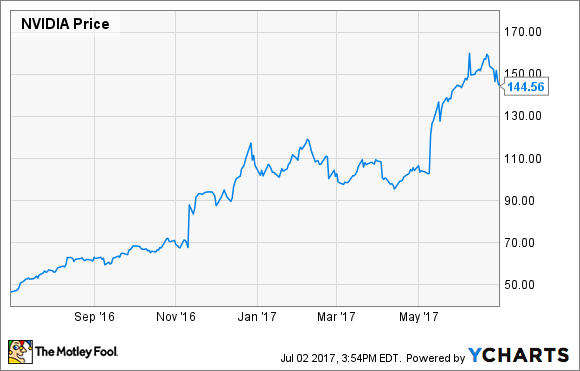

NVIDIA Corporation (NVDA 3.81%) is known for semiconductor products that are used in high-speed graphic cards for computers, chips that can power artificial intelligence, and potential applications for its devices in autonomous vehicles. The company's stock price has risen dramatically, tripling in the past year:

Now an analyst has thrown in a new application for the company's products: "mining" for cryptocurrency on the Ethereum platform, which means solving complicated math problems to earn what users have agreed is currency. Royal Bank of Canada (RY 0.65%) analyst Mitch Steves puts a potential market for Ethereum mining chips at $875 million given the current value of the currency. NVIDIA reported $7 billion in revenue in the fiscal year ended in January, so this wouldn't be a huge market for the company, but it is interesting.

What is Ethereum?

Over the past few years, bitcoin has made its way into the collective consciousness as the first popular cryptocurrency, allowing the transfer of payments via the internet without the use of credit cards, checking accounts, or old-fashioned paper money.

Now there is a new player on the cryptocurrency block, and it is called Ethereum. As with bitcoin, you can either buy in by exchanging cash for ether -- the name of Ethereum's blockchain-based cryptocurrency -- or you can have your computer "mine" for ether. //www.huffingtonpost.com/ameer-rosic-/ethereum-vs-bitcoin-whats_b_13735404.html

Image source: Getty Images.

Mining with NVIDIA

Much like the gold miners of the 1800s stocking up on supplies, picks, and shovels, tech-savvy folks looking to use their computers to mine for this currency will be looking for the optimal computer equipment, known as a mining rig, to increase their chances for success.

In the process of computer mining, NVIDIA GPUs offer a desirable combination of processing power relative to power consumption.

Mining-specific graphics cards are being introduced by companies including ASUS (ASUUY +4.54%), using the NVIDIA GPU from the GeForce line. Interestingly, these cards have no output for display connections, which allows their prices to be lower and their limited use to be aimed at computer mining. This allows NVIDIA to capitalize on the mining market and sell product to ASUS that otherwise might have to be scrapped or reworked in order to be able to support a display output.

An analyst takes note

Steves came out with a note on June 6 explaining that the cost of electricity to run the mining rigs makes NVIDIA's products an attractive solution due to their efficiency. As he put it, "We think the power consumption aspect acts as another material reason for Nvidia to maintain its market share leadership position."

The other big factor is the price of ether. At the time Steves wrote his note, the currency was trading at $260, making the cost of the rig and the probability of a payoff worthwhile. He calculated that at the $260 price, the return on investment for a mining rig would be about three months.

It is also worth considering that although Steves feels NVIDIA's GPUs would be the processor of choice, he notes that lower-end GPUs from it or Advanced Micro Devices, Inc. (AMD 5.28%) would be profitable for miners if the price of ether doesn't crash.

A better bet than Ethereum

Before one runs out to assemble a rig and start mining, it would be good to understand that ether can be quite volatile. In June, the fledgling cryptocurrency experienced a flash crash, sending prices down from above $300 to as low as $0.10 for a very short period of time. An investment that volatile would not exactly help me sleep better at night.

Maybe more important than winning a cryptocurrency-mining contest is what this says about NVIDIA's products in general. If it can become a leader in a field you didn't even know existed, can you imagine the power of this company as it prepares to take on competition in robotics, artificial intelligence, and autonomous vehicles?

NVIDIA has been yielding market-beating returns. Even though the off-label use of NVIDIA GPUs for cryptocurrency mining may be a passing fad, this company has product depth that could enhance any portfolio. In the short term, the company may see a slight uptick to earnings from ether mining. Long-term, it might be best to pass on the currency and invest in the pick-and-shovel supplier, as NVIDIA can win in so many ways beyond the mining of ether.