Study: Race, Ethnicity, and Personal Finance in America

KEY POINTS

- Wealth disparity persists: White families possess a median net worth significantly surpassing that of Black and Hispanic families, highlighting a persistent racial wealth gap.

- Emergency savings shortfall: A large percentage of Black and Hispanic households lack the financial cushion to cover unexpected expenses, in contrast to white and Asian households.

- Investment inequality evident: White households have a much higher rate of direct stock ownership compared to Black and Hispanic families, indicating investment access disparities.

For as long as organizations have tracked the wealth of different racial and ethnic groups, the net worth of white Americans has far outpaced that of people of color. Wealth inequality in America is a serious issue, and it's amplified along racial and ethnic lines.

Motley Fool Money has compiled the latest statistics along with our own survey data to provide a holistic view on race, ethnicity, and personal finance.

Here's what we found.

(Editor's note: "people of color," in this case, refers to all non-white racial and ethnic groups as a whole.)

Net worth by race and ethnicity

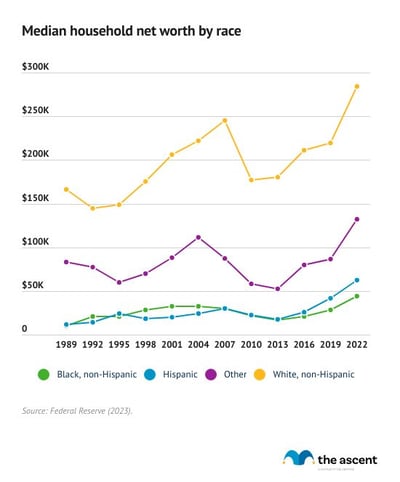

Over the past 30 years, the net worth of white families has been roughly six times greater than that of Black and five times that of Hispanic families, according to data collected by the Federal Reserve.

In 2022, white families had a median net worth of $284,300 compared to $62,000 for Hispanic families, $44,100 for Black families, and $132,200 for families of another race. Overall, the net worth of white families reached $135 trillion in the third quarter of 2024, roughly 84% of net worth overall. The net worth of Black Americans that quarter was $5.39 trillion, $3.64 trillion for Hispanic Americans, and $16.27 trillion for those of another race.

While new research shows that the wealth gap between Black and white families has narrowed since the mid-1800s, progress has stalled and reversed in recent years.

Why is that the case? While the income gap between Black and white Americans narrowed until the 1980s, the rate of growth in capital gains did not. White families hold more than twice as much of their wealth in equities as Black families and stock ownership is extremely concentrated towards white Americans, according to the Federal Reserve.

Savings account value by race and ethnicity

White Americans have roughly six times the amount of cash on hand in checking and savings accounts than Black and Hispanic Americans.

The median value of transaction accounts, which include checking and savings accounts, of white households in 2022 was $12,000, according to the Federal Reserve. The median value of those accounts in Black and Hispanic households was $2,100. The median value for households of other races was $6,000.

Nearly all households have access to a checking and savings account, according to the Federal Reserve. Still, there are slight differences in ownership rates among races.

Each type of account comes with benefits.

A checking account is a safe place to store money for everyday use. Most are FDIC insured, too. The best checking accounts have minimal to no fees and a high APY to help account holders build wealth.

The best savings accounts can offer even higher interest rates in addition to being FDIC insured.

Emergency savings by race and ethnicity

The ability to cover an unexpected $400 expense -- and how one would do so -- is a common measure of how capable someone is able to deal with a financial emergency. Ten percent of White households couldn't cover an unexpected $400 expense compared to 21% of Black households, 17% of Hispanic households, and 5% of Asian households, according to the Federal Reserve.

Across race and ethnicities, the most common way Americans would cover that type of expense is through money they have in a checking or savings account.

White and Asian Americans were roughly twice as likely as Black and Hispanic Americans to say that they would put that expense on their credit card and pay it off at their next statement. Black and Hispanic Americans were more likely to say they would put it on their card and pay it off over time, borrow money from a friend or family member, or sell something to come up with the money.

The majority of Black and Hispanic households couldn't handle an emergency expense of over $1,000 just with their current savings. By contrast, 75% of Asian families and 66% of White households say they do have enough cash to cover that size emergency expense.

Income by race and ethnicity

Asian Americans have the highest median household income at $112,800 and are the only race/ethnicity to make over six figures on the median, according to Census Bureau data.

Asian Americans make about $24,000 more than white Americans, on median, and double what Black Americans make.

American Indian and Alaska Native households have the lowest median income, $52,320, just ahead of Black households, $56,490.

The income growth rate of Black and white Americans, and therefore the wealth gap, narrowed until the 1980s, at which point incomes for both groups have grown at about the same rate, according to the Federal Reserve.

Employment rate by race and ethnicity

Hispanic or Latino Americans have the highest labor force participation rate at 67%. American Indian and Native Alaskan Americans have the lowest labor force participation rate at 59%, according to the Bureau of Labor Statistics.

White Americans carry the most financial worry

White Americans carry the most financial worry, with an average score of 3.6 out of 5, per a Motley Fool Money survey. People of color have a financial worry score of 3.3. A higher score indicates more financial stress.

Financial worry is based on how often respondents worry about their finances: all the time, most of the time, some of the time, rarely, and never.

Hispanic and Latino Americans hold the least financial worry, with an overall score of 3.3. Among those respondents, 18% said they worry about their finances all the time, the lowest percentage of any group.

Black Americans were least likely to say that they worry about their finances almost never (11%).

Overall, Americans had a financial worry score of 3.4 out of 5

Credit card ownership rate by race and ethnicity

Asian adults have the highest credit card ownership rate, with 90% holding at least one card. Eighty-six percent of white adults have a credit card, as do 74% of Hispanic adults and 70% of Black adults. Those latter two groups are more likely to have a balance on their cards, according to the Federal Reserve.

Americans of color have a harder time getting the amount of credit they request and are more likely than white Americans to opt not to apply for credit because they assume they will be turned down. This can make it harder for people of color to build credit and get financing.

Non-retirement investment account ownership rate and value by race and ethnicity

Just under a quarter of white households directly hold stocks compared to 13% of Black households and 8% of Hispanic families. Directly held stocks do not include investments owned through a retirement account or mutual funds.

That gap has closed in recent years, although white households still account for ownership of 89% of stocks.

The median value of directly held stocks by white households is $20,000, four times higher than for Black households and twice that of Hispanic families.

Investing patiently and over the long run is a great way to build wealth. The best brokers offer no-fee free trading and don't come with account minimums.

Primary investment priority by race and ethnicity

White Americans are most likely to be investing to save for retirement (46%), while people of color are most likely to be investing as part of their savings strategy or to build an emergency fund (33%), according to a Motley Fool Money survey.

Investing to build savings or an emergency fund is the most popular primary investment priority among all respondents, followed by saving for retirement.

What is your primary investment priority?

Retirement account ownership and value by race and ethnicity

Sixty-two percent of white Americans have a retirement account, according to the Federal Reserve, compared to 35% of Black households and 28% of Hispanic families.

The share of white and non-Black, non-Hispanic households that have a retirement account has steadily grown over time. However, for Black and Hispanic households, retirement account ownership has been uneven.

Outside of a company-sponsored 401(k), the best individual retirement accounts (IRA) offer no fees or account minimums, and are a great place to park investments and watch them grow until retirement.

White households have a median retirement account value of $100,000, compared to $39,000 for Black households and $55,600 for Hispanic families. Median account values for all groups have risen over time, although not evenly among groups.

Certificate of deposit ownership rate by race and ethnicity

About 8% of white Americans own a certificate of deposit (CD), more than any other race, although they are not a popular financial tool. Just 2% of Hispanic Americans and 3% of Black Americans own CDs.

The best CDs can award higher interest rates than a savings account, but money can't always be withdrawn until the CD term ends, which can last anywhere from six months to five years. Additionally, CDs often have minimum deposit requirements.

Budgeting habits by race and ethnicity

People of color review their finances more regularly than white Americans, according to a Motley Fool Money survey. While 70% of white Americans review their finances at least once a month, 71% of people of color do so at the same frequency.

Hispanic and Latino Americans review their finances least regularly, although Asian Americans are most likely to not review their finances at all.

How often do you review your finances (e.g., checking your bank account and credit card balance, reviewing your spending, viewing your investment accounts)?

Budgeting apps can simplify regular financial check ups by tracking where your money is going. The best budgeting apps not only track income, spending, investments, and more, but also help set financial goals and suggest ways to save money.

Sources of financial advice and information by race and ethnicity

Friends and family, followed by websites are the most common sources of financial advice for Americans.

People of color are more likely than white Americans to lean on other sources for financial advice, such as YouTube videos, podcasts, books, and TV shows.

Where do you get most of your financial advice and information?

Percent of Americans that know their credit score, credit card interest rate, and mortgage rate by race and ethnicity

White Americans are slightly more likely than people of color to know their credit score, credit card interest rate, and mortgage rate.

The majority of Americans know those scores, which are crucial pieces of information.

Understanding your credit score is important because credit scores are used for a range of financial decisions, from which credit cards you may be eligible for to the size and rate for a mortgage or auto loan. It's also important to know how to build credit.

Knowing your mortgage rate is crucial, because it can inform decisions about refinancing your mortgage to get a better rate, which can result in significant savings.

Race and personal finance in America

It's clear that good financial habits alone aren't responsible for a person's level of success. People of color are more likely to follow several recommended financial habits than white Americans, including regularly checking their finances and building an emergency fund.

Despite that, there's a significant racial wealth gap in America. People of color have a much lower median net worth, especially Black Americans and Hispanic and Latino Americans. And since wealth is largely passed down through inheritances, this wealth inequality continues from one generation to the next.

-

Methodology

Motley Fool Money distributed the survey to 2,000 American adults via Pollfish on April 26, 2023. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool. Quotas based on race/ethnicity were used: 500 respondents identified as white, 500 respondents identified as Asian, 520 respondents identified as Latino/Hispanic, 480 respondents identified as Black.

-

Sources

- Bureau of Labor Statistics (2024). "Labor force characteristics by race and ethnicity, 2023."

- Federal Reserve (2024). "Economic Well-Being of U.S. Households (SHED)."

- Federal Reserve (2023). "Survey of Consumer Finances."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.