Average Tax Refund: When Will I Get My Tax Refund?

KEY POINTS

- Average tax refund: The average tax refund is $3,221 as of March 21, 2025.

- When will I get my tax refund? Nine out of 10 tax refunds are issued in less than 21 days, according to the IRS. Most states estimate that state tax refunds are issued within 10 weeks.

- Will I get a refund? Two-thirds of filers received a tax refund in 2024.

Filing taxes isn't anyone's idea of a good time, but a tax refund is a light at the end of the tunnel. Considering the Internal Revenue Service (IRS) refunded $186 billion in income tax in 2024, plenty of filers get a sizable return. The average tax refund is $3,221 as of the week ending on March 21, 2025.

How long does it take to receive your tax refund? And do certain characteristics, such as income or marital status, influence tax refund amounts?

To find out, we analyzed the most recent IRS data on tax refunds. In the sections that follow, you'll learn exactly which filers get the biggest refunds.

Additional key tax refund statistics

Numbers on tax refunds by income, age, and filing status are available only through tax year 2021 (2022 filing year).

- Tax refunds by income: Average tax returns tend to rise with income. The average tax refund in 2022 for someone making between $50,000 and $75,000 was $2,712. The average tax return for someone making between $100,000 and $199,999 was $4,106.

- Tax returns by age: Tax refund amounts peak for adults in the 35 to 44 age range, and then steadily decline going forward. The average tax refund for those Americans was $4,541.

- Tax refunds by filing status: Heads of household had the highest average tax return in 2022, receiving $5,684 back. Single filers received the smallest tax refund, at $1,777. Married couples received an average refund of $2,620.

How long it takes to get your tax refund

Nine out of 10 tax refunds are issued within 21 days, according to the IRS.

Twenty-four hours after filing your refund online, you can access the IRS Where's My Refund tool to get daily updates on your tax refund status. Paper filers have to wait six months or more before the tool becomes available.

The tool shows progress in three phases:

- Return received

- Refund approved

- Refund sent

Once your refund is approved, you will be given a date to expect your refund on by the IRS.

Those who file their tax return online and sign up for direct deposit get their tax refund fastest, per the IRS.

Most states estimate that state tax refunds are issued within 10 weeks of processing.

Average tax refund in 2025: $3,221

The average individual income tax refund is $3,221 for the week ending on March 21, 2025. That's up from $3,081 a year prior.

For many consumers, tax refunds are a significant influx of extra cash they get each year. Because of that, it's common for people to plan their finances around their refunds.

Bob Cunningham, a tax analyst with TaxSlayer, told The Motley Fool that "no unusual trends" cropped up in last year's returns.

The average tax refund by year

The average tax refund changes each year as tax rules and brackets adjust. Tax refunds for the 2024 filing year were down 1% from the previous year.

The following table shows the average tax refund by year received in 2014 to 2024. It does not include data on refunds issued in 2025.

| Year | Average tax refund |

|---|---|

| 2014 | $2,792 |

| 2015 | $2,797 |

| 2016 | $2,860 |

| 2017 | $2,895 |

| 2018 | $2,899 |

| 2019 | $2,869 |

| 2020 | $2,549 |

| 2021 | $2,815 |

| 2022 | $3,252 |

| 2023 | $3,167 |

| 2024 | $3,138 |

What to expect from your tax refund in 2025

Changes are coming for the 2024 tax-filing year that could impact the size of tax refunds in 2025. These are the ones that are most likely to affect your potential tax refund.

New income tax brackets

The IRS widened income tax brackets again for the 2024 filing year due to inflation.

2024 tax-filing year income tax brackets

| Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $11,600 | $0 to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,351 or more |

As a result, filers whose salaries haven't kept pace with inflation may find themselves in a lower income tax bracket than last year.

Higher standard deduction

The IRS increased standard deduction amounts for the 2024 filing year as a result of inflation.

2024 tax filing year standard deductions

| Filing Status | 2024 Standard Deduction |

|---|---|

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Head of Household | $21,900 |

| Additional Amount for Married Seniors | $1,550 |

| Additional Amount for Unmarried Seniors | $1,950 |

The standard deduction is the amount you can reduce your standard gross income by, which lowers your taxable income. Most filers take the standard deduction rather than itemizing deductions.

A higher standard deduction may help filers fall into a lower income tax bracket, particularly if inflation has outpaced their salary.

Lower 1099-K thresholds

The 1099-K form is used to report payments via payment cards and third-party networks, like Venmo, PayPal, and Cash App, for goods and services provided in either business or personal transactions. The threshold for filing a 1099-K in the 2024 tax filing year will be reduced to $5,000. The threshold will eventually be lowered to $600.

Andy Phillips, vice president at The Tax Institute at H&R Block, told The Motley Fool, "while this income has always been reportable to the IRS, the number of people who receive a Form 1099-K will increase significantly."

The 1099-K covers side hustles, like selling crafts on Etsy, earnings from sales on a website like eBay, and ticket resales through platforms like StubHub. Transactions with friends and family are not covered by the 1099-K.

How to get the largest tax refund in 2025

While it's not possible to predict how the average refund will change in the 2024 filing year, we asked experts at major tax service providers about how to maximize tax refunds and what changes to watch out for.

Refunds should be similar in most cases compared to last year.

"Assuming someone's income and family situation is the same year over year, refund amounts should remain fairly stable," Phillips said.

"There are no major changes to the tax code this year that impact the average person," Cunningham added.

Still, there may be some cause for optimism about a slightly larger refund in particular cases.

Cunningham pointed to a $100 increase in the Additional Child Tax Credit and the slight increases in tax brackets and the standard deduction as two factors that could lead to "slightly larger" refunds in 2025.

The standard deduction increased by 5.4%, which was the core rate of inflation from October 2022 to September 2023.

"However," Cunningham said, "incomes rose slower than 5.4% in 2024, so taxpayers should have a little more income taxed at lower rates. This effect can cause folks to pay a little less in taxes as a percentage of their income year over year."

Here are some other tips for maximizing your tax return.

1. Take advantage of credits and deductions

Tax filers need to be cognizant of their own life changes, including changes to income, family size, and contributions to tax-advantaged accounts like an IRA.

"Many times a major life event, such as having a child or buying an energy efficient vehicle, can help you reduce your tax bill or increase your refund," Phillips explained. "Unfortunately, people often fail to account for those changes at tax time and end up leaving money on the table."

These three tax credits in particular can yield significant savings but are often overlooked:

- Earned Income Tax Credit: A tax credit certain filers may qualify for if they earned less than $59,187 in the 2023 tax filing year.

- Saver's Credit: A tax credit for low- and moderate-income filers who contribute to a retirement account.

- Child and Dependent Care Credit: A tax credit for filers who support a child under the age of 13 or a dependent (including those outside their family) who cannot take care of themselves and lived with the filer for more than half of the year.

Cunningham predicts that the Qualified Disaster Loss Deduction may be "especially relevant this year."

"As a result of recent hurricanes, we anticipate that property loss this year will be near or exceed the all-time record. Much of this will be uninsured, qualifying the taxpayer to take the Qualified Disaster Loss Deduction," he said. "Since taxpayers do not have to itemize to get this deduction, many taxpayers living in Florida, Georgia, South Carolina, North Carolina, and Tennessee can claim this deduction."

2. Organize W-2s and other paperwork

To maximize tax refunds and avoid delays or letters from the IRS, filers should make sure they have all their paperwork in order, including their W-2s and 1099s.

"Better recordkeeping would ultimately significantly improve accuracy and, in the long run, get the taxpayer the correct refund or minimize their amount owed," Cunningham told The Motley Fool.

3. Double-check information entered into tax software

Many tax-filing services transpose information from tax forms to calculate your return, but you should still double-check to make sure that the information received by the service matches what's on your forms.

"One of the most common mistakes is not taking a moment to review the information you entered," Mark Jaeger, vice president of tax development at TaxAct says.

Missing information or entering it incorrectly either through being rushed or disorganized can mean leaving benefits on the table. In that instance, the IRS won't catch your mistake. "It is simply a mistaken concept that if you leave off a benefit the IRS will 'find it and add it back and send you more money.' Nothing could be farther from the truth," says Steber.

Steber points out that there's a growing trend of taxpayers making small but costly mistakes on their filings. "These mistakes have resulted in thousands of taxpayers seeing a delay in receiving their tax refund because their return is sent to the IRS' error resolution system," he says.

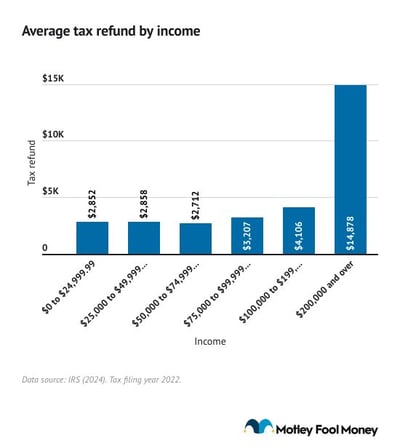

Average tax refund by income

There's a clear correlation between income and tax refund amounts. Filers who have higher incomes get more back. This average tax return by income chart will give you the details:

Americans who earn $200,000 and over experience a much higher tax return than those who earn less because high earners generally have more cash withheld from their income over the course of the year.

For a more detailed look at the average tax refund across income levels, see the table below.

A more detailed breakdown reveals that tax refund amounts and incomes are related, but there are some exceptions.

Filers with no adjusted gross income (AGI) posted an average tax refund of $4,516, which is more than or close to the average returns for most income bands up to those who earn $100,000 or more. Filers with no AGI or negative AGI aren't necessarily earning no income. It's more likely that they're taking advantage of tax deductions.

Another departure -- Americans who made $15,000 to $19,999 had a higher average refund than every subsequent group up to those making $100,000 or more.

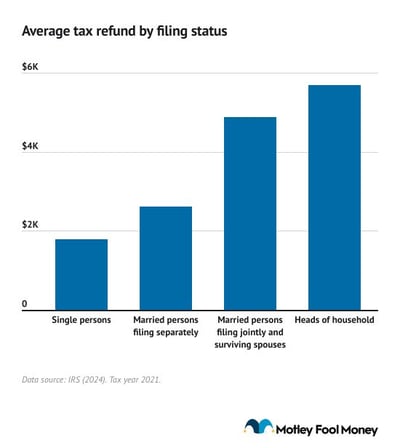

Average tax refund by filing status

Filing status makes a significant difference in the amount of taxes you pay and how much you can receive in your refund.

The difference in average returns of heads of households and single Americans or married couples filing separately is particularly large.

Heads of household received the largest refunds for the 2021 tax year, receiving $5,684 on average.

The average tax refund for single Americans was just $1,777. Married taxpayers filing separately received an average return of slightly more, $2,620.

Married Americans filing jointly and surviving spouses saw an average return of $4,874.

Heads of households -- unmarried filers who pay for at least half their household expenses and have a qualifying dependent -- receive the largest average tax returns. This is because they benefit from the second-largest standard deduction and wider tax brackets than single filers and married Americans who file separately.

Married couples who file jointly and surviving spouses have the widest tax brackets and largest standard deduction.

While some couples consider filing separately to save on taxes, this can end up being a costly tax mistake. Except in select circumstances, filing jointly tends to provide greater savings.

According to an analysis from TurboTax, 87% of couples newly filing jointly in 2023 saw their adjusted gross income increase by at least 10%. That opens up more opportunities for income based tax credits and a lower tax rate for higher income.

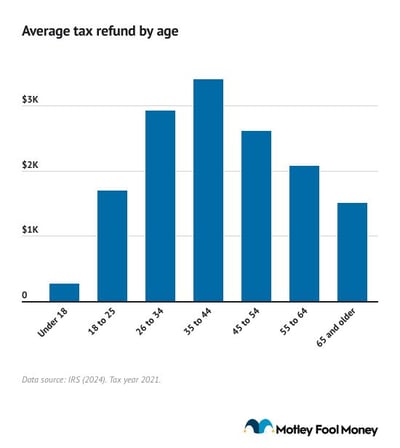

Average tax refund by age

Tax refund amounts rise with age until reaching a peak with the 35 to 44 group. After that, there's a steady decrease.

For the most part, this follows how incomes rise with age. Most filers under the age of 18 work part-time in entry-level positions. Since they're not earning much compared to other age ranges, they also have significantly smaller tax refunds.

Those in the 18 to 25 range average more hours and higher pay, but they're still just starting out in their careers. Peak earnings generally occur anywhere from the mid-30s to the mid-50s.

Average tax refund by state

Washington, D.C. residents received the largest average tax refund in 2023, getting $3,785 back, while those from Maine received the smallest average tax refund, getting just $2,467 back.

Most states estimate that state tax refunds are issued within 10 weeks.

FAQs: How to check your income tax refund status and more

-

Where is my tax refund?

Nine out of 10 tax refunds are issued within 21 days, according to the IRS.

The IRS "Where's My Refund?" tool provides information on your tax refund status. To access that information, you'll need your Social Security number, filing status, and refund amount, which can be copied from your tax return. It can take 24 hours after you file an electronic return to access a status update and up to four weeks if you file your refund on paper.

Many states offer similar tools to track state tax refunds. Most states estimate issue refunds within eight weeks.

-

Can I file for an extension on my taxes?

must request an extension prior to the tax deadline. The extension applies only to filing your taxes -- if you owe money, you still need to pay by the original due date regardless of an extension.

The IRS provides a six-month tax-filing extension if you need one; however, you

-

What's the best tax refund software?

Check out The Motley Fool's recommendations for the best tax software. We've also recommended the best free tax software. These services help taxpayers navigate the filing process and seek out deductions and credits so filers get the largest return possible.

-

Methodology

To calculate the average tax refund amount by income, age, and marital status, we divided the total refunded overpayment amount by the number of returns filed that resulted in a refund. For state averages, we divided the individual income tax refund amounts listed for each state and divided by the number of returns. All amounts were rounded to two decimal places.

-

Sources

- Internal Revenue Service (2025). "Filing season statistics by year."

- Internal Revenue Service (2025). "Filing season statistics for week ending March 21, 2025."

- Internal Revenue Service. "SOI Tax Stats - Individual Income Tax Returns Publication 1304 (Complete Report)," Table 1.3, Table 3.3, Table 3.7 (2024).

- Internal Revenue Service. "SOI Tax Stats - IRS Data Book Index of Tables," Table 7, Table 8 (2024).

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.