Image source: Getty Images.

If you're looking for a biotech with a habit of beating expectations, you may be considering Amgen (AMGN +0.44%). The company has posted positive beats for the past year, including a 3.65% surprise in Q2, and is likely to "surprise" again on Thursday.

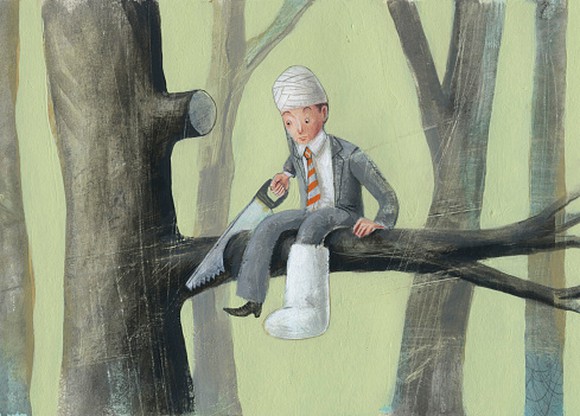

But push the pause button, because Amgen isn't as good as it looks. Specifically, the biotech has a concentrated revenue position in only a few products, it's growing revenue and earnings by increasing prices in the face of dwindling sales, and the pipeline's $10 billion flop has put a big question mark under this company's research productivity.

Let's take a closer look at the major pipeline failure first, and then see how things could shape up for this stock long-term.

Amgen's golden duck lays a big goose egg

Two years ago, Amgen's management shelled out $10.3 billion for Onyx Pharmaceuticals to acquire a drug called Kyprolis. Ambitions for this drug ran sky high. In fact, in July, Amgen CEO Robert Bradway said, "We expect [Kyprolis] to be a backbone of multiple myeloma therapy for the forseeable future."

Fast-forward to today, and Amgen's management has $10.3 billion worth of egg on its face, and Kyprolis, formerly one of its most important new drugs, is a major disappointment. Amgen badly needed proof it was a superior drug to gain approval in a first-line setting, which was the only way Kyprolis would ever reach the kind of revenue required to justify a $10 billion price tag. Instead, data released in the recent phase 3 Clarion trial showed that the drug was no better than Johnson & Johnson's (JNJ 2.27%) Velcade.

That's terrible news for Amgen, since cheap Velcade generics are already on their way -- with that drug's patent set to expire next year. Meanwhile, trial data showed Kyprolis achieving median progression-free survival of 22.3 months, next to no difference from the 22.1 months for the Velcade cohort.

Kyprolis is being used as a second-line therapy, but even in that setting it faces growing competition. Since the Onyx acquisition, new drugs have flooded the multiple myeloma market, including superstar Darzalex and Bristol-Myers Squibb and AbbVie's co-developed Empliciti. And then there's recently released Pomalyst from Celgene (CELG +0.00%). Unfortunately for Amgen, Kyprolis and Pomalyst use very similar mechanisms of action, but Celgene's drug has the big advantage of being a pill, while Kyprolis requires a bi-weekly office visit for an infusion.

Kyprolis' sales ticked downward last quarter. Sales may vacillate when Amgen reports on Oct. 27, but the real issue is this: Kyprolis, which some analysts saw reaching $3 billion at its peak, is going to bring in a small fraction of that figure at best and fail to provide Amgen the multiple myeloma "backbone" it hoped for.

Sprinkling rain on the PCSK9 parade

The second hoped-for star in Amgen's pipeline parade is PCSK9 blocker Repatha. Analysts forecast that the new cholesterol-lowering injection could reach the range of $2 billion to $4 billion. I'd dial that down to the lower number, since Repatha has rival drug Praluent to contend with, from Sanofi and Regeneron, as well as a promising PCSK9 blocker from Pfizer that is in late-stage trials.

In fact, Repatha might not even reach $2 billion. The drug, which is priced at an eye-popping $14,000 annually, is having the least inspiring launch of a major drug I can remember. Last quarter, it brought in a meager $27 million. Bottom line: The PCSK9 drugs must secure adequate payer access to keep from disappointing investors, and payers aren't having it. For just one example, the nation's largest PBM, Express Scripts, excluded both Repatha and Praluent from its formulary.

What about some analysts' belief that Repatha and the other PCSK9 drugs could end up being approved to replace statins for managing cholesterol in the general population? The FDA is going to demand a mountain of data on efficacy and safety before that happens, and in the end, it might not matter. According to the Journal of the America Medical Association report, averting a cardiovascular death by one year with the new PCSK9 inhibitors would cost the healthcare system far too much to make their use feasible in a broad application -- an estimated $500,000 per life year extended.

More than 71 million U.S. adults, or nearly one-third of the adult population, have high-LDL cholesterol -- the bad kind -- according to the CDC. The prospect of having such an expensive injectable drug replacing generic statins, which cost 90% less, simply doesn't pass a sanity test. Consider this: The bill for the healthcare system -- assuming we reduce the use to those who have not just high cholesterol, but also a history of coronary disease -- would be $100 billion to $200 billion annually.

Amgen indulges in price increases to offset declining sales

Perhaps I'm being a tad harsh on Amgen, but the company is a classic example of a biopharma that's leaning on constant price increases for growth. For example, Amgen's top-seller, rheumatoid arthritis drug Enbrel, cost $10,000 per year when it came on the market in 1998. Today, it rings the register at $4,000 per month, or $48,000 per year, a price so steep Enbrel isn't covered by most Medicare and insurance plans.

Raising prices on old drugs to make up for their declining sales has been a common practice among drugmakers for decades, but political and payer pressure is affecting the whole sector and puts Amgen at high risk.

Why Amgen in particular? Amgen generates over 50% of its revenue from two aging biologics, Neulasta and Enbrel. The days when these drugs were expected to grab an ever-increasing slice of the pie are over. Both saw declining sales volume last quarter, but lower unit sales were "managed" by raising their selling prices.

In fact, Enbrel, whose revenue apparently spiked 10% to $1.48 billion last quarter, saw its volume, or number of prescriptions written, shrink 2%. That would have been reflected in the revenue, if Amgen hadn't moved Enbrel's price up to make up for lagging sales.

Simply put, relying on manipulating drug prices is no longer a viable strategy for growth in today's price-conscious world. And with Amgen's major pipeline drugs unlikely to fulfill expectations, I see better choices elsewhere.