Wells Fargo (WFC +1.60%) released its 2016 fourth-quarter earnings report on Friday the 13th. It was the first quarterly earnings report released since CEO John Stumpf resigned in October over the fake accounts scandal. As such, it provides a good preview of the new CEO Timothy Sloan's attempts to restore some of Wells Fargo's lost prestige and earnings potential.

These issues are front and center to anyone considering an investment in Wells Fargo. If the fallout is overblown, WFC could take back its position as the largest commercial bank in the U.S. based on assets. In that case, an investment in Wells Fargo would do quite well.

Mixed results: net income was slightly down, but not bcause of the scandal

The fake accounts scandal involved branch employees who were incentivized to open extra accounts, regardless of whether customers wanted them or not. This caused an estimated 2 million extra deposit and credit card accounts to be opened, many without the customer's knowledge. In the aftermath, CEO Tim Sloan has said he wants to "restore the trust we've lost" and fix Wells Fargo's culture.

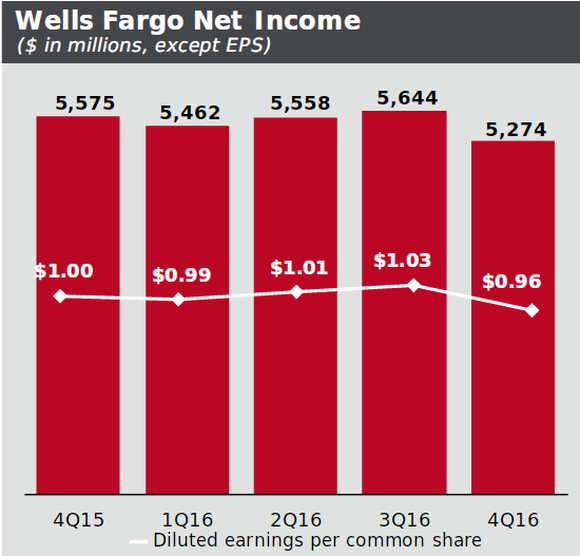

The immediate concern for Q4 2016 was how this scandal would affect earnings. The earnings news was mixed, with overall net income falling compared to Q4 2015. This was mostly due to changes in interest rates unrelated to the account scandal.

Image source: Q4 2016 Earnings Supplement.

Most of all, the scandal was supposed to affect Wells Fargo's community banking segment. That was where the fraud occurred. Activists targeted that segment by urging WFC bank customers to close their accounts. This doesn't appear to have happened.

CFO John Shrewsberry stated in November that account openings were down:

Compared with a year ago, we're still experiencing lower levels of customer interactions, new checking account opens and credit card applications, but the year-over-year decline was less than we had in October.

-- Wells Fargo Special Call 12/16/16

Surprisingly, this has not substantially affected total customer count. Retail checking accounts are still up from last year, as are credit and debit card purchases:

The minimal impact to WFC's bottom line could prove that its efforts to fix the problem are working -- or that consumers really didn't care that much about the fraud. It's hard to tell at this point. But the actions the new CEO is taking look promising.

New CEO Tim Sloan is making efforts to fix the fake accounts issue

Among the efforts to correct the fake accounts issue, the most important part is the changes made to team member compensation. The biggest change recently has been the elimination of product sales goals.

Minimum pay has been raised to $13.50-$17.00 an hour, based on location and experience level. Another major change is a greater focus on branch goals, as opposed to individual ones, based on customer service and "a longer term view of the customer relationship."

While the financial impact of these changes is yet to be seen, they appear to be a step in the right direction. People will do what they are paid to do, even if it violates stated rules. The previous culture of fraud at Wells Fargo did not spring from nothing. Team members were rewarded and punished monetarily to increase the number of accounts customers opened. It's no surprise to me that this caused widespread fraud.

This is a positive sign

Two factors make this earnings report a good sign for the future. One, the impact to earnings was minimal, and two, Wells Fargo appears to be making a true effort to change. The second factor is the most important one.

Wells Fargo was not required to make all of the changes it did. When former CEO John Stumpf resigned, I knew more changes were probably coming. The fact that these decisions have been made in a relatively short period of time shows that Wells Fargo's new leadership is serious about making tough changes to eliminate the factors that caused this problem.

It will be interesting to see how these changes affect customer acquisition and retention in the future. If customer counts continues to rise throughout 2017, I think we can safely assume the major affects of the scandal are behind Wells Fargo for good.