It's getting harder and harder for any serious investor to overlook renewable energy investments as just a simple fad. The economics of solar and wind energy improve every day and now -- depending on where they are deployed -- are often cheaper power sources than traditional fossil fuels. On top of that, you have older, more established power sources such as hydro that play a critical role in providing base load power. There is money to be made in this industry today if you make the right investments.

So we asked three of our contributors to highlight stocks in the renewable energy industry that look like great investments today. Here's a brief rundown of their three choices: Vestas Wind Systems (VWDRY 4.47%), First Solar (FSLR 1.29%), and Brookfield Renewable Partners (BEP 3.84%).

Image source: Getty Images.

The answer is blowing in the wind

Jason Hall (Vestas Wind Systems): While solar panel makers and installers tend to get all the headlines, wind turbine maker Vestas has been a far better investment in recent years. Over the past five years, shares of Vestas are up a market-destroying 1,500%.

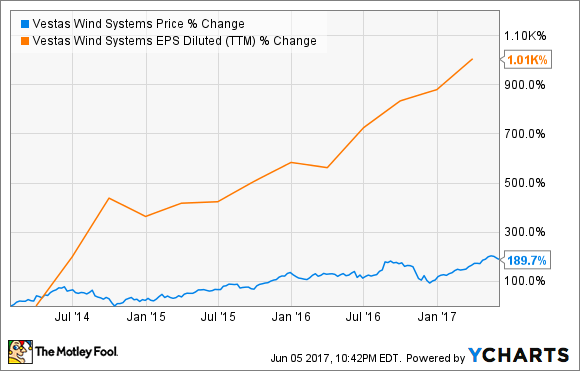

That period includes a big turnaround effort by current management after several years of struggles under high expenses and an inflexible operating model. So here's a look at a more recent period that shows how well the company has performed:

Since the beginning of 2014, Vestas has grown its profits tenfold, and the market has rewarded investors, almost tripling the stock price. But there's still plenty of long-term growth for Vestas.

To start with, the company has proven to be a stalwart in the wind turbine industry, as the only pure player competing against much bigger industrial conglomerates GE and Siemens. While there is -- and will likely be -- plenty of cyclicality in wind turbine sales, as global orders ebb and flow from one year to the next, the world's demand for electricity is only going to increase going forward.

Furthermore, it's not going to take major government action for wind power to continue growing as an energy source; in many places, it's getting very close to grid parity without tax incentives. Nonetheless, the Paris climate accord -- even without the support of the U.S. -- is likely to further bolster Vestas' prospects.

If you're looking for long-term renewables growth, it doesn't have to be in solar. Vestas is worth a close look.

The sun always rises after it sets

Tyler Crowe (First Solar): Many investors have run away from solar stocks over the past year or so as the industry hits one of its occasional speed bumps. I think the major misconception is that investing in solar is a growth story that will only go up, but the reality is that this is also a cyclical business that occasionally runs into periods of panel oversupply or lower demand. It's during periods like this that investors should be investing in solar, and First Solar continues to look like the best bet over the long term.

Producing solar panels isn't an easy business. The technology improves at a rapid pace, and companies need to spend loads of money on research and development as well as to reconfigure facilities to manufacture an improved panel. On top of that, it is a business where products quickly become commoditized, and where a company can lose a lot of money when the market swoons.

What makes First Solar most attractive considering these factors is that it has weathered several of these cycles before while maintaining some of the best returns on invested capital in the business. What's more, it has a much better financial position than any of its peers with $2.1 billion in net cash -- cash minus debt. That strong balance sheet gives First Solar many more opportunities than its peers to reinvest in the business -- it's retooling two of its facilities to manufacture its new Series 6 product as we speak -- without becoming compromised.

The future for solar power looks brighter by the day. Costs continue to come down and power producers are electing to deploy solar over traditional fossil fuels. With First Solar's stock hit by a market swoon lately, it's a great time to buy into this company at a decent discount.

The overlooked renewable

Matt DiLallo (Brookfield Renewable Partners): When most investors think about renewable energy, solar and wind are the first things that come to mind. That's why many would be surprised to learn that the largest source of renewable power in the world is hydropower, which currently accounts for 16% of total worldwide electricity generation and 85% of the globe's renewable generating capacity. Hydropower will also continue to play a crucial role in the growth of global electricity generation, with its output having the capacity to more than double by 2050, according to the International Energy Agency.

One of the companies driving this expansion is Brookfield Renewable Partners, which is one of the largest hydropower producers in the world. The company currently operates 260 generating stations across 82 river systems in seven different countries. Overall, 85% of its power comes from hydro, with most of the rest produced by the 35 wind farms it operates across six countries. What's important to note about these assets is that the company sells 92% of its power under long-term, inflation-linked contracts that generate predictable cash flow.

Brookfield Renewable Partners distributes about 70% of its cash flow back to investors each year, and at current prices, its units yield a generous 6.2%. It reinvests the rest of the money into its proprietary development pipeline that currently consists of several high-return wind and hydro projects in Europe and Brazil. The company expects these facilities to generate steady cash flow when they enter service, which supports its forecast for 5% to 9% annual distribution growth. When added to its lucrative current yield, that growth should drive double-digit total annual returns for investors over the long term, which makes Brookfield Renewable Partners an excellent option for those seeking a growth-focused clean energy stock for their portfolio.