Source: National Grid plc.

National Grid plc (NGG 1.00%) is a favorite among high-yield income investors thanks to its generous 4.4% yield. However, over the last eight years, not only has National Grid underperformed the market, in general, but most of its peers, as represented by the Vanguard Utilities ETF, as well.

NGG Total Return Price data by YCharts.

NGG Total Return Price data by YCharts.

Meanwhile, two of my favorite utilities, Brookfield Infrastructure Partners (BIP +1.32%), and NextEra Energy Inc.(NEE +0.70%), generated far-superior returns. More importantly, both are likely to continue to serve long-term dividend investors far better than National Grid in the coming decades.

National Grid: Very little growth to speak of

National Grid just reported pretty-good earnings for a large utility; however, with just 1.1% dividend growth, you can see that this company is far from a growth story. In fact, with the company moving forward with its planned sale of its U.K. natural gas distribution business, the proceeds of which are likely to be funneled into share buybacks or higher dividends, National Grid is lining up to become nearly a purely high-yield-based investment during the next few years.

That means that investors may have to settle for even slower dividend growth than what they've received over the past seven years:

- National Grid: 5.6% CAGR

- NextEra Energy: 8.6% CAGR

- Brookfield Infrastructure Partners: 14.3% CAGR

However, investors may be willing to stick with National Grid because it offers less volatility or more secure payouts. In fact, when you compare all three utilities, you'll find that NextEra Energy and Brookfield Infrastructure offer not only current income that's just as secure, if not more so, as National Grid's, but also superior growth prospects thanks to distinct advantages they possess over their British rival.

Brookfield and NextEra have more-secure and growing payouts

| Utility | Yield | Q1 2016 Dividend Payout Ratio | Projected Long-Term Dividend Growth Rate | Beta |

| National Grid | 4.3% | 75.5% | 2.9% | 0.55 |

| Brookfield Infrastructure Partners | 5.4% | 62.8% | 5% to 9% | 1.27 |

| NextEra Energy | 2.9% | 63.5% | 8.1% | 0.34 |

Brookfield Infrastructure Partners boasts a higher yield than National Grid. It's also supported by diverse, fast-growing, long-term contracted and regulated assets around the globe. That international exposure, as well as its smaller market cap, results in more share-price volatility, which is something that highly risk-averse investors should keep in mind.

However, for those who primarily seek secure dividends and minimal market volatility, NextEra Energy trumps National Grid in these regards, as well. In fact, NextEra Energy's higher retained cash flow after dividend payments means more-secure income, and superior long-term dividend growth potential, courtesy of NextEra's business model.

NextEra Energy: Regulated utility with a growth kicker

Through its Florida Power & Light subsidiary, NextEra Energy obtains the same benefits as regulated utilities such as National Grid: stable and guaranteed returns on capital to anchor its dividend. However, because Florida's population and economy are growing faster than National Grid's Appalachian-focused business, it offers superior long-term growth prospects.

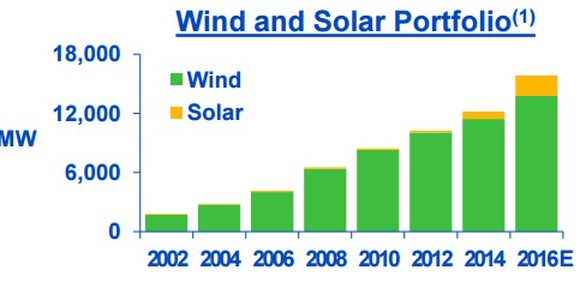

The real reason to own NextEra, though, is its NextEra Resources subsidiary, which, in addition to providing energy to customers in 27 states and Canada, also holds a dominant position in renewable energy. NextEra Energy is America's largest solar and wind power generator, providing it with potentially decades of strong earnings, cash flow, and dividend growth as America transitions toward greener energy sources.

Source: NextEra Energy investor presentation.

Thanks to the recent extensions of solar and wind tax credits, NextEra plans to keep investing heavily in solar and wind, with as much as 5.4 GW of additional capacity expected to come online in 2017 and 2018, in addition to the 4 GW of capacity added in 2015 and 2016.

To help finance all this new renewable capacity, NextEra Energy Inc has the benefit of its yieldCo, NextEra Energy Partners (NEP +3.30%), which allows NextEra Energy Inc to offset the cost of this aggressive growth. This helps the utility preserve a strong balance sheet and financial flexibility.

Here's how it works: NextEra Energy Partners raises a substantial amount of external debt and equity capital from investors, which it then uses to buy NextEra Energy's assets and grow its long-term contracted, fixed-fee cash-flow stream. This funds NextEra Energy Partners' generous 4.6% yield, which management expects to grow 12% to 15% annually through at least 2020.

As a 29.2% owner of NextEra Energy Partners' shares, as well as its incentive distribution rights, NextEra Energy Inc, gains an exponentially growing contracted cash-flow stream that can help maintain its own earnings and dividend growth for years to come.

Bottom line

While National Grid is far from a bad long-term income stock, investors must always consider better alternatives for their limited capital. With Brookfield Infrastructure Partners and NextEra Energy Inc, you can not only gain generous and secure dividend income today, but also benefit from superior income growth in the years to come, courtesy of their access to faster-growing utility markets, both in the U.S. and abroad.