Image source: Getty Images.

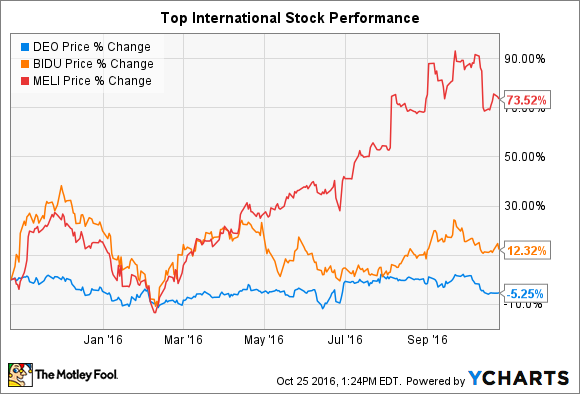

Though investing in foreign stocks brings with it some additional risks, finding the top international stocks to buy is also a great way to find and profit from opportunities many investors overlook. Case in point, Nestle (NSRGY -2.27%), Baidu (BIDU -4.12%), and MercadoLibre (MELI 1.40%) are some of the best foreign businesses operating today, making these names some of the top international stocks to buy today.

Nestle: the international dividend aristocrat

Nestle is a classic "boring is beautiful" kind of company, and its ability to consistently execute its straightforward business model makes it a fantastic stock for international investors who aren't seeking something highly exotic. Today, Nestle stands as the world's largest food company; it owns over 2,000 brands and 20 brands that generate over $1 billion in annual sales. Much like U.S.-based consumer staples giants Procter & Gamble and Kimberly-Clark, Nestle manufactures and sells a wide range of goods that consumers consistently buy regardless of the state of the economy. Given its massive size, the company's global distribution system also serves as a powerful competitive advantage, enabling it to easily adapt to trends more quickly than smaller competitors.

Though the company dates back to 1875, Nestle's enviable streak of consecutive annual dividend increases started nearly a century later. Since 1959, the company has grown its annual cash payouts, easily qualifying the stock as a Dividend Aristocrat. Its 3.1% dividend yield combines with this track record to make Nestle one of the more alluring dividend growth stocks among international companies on the market today.

Baidu: a generational Chinese growth stock

Baidu remains one of my favorite international stocks -- I personally own it -- as well as a longtime recommendation in the Fool's premium services. Plainly stated, Baidu lies at the epicenter of several of the most important technology growth markets in the world's most populous country.

Known as the "Google of China," Baidu operates what is by far the most dominant search engine in China. As one measure of market share, Baidu is estimated to have generated over 80% of all search engine advertising revenue in 2015; recall that Google is officially blocked in China. Despite historic spending to drive deeper into new growth markets, the outsized profitability of Baidu's search operations still managed to produce 15% operating margins in its most recent quarters.

Still catering to a relatively small percentage of its potential advertising audience, the growth potential of Baidu's core search operations are enough to justify owning this international stock. However, Baidu's aggressive push deeper into new online services like food deliveries and more, its Google-esque development of self-driving car technology, and its deep investments into nascent technology verticals like artificial intelligence each offer massive potential payoffs for investors. The state of the Chinese economy and intense competition from other large Chinese tech companies can indeed weigh on its volatile shares, but over the long term, Baidu offers international investors one of the most appealing growth profiles anywhere in the market.

MercadoLibre: Latin America's e-commerce growth stock

Much like Baidu, MercadoLibre has successfully applied a proven online business model -- e-commerce in this case -- and built a dominant regional franchise around it. Since it's easy to understand, think of MercadoLibre as the "Amazon or eBay of Latin America." The company operates the continent's largest e-commerce platform, spanning 13 countries and 550 million people. What's more, its impressive recent financial performance demonstrates what makes this international growth stock such an attractive option for investors today.

In its most recent quarter, MercadoLibre saw its revenues increase 29% in U.S. dollar terms, and the volume of total units sold rose 45%. Perhaps more importantly, MercadoLibre continues to establish its ancillary payments and shipping services that leading e-commerce businesses like Amazon have leveraged as competitive advantages so successfully in recent years. MercadoLibre's PayPal-esque service MercadoPago saw the number of transactions it processed rise 76% in the company's most recent quarter; its current penetration among MercadoLibre users today stands at 75%. Similarly, the shipment volume in the company's fulfillment services operation also doubled from the year prior.

In virtually every sense, MercadoLibre appears to be firing on all cylinders. Despite that success, MercadoLibre's full-year 2015 sales of $651 million accounted for just 1.5% of Latin America's estimated $40.9 billion in e-commerce sales, a number expected to double by 2019. MercadoLibre will certainly face volatility in its business, particularly given the region's long-standing history of foreign currency turmoil. Competitors like Amazon also figure to move deeper into the continent. However, with its brand credibility and customer-centric suite of offerings, MercadoLibre, like Nestle and Baidu, still stands as one of the best international stocks for long-term investors.