2025 Cryptocurrency Investor Trends Survey

KEY POINTS

- Bitcoin Hits $100K: Bitcoin reaching $100,000 boosts interest among existing crypto investors, especially young males.

- Trump-Musk Influence: Trump's re-election and Musk's involvement lead 50% of respondents to expect positive crypto market performance in 2025.

- Crypto Skepticism Barriers: Lack of knowledge, buying difficulties, and security concerns deter potential new investors.

Cryptocurrency is once again in the spotlight with Bitcoin hitting a record high of $109,500 in May and the Trump administration taking a friendlier approach to the industry.

Motley Fool Money's 2025 Cryptocurrency Investor Trends Survey shows interest in crypto is strong -- 21% of respondents to Motley Fool Money's survey own crypto. That's 1 in 5 American adults who own crypto in 2025. This tracks with a separate survey conducted by the National Cryptocurrency Association and Harris Poll finding that 21% of U.S. adults (55 million people) own crypto.

Overall, 42% of respondents to Motley Fool Money's crypto survey said they're likely to buy cryptocurrency in the next year -- in line with the general level of enthusiasm recorded in 2024.

Read on to understand the most important trends in the crypto space, as the industry enters a pivotal moment.

Bitcoin hitting $100,000, Trump's return to office buoys crypto enthusiasm

President Donald Trump's re-election and Bitcoin crossing $100,000 in December 2024 gave respondents, particularly those that already own cryptocurrency, reason to be bullish about the industry.

- Bitcoin crossing $100,000: 48% percent of respondents said they're more likely to invest in crypto in light of Bitcoin being valued at more than $100,000 at one point in December 2024.

- The Trump-Musk effect: 50% of all respondents say that the cryptocurrency market will perform positively in 2025 given President Trump's re-election and Elon Musk potentially serving as an advisor. Just 13% think crypto will do poorly in 2025, and the remaining 37% think the market won't change much.

Enthusiasm shrinks and grows depending on respondents' generation, gender, and whether they've ever invested in crypto.

Bitcoin hit a new all-time record of $109,500 in May.

How Bitcoin crossing $100,000 is influencing investors

Thirty percent of respondents who have never invested in crypto say Bitcoin crossing $100,000 makes them more likely to invest in crypto, compared to 85% of those who currently own crypto and 83% who are invested in crypto through an ETF.

A slight majority of male respondents, 54%, say Bitcoin hitting the $100,000 threshold makes them more likely to invest compared to 42% of female respondents. That division tracks with general sentiment towards cryptocurrency investing.

Younger generations are more likely to be bullish on crypto due to Bitcoin's rise in 2024. Fifty-six percent of Gen Z and 62% of millennial respondents say they're more likely to buy crypto as a result, compared to 46% of Gen X and just 27% of baby boomers. Those results are again in line with how enthusiasm for crypto investing shakes out among generations.

Potential crypto investors may be more willing to get off the sidelines with Bitcoin setting a new record high of $109,500 in late May.

Trump and Musk's influence on how investors view crypto

Bitcoin jumped to over $109,000 the day after President Trump was sworn in for his second term, a reflection of the expectation that his administration will be friendly towards cryptocurrencies.

That view is shared by 50% of respondents in Motley Fool Money's 2025 Cryptocurrency Investor Trends Survey and an overwhelming share -- 82% -- of respondents that are current crypto investors. Just 13% of all respondents think crypto will do poorly in 2025.

Men and younger generations are more optimistic about how cryptocurrency will perform with Trump in the Oval Office and Elon Musk being in his orbit. Sixty percent of male respondents said they think crypto will perform positively in 2025 in light of those factors, compared to 41% of female respondents. And nearly 60% of Gen Z and millennial respondents see crypto doing well in 2025 compared to 46% of Gen X and 39% of baby boomers.

Respondents who devoted more of their portfolio to crypto are more bullish on how crypto will fare in 2025 with Trump and Musk in positions of power. Among crypto owners with 10% or less of their portfolio in crypto, 69% think 2025 will be a strong year for crypto. That percentage jumps to 83% among those whose portfolios are 10% to 25% crypto, and to 90% among those whose portfolios are at least 50% crypto.

68% of crypto investors think Bitcoin will hit $200,000 in 2025

Sixty-eight percent of respondents that are invested in cryptocurrency believe Bitcoin will essentially double in 2025 to hit $200,000.

Those who don't own crypto are more skeptical -- 25% of respondents in that group think it's likely Bitcoin will reach $200,00, while 49% are uncertain and 26% think it's unlikely.

Among crypto investors, optimism grows dramatically based on how much of their portfolio is composed of cryptocurrency. Forty-six percent of respondents that own crypto and have 10% or less of their portfolio made up of crypto think Bitcoin will hit $200,000 in 2025 compared to 76% of those whose portfolios are 10% to 25% crypto and 90% of those whose portfolios are 75% crypto or more.

As with other measures of crypto bullishness, men and younger generations are more likely to think Bitcoin will cross the $200,000 threshold in 2025. Forty-three percent of male respondents said they think it would, compared to 37% of female respondents. 54% of Gen Z and 52% of millennial respondents believe Bitcoin will rise to $200,00 compared to 35% of Gen X and 21% of baby boomer respondents.

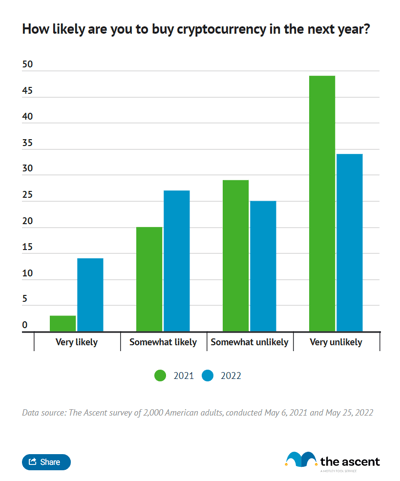

42% say they're likely to buy crypto in the next year

Forty-two percent of respondents to Motley Fool Money's Cryptocurrency Investor Trends Survey said they are somewhat likely or very likely to buy cryptocurrency in the next year. That's a percentage lower than 2023's record high.

Twenty percent said they are very likely, while 22% said they are somewhat likely.

Crypto ownership by generation

Younger generations are leading the way in crypto adoption. According to recent data, ownership is highest among Millennials and Gen Z, highlighting a generational shift in financial behavior and digital asset engagement. Here's how crypto ownership stacks up by generation:

- Gen Z: 26%

- Millennials: 37%

- Gen X: 18%

- Baby Boomers: 9%

The majority of those likely to buy crypto have already invested

While interest in cryptocurrency among respondents is high, most of it is coming from respondents who already own cryptocurrency either directly or through an ETF. Those respondents were much more likely to say that they're likely to invest in crypto in the coming year.

Among respondents who have never owned cryptocurrency, just 2% said they're very likely to buy next year, and only 14% said they're somewhat likely. Eighty-four percent said they're unlikely to purchase crypto in the coming year.

On the other hand, 66% of respondents who currently own crypto and 67% who have invested in a crypto ETF said they're very likely to buy more this year.

Respondents who previously owned cryptocurrency but don't hold any right now are somewhat interested in buying this year. Sixteen percent of that group say they're very likely to invest this year, 44% are somewhat likely, 26% are somewhat unlikely, and 14% are very unlikely.

Men and younger respondents are more likely to buy crypto than women and older respondents

Male respondents, particularly Gen Z and millennials, are much more likely than women to own cryptocurrency and be interested in investing in it in the future.

That demographic trend has been repeatedly observed, including by Pew, JPMorgan Chase, and Morning Consult.

As Bitcoin has rallied to a new high, the industry's ability to expand beyond the young male demographic will be instructive as to whether its growth is sustainable and if volatility can be reined in.

Record high 81% of crypto owners view it as investment

A record high 81% of respondents who own cryptocurrency view crypto as an investment. Most respondents don't own crypto to make secure payments or because they think it will replace currencies -- despite those being among the most hyped alleged use cases for cryptocurrencies.

Whether the shift in crypto owners' attitudes is a boon or dampener for the industry remains to be seen. Much of the initial attraction to crypto was driven by the idea that it could become a global currency and vehicle for secure payments. Those ideas have been slow to take hold while retail investors and now financial institutions increasingly see cryptocurrencies as just another investment class.

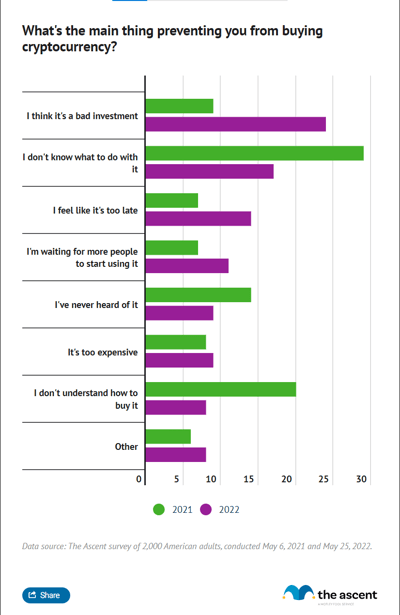

The top reasons why crypto skeptics won't invest

The most-cited reasons why respondents who don't own cryptocurrency haven't invested are not knowing what to do with it (36%), not understanding how to buy crypto (33%), and security concerns (31%).

Twenty-two percent of respondents who don't own cryptocurrency haven't invested because they don't think it will generate a good return. That's despite Bitcoin hitting record highs. Nineteen percent think crypto is too expensive to buy.

Twenty-three percent of non-investors won't buy crypto because they think it's a scam and another 22% haven't invested due to the lack of a clear regulatory framework for crypto. Those concerns are likely fueled by crypto's scandal-filled 2023 which may have tarnished its reputation for a slice of the public.

No single reason drives crypto skepticism, which suggests that the industry will have to overcome multiple barriers to attract new retail investors. The most-cited obstacles are fundamental and signal that there's a trust gap that will need to be bridged for new investors to enter the market.

40% would consider investing in crypto through their retirement account

Forty percent of respondents would consider investing in cryptocurrency through their retirement account, down from 44% in 2024 despite Bitcoin hitting record levels.

The decline in interest may be attributable to crypto's volatility and the slew of scams, scandals, and security concerns that rocked the industry -- the most notable being the collapse of FTX and revelations of fraud perpetrated by its founder Sam Bankman-Fried.

The respondents most interested in adding crypto to their 401(k)s and IRAs are current and previous crypto investors, those with investment portfolios tilted towards crypto, millennials, Gen Z, and men. Non-owners, women, and older generations are least likely to be interested in putting crypto in their retirement funds.

Being able to store crypto in a bank account may encourage some to invest

Fifty-six percent of respondents, including 39% of those who have never owned crypto, said that being able to store crypto in their bank account would make them consider investing. That suggests that safety, security, and regulation are keys to bringing new investors into the crypto space.

Still, the percentage of respondents who would consider buying crypto if they could put it in their bank account is down from 62% in 2022 and 70% in 2021, indicating that crypto's integration with more stable financial institutions isn't a golden ticket to adding investors.

86% of crypto owners would consider a credit card with crypto rewards

Crypto credit cards unsurprisingly draw serious interest from crypto investors and some interest from those who have never invested. Twenty-nine percent of that group would consider a credit card that provides crypto rewards.

That suggests that crypto credit cards could be an entry point for some crypto skeptics.

There are a limited number of crypto credit cards and they are unique in that rewards may be taxable if a gain is realized from them.

Confidence in crypto understanding is on the decline

Eleven percent of respondents claim to understand how cryptocurrency works "very well," down from 18% in 2024 and 24% in 2022. A record high 38% said they don't understand how crypto works at all, up from 33% in 2024 and 19% in 2022.

Crypto owners, men, and millennials are most confident about their crypto knowledge, while women and older respondents were more likely to say they have no or little understanding. It would appear that those groups are following the wisdom of only investing in what they understand.

69% think the government hasn't done enough to regulate crypto

Government regulation of crypto is a hot button topic that divides crypto holders, 61% of whom believe there's enough regulation now, and 83% of non-owners believe that there isn't enough government regulation. Among all respondents, 69% think the government hasn't done enough to regulate cryptocurrencies.

Respondents who previously owned crypto but don't currently hold any may feel as though they were spurned by insufficient regulation. Sixty-two percent of those respondents don't think there's enough regulation. This is one of the few topics for which that group breaks with current crypto investors.

Even among crypto owners, those who are least invested want to see more government regulation. Among those whose portfolios are 10% or less crypto, 41% think the government has done enough to regulate cryptocurrencies. That percentage jumps to 64% among those whose portfolios are 10% to 25% crypto, and up to 74% for those whose portfolios are 25% to 50% crypto.

The debate over cryptocurrency regulation in the United States centers on whether crypto assets can be considered securities, which would subject them to the same regulations as stocks and other securities. In a blow to proponents of regulation, a district court of appeals in 2023 ruled that cryptocurrency functioned as a security when sold to institutions, but not when traded on exchanges.

Interest in crypto remains, but the biggest boosters are already invested

Retail investors surveyed by Motley Fool Money showed near-record interest in crypto, but there are signs that the industry is struggling to grow its pool of investors beyond Gen Z and millennial males.

Consecutive surveys from Motley Fool Money show that Gen Z and millennial men remain most enthusiastic towards crypto while women, Gen X, and baby boomers are still skeptical of investing. That's despite two developments that could make investors more bullish about cryptocurrency's future: Bitcoin reaching the $100,000 threshold and President Trump returning to the White House with a promise of being a "crypto president," accompanied by Elon Musk as a potential advisor.

Those findings are consistent with survey results from Pew, which found that interest in crypto among new investors has remained stagnant for years, and that trust remains a significant obstacle to more widespread investment. Morning Consult's quarterly cryptocurrency adoption tracker also shows that the share of adults who own crypto has remained essentially level for years. A 2025 survey from the National Cryptocurrency Association and The Harris Poll found that 21% of American adults, roughly 55 million people, own crypto, and that ownership skews younger and male.

Integrating cryptocurrency with existing, trusted financial institutions and products like banks and credit cards could help some overcome their crypto skepticism, but isn't a silver bullet for mass adoption.

Sustainable, long-term, and less-volatile growth in the crypto industry may depend on whether it can correct its demographic imbalance and show would-be investors that crypto is secure, easy to buy, and has real value beyond speculation.

Sources

- JPMorgan Chase (2022). "The Dynamics and Demographics of U.S. Household Crypto-Asset Use."

- Morning Consult (2025). "Tracking Trends in Cryptocurrency."

- The National Cryptocurrency Association (2025). "2025 State of the Crypto Holders Report."

- Pew (2024). "Majority of Americans aren't confident in the safety and reliability of cryptocurrency."

Methodology

Motley Fool Money distributed surveys via Pollfish on Jan. 3, 2025, March 6, 2024, May 25, 2022, and May 6, 2021. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool. Each survey was composed of 2,000 adult Americans.

Our Research Expert