The NFT Market: Average NFT Prices, Largest Marketplaces, and More

The non-fungible token (NFT) market took off in 2021. Trading volume reached $11.7 billion in the fourth quarter, increasing tenfold over the course of the year, and there were 2.7 million unique active NFT wallets -- a proxy for users -- by the end of the year.

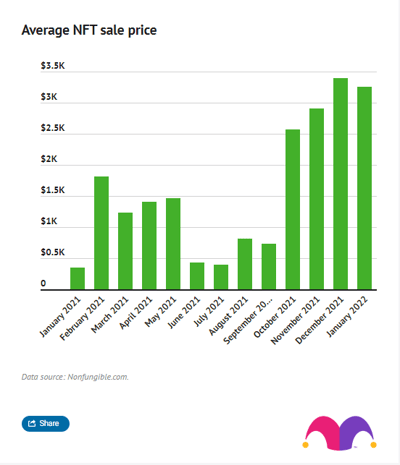

Last year, hardly a month went by without news of a non-fungible token selling for thousands or even millions of dollars -- prices that pieces of fine art can fetch. The average price of an NFT rose from around $150 to $4,000 as interest in NFTs exploded.

This year, NFT prices have plummeted by over 50% in just one month.

Despite the rollercoaster in prices, interest in NFTs has persisted. In January, 2.4 million NFTs sold on OpenSea, the largest NFT marketplace -- over a million more than sold in December. NFT sales by value broke records in January, with over $4.8 billion sold on OpenSea. Major art auction houses like Christie’s and Sotheby’s have leaned into auctioning NFTs. And NFTs are central to burgeoning efforts to create the metaverse, providing a way to own virtual assets like homes, offices, art, clothing, and more.

To foster better understanding of the NFT market, Motley Fool Money, put together this NFT market guide composed of historical data on NFT prices, sales, volume, and the most expensive NFTs sold.

Key findings

- The trade volume of NFTs in 2021 was $24.9 billion, according to DappRadar. That’s up from $95 million in 2020.

- Unique active wallets -- a proxy for users -- reached 2.7 million in 2021, and 49% of those users were connected to NFT games.

- OpenSea is the largest NFT marketplace in terms of sales value. Axie Infinity is the largest marketplace by user count.

- A record-breaking 2.4 million NFTs (worth $4.8 billion) were exchanged on OpenSea in January, despite the average NFT price gyrating between $6,900 and $1,300 that month.

- The top five most expensive NFTs were sold in 2021. The most expensive, "The Merge" by Pak, sold for $91.8 million, making it among the most expensive pieces of art auctioned.

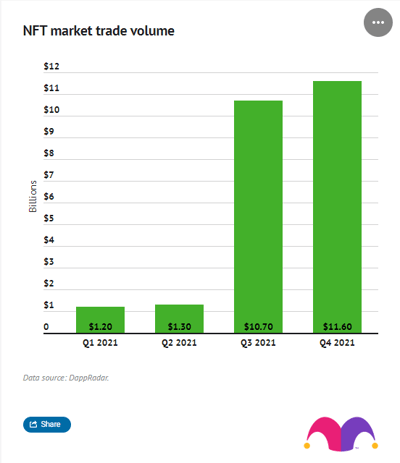

NFT trading volume reached $25 billion in 2021

The value of NFTs exchanged in 2021 was $24.9 billion, according to DappRadar, which tracks over 30 blockchains.

Trading took off in the second half of the year. NFT trading volume in the first and second quarters of 2021 was $1.2 billion and $1.3 billion, respectively. Trading volume then skyrocketed to $10.7 billion in the third quarter and $11.6 billion in the fourth.

| Quarter | Trade volume (billions) |

|---|---|

| Q1 2021 | $1.20 |

| Q2 2021 | $1.30 |

| Q3 2021 | $10.70 |

| Q4 2021 | $11.60 |

Per DappRadar, unique active wallets -- an imperfect proxy for users -- grew by seven times, to 2.7 million, over the course of 2021. Of those users, 49% were connected to NFT games like Axie Infinity.

OpenSea is the largest NFT marketplace by volume

Before diving into how the NFT market has changed, it’s important to understand where buying and selling are occurring. Most NFT transactions occur on the Ethereum blockchain, using the Ethereum cryptocurrency. Other blockchains are beginning to support NFT transactions as well.

To make shopping for NFTs easier, marketplaces have popped up. Creators and owners can list NFTs on marketplaces and prospective buyers can bid on listed NFTs. The largest marketplace by overall transaction value is OpenSea, which has facilitated $14.68 billion worth of NFT sales, according to data from DappRadar.

Axie Infinity, a video game in which players collect and battle creatures called “Axies” (which are NFTs), boasts the most traders, with 1.6 million using the Axie Infinity marketplace since its inception in 2018. Almost $4 billion worth of NFT transactions have occurred on the Axie Infinity Marketplace.

The CryptoPunks marketplace houses the CryptoPunks NFT collection, which includes some of the most expensive NFTs ever sold. The marketplace has the highest average NFT price among major NFT marketplaces and has seen over $2 billion worth of NFT sales.

| Market | Average price | Traders | Volume, billions |

|---|---|---|---|

| OpenSea | $938.99 | 1,387,357 | $14.68 |

| Axie Infinity | $216.15 | 1,624,169 | $3.94 |

| CryptoPunks | $123,690.00 | 5,600 | $2.40 |

| NBA Top Shot | $63.63 | 492,039 | $0.78 |

| Magic Eden | $308.74 | 304,403 | $0.62 |

| Solanart | $1,100.00 | 170,703 | $0.59 |

| Mobox | $790.81 | 59,178 | $0.53 |

| AtomicMarket | $24.98 | 895,199 | $0.32 |

| Rarible | $990.79 | 92,115 | $0.28 |

| SuperRare.co | $7,940.00 | 5,493 | $0.21 |

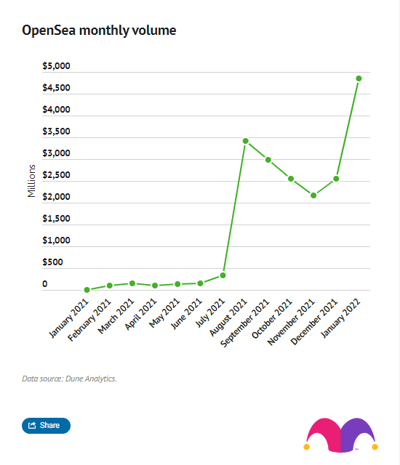

A record-breaking $4 billion worth of NFTs sold on OpenSea in January

NFT sales reached a new high in January, with over $4.8 billion sold on OpenSea alone. That’s a massive increase from January 2021, when $8 million worth of NFTs sold on OpenSea, and a $2.3 billion increase from December 2021.

| Month | Volume, millions |

|---|---|

| January 2022 | $4,846.57 |

| December 2021 | $2,548.31 |

| November 2021 | $2,161.23 |

| October 2021 | $2,546.83 |

| September 2021 | $2,990.96 |

| August 2021 | $3,421.84 |

| July 2021 | $328.96 |

| June 2021 | $150.31 |

| May 2021 | $138.92 |

| April 2021 | $95.78 |

| March 2021 | $148.02 |

| February 2021 | $96.73 |

| January 2021 | $8.07 |

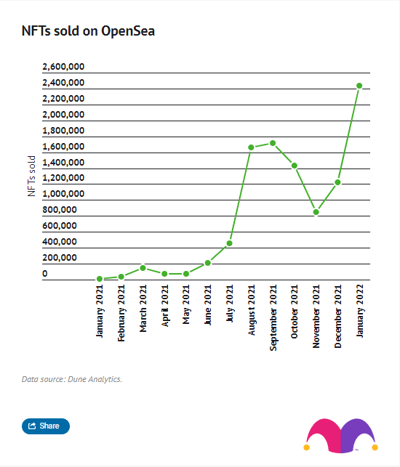

Over 2.4 million NFTs sold on OpenSea in January 2022

January was also a record-breaking month for the number of NFTs sold on OpenSea, which reached over 2.4 million. That’s another huge jump from January 2021, when just over 11,000 NFTs sold on the marketplace.

| Month | NFTs sold |

|---|---|

| January 2022 | 2,432,300 |

| December 2021 | 1,220,242 |

| November 2021 | 845,026 |

| October 2021 | 1,434,912 |

| September 2021 | 1,711,942 |

| August 2021 | 1,657,229 |

| July 2021 | 458,052 |

| June 2021 | 211,469 |

| May 2021 | 71,279 |

| April 2021 | 74,239 |

| March 2021 | 142,075 |

| February 2021 | 41,040 |

| January 2021 | 11,208 |

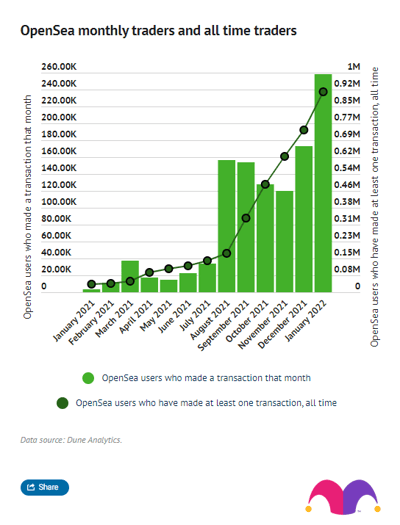

Over 1.1 million users have made at least one NFT transaction on OpenSea

As NFT sales and prices took off during the last half of 2021, so did the number of active users on OpenSea. In January 2021, nearly 4,000 users made a transaction on OpenSea. In January 2022, 258,000 users made a transaction.

| Month | OpenSea users who made a transaction that month | Total OpenSea users who have made at least one transaction, all time |

|---|---|---|

| January 2022 | 258,245 | 1,168,017 |

| December 2021 | 172,941 | 738,716 |

| November 2021 | 119,809 | 617,108 |

| October 2021 | 127,870 | 490,125 |

| September 2021 | 153,669 | 339,071 |

| August 2021 | 156,177 | 178,724 |

| July 2021 | 33,693 | 143,184 |

| June 2021 | 22,257 | 120,780 |

| May 2021 | 14,375 | 106,480 |

| April 2021 | 17,535 | 88,849 |

| March 2021 | 37,287 | 51,593 |

| February 2021 | 10,920 | 40,181 |

| January 2021 | 3,837 | 36,195 |

The average price of an NFT swung between $6,900 and $1,400 in January

The average price of an NFT has fluctuated wildly over the past month and year. In January alone, the average NFT sale varied a great deal. On January 2, the average NFT sale price was around $6,890. By January 23, the average sale price was $1,363.

In January 2021, the average sale price of an NFT was $347, according to nonfungible.com. In February, the average sale price rose to around $1,800, only to fall a couple hundred dollars through May, then plummet back to around $400 in June and July. Prices took off again in August and September and then launched to over $2,500 in October.

The average sale price of an NFT in January 2022 was $3,257.

| Month | Average NFT price |

|---|---|

| January 2022 | $3,256.64 |

| December 2021 | $3,390.47 |

| November 2021 | $2,911.40 |

| October 2021 | $2,573.30 |

| September 2021 | $730.24 |

| August 2021 | $817.45 |

| July 2021 | $390.34 |

| June 2021 | $428.16 |

| May 2021 | $1,464.39 |

| April 2021 | $1,412.37 |

| March 2021 | $1,228.18 |

| February 2021 | $1,816.81 |

| January 2021 | $346.85 |

NFT prices generally track with Bitcoin and Ethereum

As Bitcoin and Ethereum plunged in December 2021 and January 2022, so did the average NFT price. NFT prices show a weak positive correlation with Bitcoin and a moderate positive correlation with Ethereum -- unsurprising, given that Ethereum is the cryptocurrency used in the majority of NFT transactions.

| Month | NFT, change in average price | Ethereum | Bitcoin |

|---|---|---|---|

| January 2022 | -21.81% | -28.61% | -19.35% |

| December 2021 | -1.16% | -19.84% | -19.27% |

| November 2021 | 13.89% | 7.06% | -6.53% |

| October 2021 | 81.22% | 29.64% | 27.39% |

| September 2021 | 20.08% | -21.67% | -10.34% |

| August 2021 | 23.23% | 34.21% | 18.16% |

| July 2021 | 127.71% | 19.88% | 23.59% |

| June 2021 | -43.91% | -13.59% | -4.45% |

| May 2021 | -27.30% | -8.14% | -35.52% |

| April 2021 | -36.14% | 41.09% | -1.58% |

| March 2021 | 85.13% | 22.05% | 18.43% |

| February 2021 | -22.95% | 3.46% | 34.92% |

| January 2021 | 532.84% | 79.81% | 12.70% |

The most expensive NFTs

"The Merge," $91.8 million

-- Artist: Pak. Year created: 2021.

"The Merge" is a dynamic NFT that was sold on Nifty Gateway as 312,686 total units of “mass” purchased by 28,983 users. “Mass” owned by individual users merges into a unique NFT, dependent on how much “mass” has been collected. This quality makes "The Merge" a dynamic NFT, and has led to debate over whether it’s a single piece of art. Given that “mass” merges, it would be possible for one buyer to consolidate all of the original “mass” through the secondary market, although doing so would undoubtedly be expensive.

"Everydays: the First 5000 Days," $69.3 million

-- Artist: Beeple. Year created: 2021.

In May 2007, digital artist Beeple (Mike Winkelmann) began producing a piece of digital art every day. "Everydays: the First 5000 Days" is a collage of the first 5,000 daily pieces from Beeple. Auctioned at Christie’s, "Everydays: the First 5000 Days" was the first NFT sold at a major auction house.

"HUMAN ONE," $29 million

-- Artist: Beeple. Year created: 2021.

Beeple partnered again with Christie’s to auction "HUMAN ONE," a “kinetic video sculpture” housed in four video screens that display an astronaut walking through shifting landscapes. "HUMAN ONE" can be updated by Beeple at any time, a unique twist given that art, even in the digital space, is traditionally static.

"CryptoPunk 7523," $11.8 million

-- Artist: Larva Labs. Year created: 2017.

Auctioned through Sotheby’s, "CryptoPunk 7523," also known as "Covid Alien," is a 24x24 pixel portrait of a blue alien with a gold earring, beanie, and medical mask. It is one of nine Alien Cryptopunks, each following the same 8-bit style and featuring different accessories.

"CryptoPunk 3100," $7.7 million

-- Artist: Larva Labs. Year created: 2017.

Another of the nine Alien Cryptopunks, "CryptoPunk 3100" sports a simple headband with single horizontal blue and white stripes. It sold for 4,200 Ethereum (then valued at $7.7 million) on March 11, 2021. It is currently on sale for 35,000 Ethereum, roughly $86 million.

The most valuable NFT collections

Bored Ape Yacht Club

-- Market capitalization: $2.95 billion

NFTs from the Bored Ape Yacht Club are owned by international sports stars including Neymar Jr. and Steph Curry, music superstars including Justin Bieber and Snoop Dogg, entertainers including Jimmy Fallon and Kevin Hart, and high-profile inventors such as Mark Cuban.

Developed by Yuga Labs, Bored Ape Yacht Club is a collection of 10,000 NFTs that are portraits of stylized apes wearing different accessories and outfits. Individual Bored Ape Yacht Club NFTs have recently sold for millions of dollars' worth of Ethereum, and most have fetched hundreds of thousands of dollars.

CryptoPunks

-- Market capitalization: $2.04 billion

It’s no surprise that the CryptoPunks collection is among the most valuable NFT collections, given that two CryptoPunk NFTs are among the top five most expensive NFTs ever sold. CryptoPunks is a collection of 10,000 pixelated, 8-bit style portraits designed by LarvaLabs, each sporting a unique combination of accessories.

Mutant Ape Yacht Club

-- Market capitalization: $1.14 billion

Half of the 20,000 NFTs that form the Mutant Ape Yacht Club collection are tied to Bored Ape Yacht Club. In August, owners of Bored Ape Yacht Club NFTs were given vials of “mutant serum” (the serums form a separate NFT collection called Bored Ape Chemistry Club) that allowed them to transform their Bored Apes into Mutant Apes. Another 10,000 Mutant Apes were minted and put on the market.

The Apes aren’t the only items fetching high prices -- a vial of serum is going for an average of $78,800. The most expensive serum so far recently sold for $5.8 million.

CLONE X - X TAKASHI MURA

-- Market capitalization: $801.87 million

CLONE X - X TAKASHI MURA is a collection of 20,000 3D NFT avatars with randomly generated features, designed by RTKFT Studios and Takashi Murakami. It is intended that owners will be able to use avatars from this collection across the metaverse, in Zoom meetings, and elsewhere. Clone X avatars have sold for hundreds of thousands of dollars' worth of Ethereum.

Cool Cats

-- Market capitalization: $376.31 million

Cool Cats is a collection of 9,999 randomly generated cat portrait NFTs, each with a different combination of body style, face style, accessories, and outfits. The makers of Cool Cats plan to eventually allow “breeding,” which some have speculated will allow owners of two Cool Cats to combine them into a new Cool Cat NFT with traits from each of the “parents.”

The NFT outlook

2021 was a monumental year for NFTs. Despite fluctuating prices, NFTs grew more popular and moved toward the mainstream. Artists and developers pushed the boundaries of what’s possible with NFTs as an artistic medium. Efforts to conceptualize and build the metaverse with NFTs as a foundational element picked up steam.

In each of these areas a significant amount of money was exchanged, and interest, as measured by dollars, grew by levels of magnitude in 2021.

What does that mean for the future of NFTs?

From a skeptic's point of view, long-term, mainstream use cases for NFTs are still largely unproven. NFTs have certainly carved out a sizable niche in the art market, but whether they can reach and provide value to a larger audience remains to be seen, and the advantages of using an NFT over more traditional digital art are not entirely proven. NFT values remain volatile and prices correlate with Ethereum, a relatively risky and unregulated cryptocurrency.

On the other hand, there’s still a lot of room for growth. Only a tiny fraction of potential customers have purchased an NFT. Big companies like Twitter, Taco Bell, and Nike are just beginning to explore possibilities NFTs provide customers and their brands. Growing interest (and capital) in the metaverse give developers and artists ample motivation to innovate.

Sources:

- Barron’s (2021). “PAK’s NFT Artwork ‘The Merge’ Sells for $91.8 Million.”

- Chainalysis (2021). “The NFT Market Report.”

- Christie’s. “HUMAN ONE.”

- Christie’s. “Everydays: the First 5000 Days.”

- Coindesk. “Bitcoin.”

- Coindesk. “Ethereum.”

- DappRadar. “NFTs Overview.”

- Dune Analytics. “OpenSea.”

- Larva Labs. “CryptoPunk 3100.”

- Markets Insider, (2021). “The NFT market is now worth more than $7 billion, but legal issues facing the nascent sector could hinder its growth, JPMorgan says.”

- NonFungible. “Market History.”

- Sotheby’s. “CryptoPunk 7523.”

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.