Survey: Most Believe They're Overpaying for Their Subscriptions

KEY POINTS

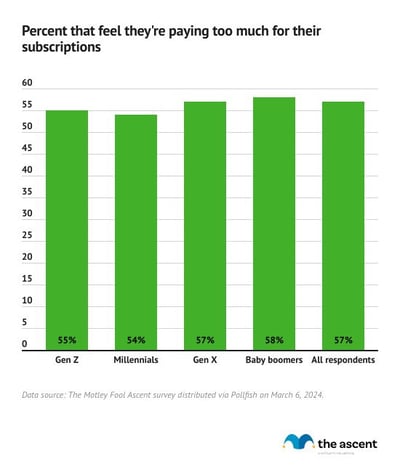

- Overpaying for subscriptions: 57% of respondents to Motley Fool Money's 2024 Subscription Sanity survey believe they're overpaying for their subscriptions

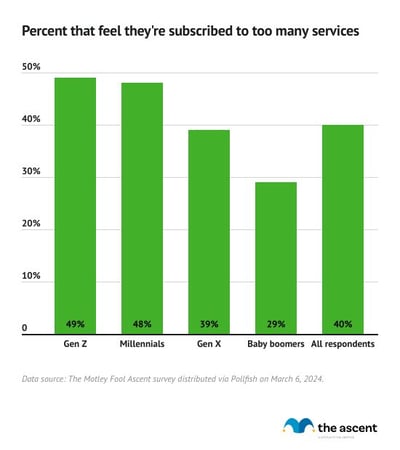

- Feeling oversubscribed: 40% think they're subscribed to too many services. Close to 50% of Gen Z and Millennials feel oversubscribed.

- Monthly subscriptions spending: A third of respondents spend more than $100 a month on subscriptions.

Consumers feel as if they're paying too much for subscription services, but aren't bothered by how many subscriptions they have, according to Motley Fool Money's 2024 Subscription survey.

The backdrop to these findings is a subscription economy that's grown by nearly 600% in the past decade. Subscriptions are embedded throughout our daily lives. Music, TV, retail and grocery shopping, food delivery, home security, data storage, and more are offered to consumers on a subscription basis.

It's not the number of subscriptions that are being offered but their price -- and value -- that customers are beginning to question.

Read on for a deep dive into what consumers think about the spread of subscriptions into nearly every corner of the economy, how much they're spending on subscriptions, and what subscriptions they value most.

Over 50% think they're spending too much on subscriptions

Fifty-seven percent of respondents to Motley Fool Money's 2024 Subscription survey believe they're spending too much for their subscription services.

Over 50% of every generation surveyed thinks they're overspending on subscriptions. Baby boomers are most likely to think they're spending too much (58%), while millennials are least likely to think so (54%).

That most respondents believe they're paying too much for their subscriptions could be a reflection of two trends:

- More products available only on a subscription basis, which means a larger percentage of the average consumer's budget is put toward subscriptions.

- Rising subscription prices not aligning with increased subscription value.

One-third of survey respondents pay $100 or more per month on subscriptions

| How much do you spend monthly on subscriptions? | $0 to $50 | $51 to $100 | $100 to $150 | More than $150 |

|---|---|---|---|---|

| Gen Z | 28% | 30% | 26% | 16% |

| Millennials | 24% | 32% | 27% | 17% |

| Gen X | 44% | 29% | 14% | 13% |

| Baby boomers | 54% | 22% | 12% | 12% |

| All respondents | 39% | 27% | 19% | 14% |

A third of respondents are paying over $100 a month on subscription services. Fourteen percent are spending more than $150 a month and 19% are spending between $100 and $150.

Gen Z and millennials spend more on subscriptions than Gen X and baby boomers. Forty-two percent of Gen Z and 44% of millennial respondents report spending more than $100 per month on subscriptions compared to 27% of Gen X and 24% of baby boomers.

Baby boomers spend the least on subscriptions, with 54% spending $0 to $50 on subscriptions each month. That's 10% higher than Gen X, 30% higher than millennials, and 26% higher than Gen Z.

40% feel as though they're oversubscribed

Forty percent of respondents to Motley Fool Money's 2024 Subscription survey feel as if they're subscribed to too many services. That percentage jumps to nearly 50% for Gen Z and millennials, but drops to 39% for Gen X and 29% for baby boomers.

Younger generations hold the most subscriptions

| How many services are you subscribed to, not including internet and other basic services, like utilities, rent, and insurance? | 0 to 5 | 6 to 10 | More than 10 |

|---|---|---|---|

| Gen Z | 43% | 42% | 14% |

| Millennials | 45% | 42% | 13% |

| Gen X | 66% | 24% | 10% |

| Baby boomers | 71% | 24% | 5% |

| All respondents | 58% | 32% | 10% |

Baby boomers and Gen X may not feel as oversubscribed as younger generations because they're subscribed to fewer services on average.

Seventy-one percent of baby boomers and 66% of Gen X respondents report being subscribed to zero to five services. By comparison, around 45% of Gen Z and millennials say they're subscribed to five or fewer services.

Forty-two percent of Gen Z and millennials are subscribed to six to 10 services and just under 15% are subscribed to over 10. Just 24% of Gen X and baby boomers hold six to 10 subscriptions and 10% and 5% respectively are subscribed to more than 10 services.

30% are spending more on subscriptions compared to last year

| How has your spending on subscriptions changed over the past year? | I'm spending more | I'm spending less | I'm spending the same |

|---|---|---|---|

| Gen Z | 36% | 30% | 34% |

| Millennials | 44% | 24% | 32% |

| Gen X | 25% | 28% | 47% |

| Baby boomers | 16% | 28% | 55% |

| All respondents | 30% | 27% | 43% |

Most respondents to Motley Fool Money's 2024 Subscription survey are spending the same amount on subscriptions as last year (43%) or more (30%).

Only 27% reported spending less on subscriptions this year compared to last, despite 57% of respondents overall saying they think they spend too much on subscriptions.

Just 16% of baby boomers and 25% of Gen X say they're spending more compared to 44% of millennials and 36% of Gen Z.

This suggests that consumers find it difficult to break away from subscriptions once they've signed up or that they're willing to put up with a combination of more subscription services and higher subscription prices -- for now.

Delivery services, TV and movies are the most important subscriptions

Grocery delivery, followed by TV and movies, and retail delivery services like Amazon Prime, are the three subscription services respondents value most, overall.

Subscriptions that provide access to live sports, video games, and books are valued least among all respondents.

Generations have different preferences:

- Gen Zers value retail delivery subscriptions slightly less and value music more.

- Millennials assign greater importance to clothing, fashion, and beauty subscriptions and video game services.

- Gen Xers values clothing, fashion, and beauty services more than baby boomers and Gen Z.

- Baby boomers value food delivery less than Gen Z and Gen X, and value book and magazine subscriptions more than any other generation.

Nearly a third have opened a credit card to take advantage of subscription perks

Thirty-one percent of respondents have opened a credit card to earn perks and rewards related to subscription services.

Gen Z (44%) and millennials (47%) were much more likely than Gen X (25%) and baby boomers (15%) to have done so.

Some credit cards offer competitive cash back or points for spending on streaming services while others are available only for subscribers to certain services. One example is the Prime Visa. A few cards offer statement credits for subscription services.

Given that Gen Z and millennials are subscribed to more services and are spending more on subscriptions than older generations, it's no surprise they'd seek out savings or bonuses related to them.

Americans are starting to feel subscription fatigue

The majority of Americans think they're spending too much on subscriptions and a sizable chunk -- 40% -- think they have too many subscriptions. Younger generations in particular feel oversubscribed and may be having trouble cutting their spending on subscriptions.

That points to growing subscription fatigue. With more products and services -- from food delivery to personal data storage, home security to fitness tracking -- adopting subscription models, people are growing weary of adding more monthly payments to their budgets.

Older generations are particularly sensitive to becoming oversubscribed and may not see the same value in subscription services as younger generations do. Baby boomers and Gen Z have the fewest subscriptions, spend the least on subscriptions, and are least likely to feel as though they're oversubscribed, but are most likely to think they're spending too much.

In some instances, subscriptions may be a convenient -- and cheaper -- way to automate regular purchases or replace previous services or products, like cable and buying music from a digital storefront.

On the other hand, research has found that economically vulnerable people are more likely to have subscriptions they don't want and that auto-renewals can result in unwanted spending on forgotten services. Subscriptions can also lead to more spending on a particular category, driving up overall costs.

There are options for those who feel as if they have too many subscriptions or are paying too much for them but don't want to cancel subscriptions altogether:

- Cut the price: Some services offer lower tier subscriptions that are cheaper but offer fewer features. This is a great option for premium services that provide too much to fully take advantage of.

- Switch to ad-supported options: Many streaming services offer ad-supported plans at a lower cost.

- Opt for annual billing: Some streaming services offer a lower price for an annual subscription than a year's worth of monthly subscription payments. This is a good option for those who know they'll use a service for an entire year.

Among the best ways to keep subscription costs down is a simpler solution: keep track of what you're subscribed to and if you're not using it, or using it rarely, cancel it.

Canceling a subscription can be harder than signing up for one. But once you let go of it, it may be easier to realize the value didn't justify the cost.

Methodology

Motley Fool Money distributed a survey via Pollfish on March 6, 2024. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling. The survey was composed of 2,000 American adults.

Sources

- Deloitte (2022). "Demystifying the hype of subscription."

- National Bureau of Economic Research (2023). "Selling Subscriptions."

- Zuora (2023). "The Subscription Economy Index."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.