Study: How Rich Americans Use Credit Cards

The wealthiest are known for using the most exclusive credit cards -- luxury credit cards and so-called black credit cards. We decided to find out if that's the case and understand how rich Americans actually use their credit cards.

There are some similarities between how wealthy Americans use credit cards and how the average American does.

They prefer to use credit cards when they can, opt for cash back and no annual fee cards, and generally trust the big issuers. But they have some bad habits, too -- about half had an automatic payment set up, and only a third pay their statement or full balance every month.

Based on a survey distributed by Motley Fool Money, millionaires have some different preferences than the less wealthy when it comes to credit cards.

For example, they're more likely to have travel rewards cards and place more importance on rewards over interest rates.

To get a peek into how rich Americans use credit cards and see how they compare to the average American, read on.

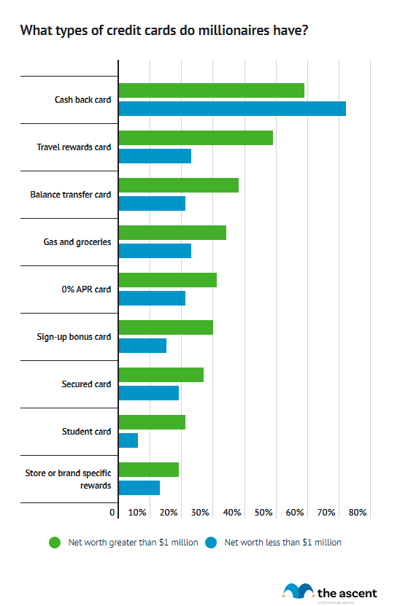

Cash back credit cards are the most popular type of credit card among wealthy Americans

Fifty-nine percent of high-net-worth Americans have a cash back card, compared to 72% of Americans with a net worth under $1 million.

While millionaires are less likely to have a cash back card than the average American, they're more likely to have every other major type of credit card, including travel rewards cards, balance transfer cards, gas and grocery cards, and sign-up bonus cards.

| Which of the following types of credit cards do you have right now? | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| Cash back card | 59% | 72% |

| Travel rewards card | 49% | 23% |

| Balance transfer card | 38% | 21% |

| Gas and groceries | 34% | 23% |

| 0% APR card | 31% | 21% |

| Sign-up bonus card | 30% | 15% |

| Secured card | 27% | 19% |

| Student card | 21% | 6% |

| Store or brand specific rewards | 19% | 13% |

Wealthy Americans may be less likely to have a standard cash back credit card than the average American, because earning cash back is less important to them given their net worth.

On the other hand, travel rewards may better fit their lifestyle. Rich Americans may be more willing to swap cards on a more regular basis to maximize rewards via credit card churn, which may lead them to balance transfer and sign-up bonus cards more so than the average consumer.

A more straightforward explanation to the differences in types of credit cards owned is that rich Americans tend to have more credit cards and open new cards at a quicker pace than average Americans.

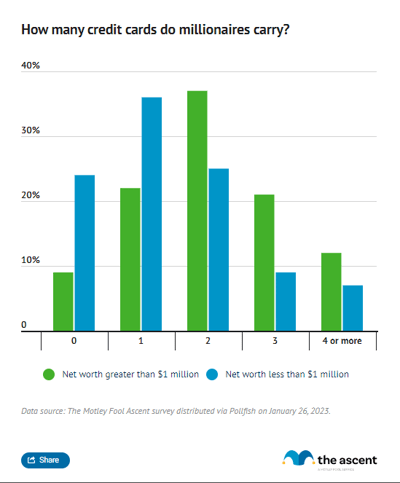

Millionaires are more likely to have multiple credit cards compared to the average American

Seventy percent of Americans with a net worth over $1 million have two or more credit cards, compared to 41% of Americans with a net worth under $1 million.

Another major discrepancy is that only 9% of high-net-worth Americans have no credit cards while 24% of Americans with a net worth under $1 million report not having a credit card.

Less wealthy Americans are more likely to have one credit card (36%) than rich Americans (22%). Rich Americans are more likely to have two, three, and four or more credit cards than Americans who are worth less than $1 million.

| How many credit cards do you have | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| 0 | 9% | 24% |

| 1 | 22% | 36% |

| 2 | 37% | 25% |

| 3 | 21% | 9% |

| 4 or more | 12% | 7% |

Motley Fool Money recommends that most consumers should have one or two credit cards, although wealthy Americans may have the finances to juggle more than two cards. Plus, their spending in certain categories may be sufficient to justify an extra card or two to maximize rewards.

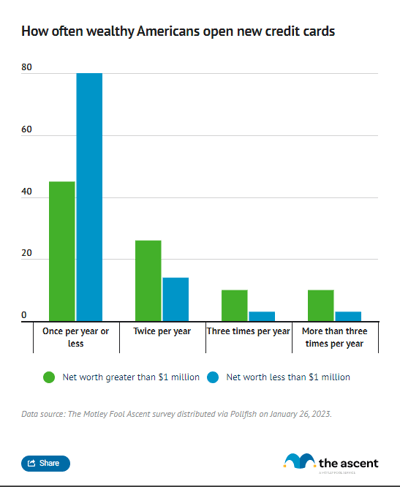

Rich Americans open new credit cards more frequently than the average American

In addition to having more credit cards than the average American, rich Americans also open credit cards more frequently.

Twenty-six percent of Americans worth over $1 million open a new credit card twice a year compared to 14% of those worth less. Twenty percent open a new card three or more times per year compared to just 6% of all other Americans.

| How often do you open a new credit card, on average? | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| Once per year or less | 45% | 80% |

| Twice per year | 26% | 14% |

| Three times per year | 10% | 3% |

| More than three times per year | 10% | 3% |

Wealthy Americans may be more likely to try their hand at credit card churning in a bid to maximize rewards. Credit card companies are making this practice tougher, however, and applying for more credit on a regular basis can have a negative impact on credit scores.

Rich Americans care less about interest rates, more about rewards, than the average American

Wealth changes credit card priorities. Twenty-six percent of wealthy Americans view interest rates as the most important factor when choosing a credit card compared to 40% of Americans that are less wealthy.

By contrast, 22% of rich Americans prioritize credit card rewards when shopping for a new card compared to 17% of Americans with a net worth below $1 million.

Wealthy Americans also care less about annual fees (9% to 18%) and care more about card design (6% to 2%), balance transfer terms (6% to 3%), and foreign transaction fees (5% to 1%).

| What is the most important factor in choosing a credit card to apply for? | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| Interest rate | 26% | 40% |

| Rewards rate | 22% | 17% |

| 0% APR window | 10% | 10% |

| Annual fees | 9% | 18% |

| Sign-up bonus | 8% | 6% |

| Card design | 6% | 2% |

| Balance transfer terms | 6% | 3% |

| Foreign transaction fees | 5% | 1% |

| Issuing bank/organization | 4% | 3% |

| Contactless capability | 4% | 2% |

Interest rates may matter less to rich Americans because they likely have an easier time paying off their credit card each month. A larger budget may translate to more travel, or at least a demand for more luxurious travel, so wealthy Americans naturally gravitate towards travel rewards cards.

Bank of America and American Express are the most popular credit card issuers among high-net-worth Americans

Despite the wealthiest being associated with luxury credit cards and so-called "black cards," Bank of America is the most popular credit card issuer among millionaires. Fifty percent of Americans with a net worth over $1 million have a Bank of America credit card.

American Express (38%), Capital One (35%), and Chase (34%) are other popular credit card issuers among America's wealthy.

| From which of the following issuers do you currently hold a card? | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| Bank of America | 50% | 24% |

| American Express | 38% | 19% |

| Capital One | 35% | 37% |

| Chase | 34% | 23% |

| Citibank | 27% | 11% |

| Discover | 24% | 14% |

| Barclays | 21% | 4% |

| USAA | 21% | 6% |

| Wells Fargo | 21% | 13% |

| U.S. Bank | 20% | 4% |

| PNC | 16% | 5% |

| Navy Federal Credit Union | 14% | 3% |

Millionaires are more likely to have a credit card from nearly every major issuer than less wealthy Americans, with Capital One being the only exception. This is likely due to rich Americans simply having more credit cards than the average American.

Wealthy Americans are less trustworthy of nearly every credit card issuer compared to the average American

Despite having more credit cards from most issuers, wealthy Americans are less trusting of almost every credit card issuer compared to Americans worth less than $1 million.

The exceptions are Barclays, which is the least trusted credit card issuer among less wealthy Americans and rich Americans, and PNC.

| Which of the following credit card issuers do you find most trustworthy? | Net worth greater than $1 million | Net worth less than $1 million |

|---|---|---|

| American Express | 80% | 89% |

| Bank of America | 77% | 80% |

| Barclays | 70% | 62% |

| Capital One | 78% | 86% |

| Chase | 76% | 85% |

| Citibank | 77% | 82% |

| Discover | 74% | 85% |

| Navy Federal Credit Union | 72% | 80% |

| PNC | 74% | 72% |

| U.S. Bank | 76% | 77% |

| USAA | 76% | 78% |

| Wells Fargo | 71% | 73% |

High-net-worth credit card holders are interested in crypto, environmental, and social cards

The Motley Fool's recent study found that high-net-worth investors are interested in cryptocurrency -- and this survey echoes that finding.

Just under a third of our respondents said they'd be "very likely" to apply for a credit card that offered crypto rewards. This was consistent across the board, regardless of self-reported net worth.

| How likely would you be to apply for a credit card that delivered rewards in cryptocurrency? | Percentage of respondents |

|---|---|

| Very unlikely | 21.73% |

| Somewhat unlikely | 22.40% |

| Somewhat likely | 23.07% |

| Very likely | 32.80% |

Wealthy respondents also said they'd be very likely to apply for a credit card that supports environmental or social causes, and there was even more agreement here than there was on crypto -- a third said they'd be "very likely" to apply while less than 20% said they'd be "very unlikely."

| How likely would you be to apply for a credit card that focused on supporting environmental or social causes? | Percentage of respondents |

|---|---|

| Very unlikely | 19.00% |

| Somewhat unlikely | 20.40% |

| Somewhat likely | 27.60% |

| Very likely | 33.00% |

Wealthy credit card holders have bad habits, too

High-net-worth credit card holders are often held up as model users of credit. Interestingly, these results didn't point that way -- at least when it comes to paying off credit cards on time.

Only a third of respondents pay their statement balances every month, and almost 20% said they almost never pay their statement balance. Compare that to the 60% of respondents in Motley Fool Money's 2021 survey who said they pay their statement or full balance every month.

| HOW OFTEN DO YOU PAY OFF YOUR STATEMENT BALANCE (NOT NECESSARILY YOUR ENTIRE CARD BALANCE), ON AVERAGE? | PERCENTAGE OF RESPONDENTS |

|---|---|

| Every month | 33.07% |

| Not every month, but often | 22.20% |

| A few times a year | 24.80% |

| Almost never | 19.93% |

That's a lot of money going toward interest payments.

With that in mind, it might not be surprising that over half of our respondents had maxed out a credit card. The only group that saw a number under 50% was those with a self-reported net worth of $5 million to $10 million.

| HAVE YOU EVER MAXED OUT A CREDIT CARD? | PERCENTAGE OF RESPONDENTS |

|---|---|

| Yes | 51.73% |

| No | 48.27% |

Another surprising result of our survey is that just over half -- 50.93% -- of respondents have automatic billing set up. The rest pay manually online or use another method.

Setting up automatic billing can help credit card users avoid interest charges by eliminating the possibility of forgetting to make a payment.

How do wealthy people use credit cards?

Wealthy Americans generally use credit cards the same way that everyone else does.

They opt for cash back and no annual fee cards, and generally trust the big issuers. But they have some bad habits, too -- about half had an automatic payment set up, and only a third pay their statement or full balance every month. Rich Americans also open new credit cards at a relatively fast pace and carry more cards than the typical person.

Unsurprisingly, wealthy credit card holders are also interested in cards that provide crypto rewards and those that support environmental and social causes.

In the end, modeling your own credit card use after the rich isn't going to get you much further than responsibly using credit cards and keeping an eye on rewards and offers.

Methodology

Motley Fool Money distributed two surveys via Pollfish. The survey distributed on Dec. 30, 2021 was taken by 1,500 American adults who hold a credit card and self-reported a net worth of at least $1 million, Respondents were 42% female and 58% male. The survey distributed on Jan. 26, 2023 was taken by 600 American adults that identified as having a net worth over $1 million and 1,400 American adults who identified as having a net worth under $1 million. Respondents were 49% male and 51% female.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.