Study: COVID-19 Led Americans to Prioritize Spending Over Saving

KEY POINTS

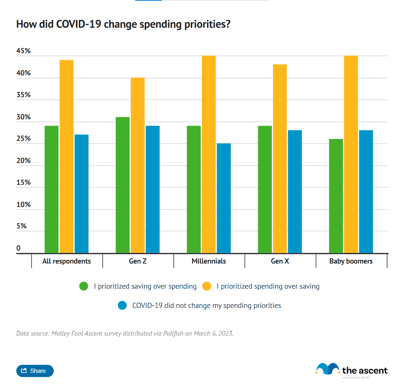

- Forty percent of respondents say COVID-19 led them to prioritize spending over saving.

- Twenty-nine percent say the pandemic caused them to prioritize saving over spending. Twenty-seven percent did not change spending priorities.

- Fifty-one percent of Americans are shopping online more than they did before the pandemic. Eighteen percent are shopping online less.

Americans responded to the COVID-19 pandemic by focusing on spending, and that change has persisted, according to a survey from Motley Fool Money.

The survey combined with data from the Bureau of Labor Statistics Consumer Expenditure Survey shows that Americans are spending more on groceries, housing, and transportation since the pandemic came to America in March 2020.

Another change that has stuck around since the start of the pandemic: 51% of Americans are still shopping online more than they did before COVID-19.

Read on for more insights into how consumer spending has shifted since the COVID-19 pandemic.

40% of Americans say COVID-19 led them to prioritize spending over saving

Forty percent of Americans believe the COVID-19 pandemic has led them to prioritize spending over saving, according to a survey from Motley Fool Money.

Spending on goods and services is where most of those respondents have increased spending.

Just 5% say they have increased spending on family, 4% say they have increased spending on experiences, and 7% say they have upped their spending on personal development. Those are areas significantly impacted by the pandemic so it's notable that they took the backseat to other spending categories.

A chunk of Americans -- 29% -- say the pandemic led them to prioritize saving over spending and another 27% say the pandemic did not change their spending priorities.

Generation Z were slightly more likely to shift toward saving than other generations, while baby boomers were more likely to prioritize spending.

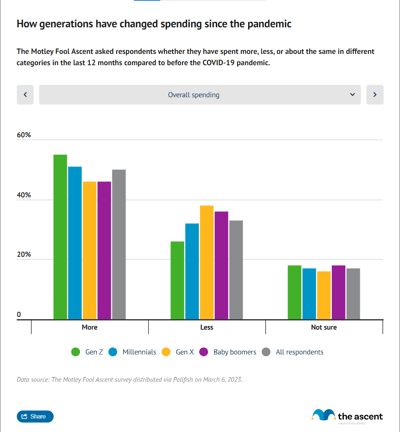

Americans are spending more on groceries, less on restaurants, compared to pre-COVID

Groceries, housing, and transportation are the areas in which the most Americans report spending more since the COVID-19 pandemic, according to a survey from Motley Fool Money.

On the other hand, 50% of Americans say they have spent less on restaurants since the pandemic and 42% say they have spent less on apparel.

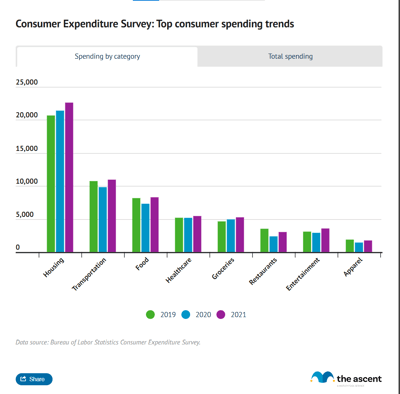

Those findings generally align with consumer spending data collected by the Bureau of Labor Statistics for the Consumer Expenditure Survey.

Spending declined from 2019 to 2021 on apparel and restaurants per the Consumer Expenditure Survey -- the two categories the most Americans said they've spent less on since the pandemic.

The categories that most Americans say they have spent more on since the pandemic -- groceries, housing, and transportation -- have also seen significant inflation since the pandemic began.

Consumer Expenditure Survey: Top consumer spending trends

This is how spending in top-level categories has shifted since the COVID-19 pandemic, per the Consumer Expenditure Survey.

51% of Americans are shopping online more since the start of the COVID-19 pandemic

Online shopping was already a mainstay for many Americans before the pandemic and has since accelerated and stuck around.

Fifty-one percent of Americans say they're shopping online more than they did prior to the pandemic, led by 54% of millennials.

Gen X and baby boomers are the only generations in which the majority are not shopping online more since the pandemic.

More of Gen Z than any other generation are shopping more in person since the pandemic.

Have your online shopping habits changed since the start of the COVID-19 pandemic?

| Response | All respondents | Gen Z | Millennials | Gen X | Baby boomers |

|---|---|---|---|---|---|

| I shop online more than I did prior to the pandemic | 51% | 50% | 54% | 49% | 48% |

| I shop online less than I did prior to the pandemic | 18% | 22% | 17% | 17% | 13% |

| My online shopping habits have not changed | 31% | 27% | 29% | 35% | 39% |

Chances are if you're shopping online you're probably using a credit card. The best credit cards for online shopping can score you cash back and more.

How to take advantage of new spending habits

With spending on groceries, transportation, and housing on the rise, it might be worth taking a look at whether you're maximizing potential cash back and rewards from that spending.

The best grocery credit cards, for example, can score up to 6% cash back. The best travel credit cards can score bonus points for certain hotel stays and airline miles.

On the other hand, if you've found yourself overspending since the pandemic, particularly as inflation has remained hot, now might be the time to revisit a budgeting app or look into a high-yield savings account.

Methodology

Motley Fool Money distributed a survey to 2,000 American adults via Pollfish on March 6, 2023. Respondents were 40% male and 60% female.

Sources

- Bureau of Labor Statistics. "Consumer Expenditure Survey."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.