Wage Garnishment Laws in All 50 States

KEY POINTS

- Wage garnishment explained: Creditors can take a cut of a debtor's paycheck to collect on defaulted debt.

- Wage garnishment losses: 1% of workers are subject to wage garnishment with an average loss of 10% of their gross earnings.

- Garnishment prohibition: Four states don't allow wage garnishment for consumer debts.

As consumer debt continues to hit new records, concerns may be growing about wage garnishment -- the process in which creditors take a cut of a worker's paycheck to collect on defaulted debt.

Roughly 1 in 100 workers are subject to wage garnishment and they lose an average of 10% of their gross earnings to creditors, according to a 2023 study of payroll data from 2014 to 2019 by professors from Northwestern and MIT. They found that garnishments lasted from roughly five to eight months, depending on the type of debt.

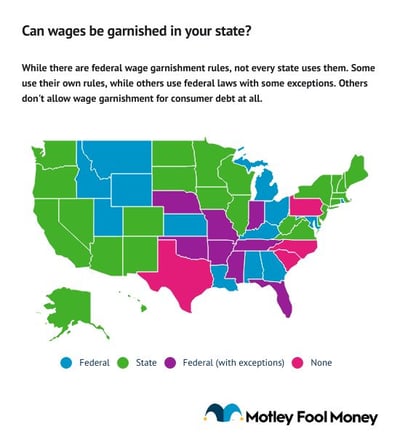

Wage garnishment rules vary by state. Some have even prohibited garnishing wages for consumer debt. Read on for a rundown of wage garnishment rules in every state.

What is wage garnishment?

For those with unpaid consumer debt (like credit card debt or payday loans), wage garnishment is one costly possible outcome. If a creditor gets a judgment in its favor, federal law allows garnishment of up to 25% of the debtor's disposable earnings. This money is taken out of their paycheck by their employer and sent to the creditor. A study published in the National Bureau of Economic Research found that workers subject to wage garnishment lose an average of 10% of their gross income.

That's a big chunk of your paycheck that could be taken away. States can also pass their own debt collection laws, and several have set stricter limits on how much creditors can take or have added protections

Federal wage garnishment law

Per federal law, 75% of your disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment for ordinary garnishments, which includes consumer debt. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules.

Let's say you have $500 of disposable earnings per week. The greater of the following two amounts would be exempt:

- 75% of $500, which is $375

- 30 times the federal minimum wage (currently $7.25 an hour), which is $217.50

Since $375 is the greater amount, that's how much of your earnings would be exempt, meaning $125 could be taken from your weekly pay. If, on the other hand, you earn $217.50 per week or less, then your wages can't be garnished at all.

Wage garnishment laws by state

Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. A few have even prohibited wage garnishment for consumer debt entirely.

Alabama

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Alaska

$473 per week, $743 per week if the debtor's earnings alone support their household, or the first 75% of disposable earnings, whichever is greater, is exempt from wage garnishment.

Arizona

The lesser of 10% of disposable earnings, lowered to 5% if a judge determines extreme economic hardship has been shown, or disposable income remaining after deducting 60 times the highest applicable federal, state, or local minimum wage.

Arkansas

Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment.

California

The lesser of 20% of disposable earnings or disposable income remaining after deducting 40 times the state's minimum wage.

Colorado

The lesser of 20% of disposable income or disposable income remaining after deducting 40 times the federal or state minimum wage.

Connecticut

The lesser of 25% of disposable earnings or disposable income remaining after deducting 40 times the federal or state minimum wage.

Delaware

The lesser of 15% of disposable income or disposable income remaining after deducting 30 times the federal minimum wage.

District of Columbia

The lesser of 25% of disposable income or disposable income remaining after deducting 40 times the district's minimum wage. Additional wages can be exempt from garnishment if a judge determines that undue hardship has been shown.

Florida

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Debtors are exempt if they are a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment.

Georgia

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Hawaii

Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. If this amount is greater than the amount that would be garnished under the federal guidelines, then the federal guidelines must be used.

Idaho

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Illinois

The lesser of 15% of disposable earnings or disposable income remaining after deducting 45 times the state's minimum wage.

Indiana

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

If the debtor can prove with good cause that the amount should be reduced, in which case it can be set to under 25%, but no less than 10%, of the debtor's disposable income.

Iowa

The maximum amount that can be garnished per year is based on the debtor's income as follows:

- Below $12,000: Up to $250

- $12,000 to $15,999: Up to $400

- $16,000 to $23,999: Up to $800

- $24,000 to $34,999: Up to $1,500

- $35,000 to $49,999: Up to $2,000 may be garnished

- $50,000 and above: No more than 10% of wages may be garnished

Kansas

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Kentucky

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Louisiana

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Maine

The lesser of 25% of disposable earnings or the amount of disposable income exceeding 40 times the federal or state minimum wage.

Maryland

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Massachusetts

The lesser of 15% of disposable earnings or the amount of disposable income exceeding 50 times the federal or state minimum wage.

Michigan

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Minnesota

The lesser of 25% of disposable earnings or the amount of disposable income exceeding 40 times the federal minimum wage.

Mississippi

The first 30 days of wages after the garnishment order is served are exempt from wage garnishment. After that Mississippi follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Missouri

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

If the debtor is the head of the household, the lesser of 10% of disposable income or the amount of disposable income exceeding or 30 times the federal minimum wage, is subject to garnishment.

Montana

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Nebraska

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

If the debtor is the head of the household, the lesser of 15% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage, is subject to garnishment.

Nevada

The lesser of the the following amounts is subject to wage garnishment:

- 18% of disposable earnings if the debtor's gross weekly wages are $770 or less

- 25% of disposable earnings if the debtor's gross weekly wages exceed $770

- Disposable income exceeding 50 times the federal minimum wage

New Hampshire

The lesser of 25% of disposable earnings or the amount of disposable income exceeding 50 times the federal minimum wage. New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish.

New Jersey

In New Jersey, 10% of disposable income is subject to wage garnishment if the debtor's earnings are less than 250% of the federal poverty level. 75% of income is exempt from wage garnishment if the debtor's earnings are more than 250% of the federal poverty level.

New Mexico

The lesser of 25% of disposable earnings or the amount of disposable income remaining after 40 times the federal minimum wage is subject to wage garnishment.

New York

The lesser of the following amounts is subject to wage garnishment:

- 10% of the debtor's gross earnings

- 25% of the debtor's disposable earnings

- Disposable income exceeding 30 times the federal minimum wage

Wages can not be garnished if disposable income is less than 30 times the federal minimum wage.

North Carolina

Wage garnishment for consumer debt is not permitted.

North Dakota

The lesser of 25% of disposable earnings or the amount of disposable income remaining after 40 times the federal minimum wage is subject to wage garnishment.

An additional $20 per week is exempt for each dependent family member who resides with the debtor.

Ohio

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Oklahoma

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Debtors that show undue hardship and support one or more dependents may receive a larger exemption.

Oregon

In Oregon, 25% of disposable earnings, however a debtor's disposable income after garnishment cannot be less than the following amounts based on the debtor's pay frequency:

- $254 per week

- $509 per any two-week period

- $545 for any half-month period

- $1,090 for any one-month period

Pennsylvania

Wage garnishment for most consumer debt is not permitted.

Rhode Island

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

South Carolina

Wage garnishment for consumer debt is not permitted.

South Dakota

The lesser of 20% of disposable earnings or the amount of disposable earnings exceeding 40 times the federal minimum wage. An additional $25 per week is exempt for each dependent family member who lives with the debtor.

Tennessee

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week. Adds an exemption of $2.50 per week for each of the debtor's dependent children under the age of 16 who live in the state.

Texas

Wage garnishment for consumer debt is not permitted.

Utah

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

Vermont

The lesser of 20% of disposable earnings or the amount of disposable earnings exceeding 40 times the federal minimum wage.

Virginia

The lesser of 25% of disposable earnings or the amount of disposable earnings exceeding 40 times the federal minimum wage.

Washington

The lesser of 20% of disposable earnings or disposable earnings exceeding 35 times the federal minimum wage.

West Virginia

The lesser of 20% of disposable earnings or disposable income exceeding 50 times the federal minimum wage.

Wisconsin

The lesser of 20% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment.

Wyoming

Follows federal wage garnishment guidelines: The lesser of either 25% of disposable income or the amount of disposable income exceeding 30 times the federal minimum wage per week.

How to protect yourself from wage garnishment

If your wages are currently being garnished, a creditor has filed a lawsuit against you, or you're worried that could happen due to an unpaid debt, there are a few ways you can protect yourself.

- Check the laws and exemptions in your state: Some states allow you to exempt more income if you're the head of your household, if you support dependents, or if you prove that the normal exemption wouldn't leave you enough money to pay your bills. You typically need to apply for these types of larger exemptions, though. If you fail to do that, the court won't know that your circumstances qualify you to keep more of your wages. It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid.

- Settle the debt with the creditor: Creditors are often willing to negotiate and either set up a payment plan or accept one lump-sum debt settlement payment. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method.

- Object to the garnishment: You can object to a garnishment if it's causing financial hardship. To learn how, contact the courthouse that issued the judgment. Be prepared to provide your current income and monthly expenses.

- File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. This is a big step, so it's important to understand how bankruptcies work first. A bankruptcy causes an automatic stay order, which will stop the wage garnishment against you until either your debts are discharged, you set up a payment plan (for a Chapter 13 bankruptcy), or your bankruptcy filing is dismissed.

Methodology

The federal wage garnishment laws and state wage garnishment laws listed are accurate as of April 23, 2024.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.