data from Quadrant Information Services. These rates were publicly sourced from the top ten (10) to fifteen (15) carrier markets, within each state, based on annual written premium and should be used for comparative purposes only -- your own quotes may be different.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.