Long-term investors looking for stable, mature businesses may be overlooking an investment hiding in plain sight: corn stocks. Given the broad definition of the term, I would encourage investors to steer away from agriculture ETFs and focus instead on individual companies that can maximize returns for your portfolio's unique needs.

|

Company |

Market Cap |

2016 Revenue |

Dividend Yield |

|---|---|---|---|

|

Archer Daniels Midland (ADM 1.48%) |

$24.2 billion |

$62.3 billion |

3% |

|

Bunge Ltd (BG 1.25%) |

$10.8 billion |

$42.7 billion |

2.4% |

|

Green Plains (GPRE 5.28%) |

$772 million |

$3.4 billion |

2.5% |

|

Ingredion (INGR -0.19%) |

$8.9 billion |

$5.7 billion |

1.6% |

|

MGP Ingredients Inc (MGPI 2.15%) |

$945 million |

$318.3 million |

0.3% |

Data source: Google Finance.

Where should investors start their research? Well, there are three major applications for corn: fuel ethanol, animal feed, and human food ingredients. The top five corn stocks to buy right now address pain points and sell products for each industry.

Image source: Getty Images.

All-of-the-above corn stocks

With combined sales of $104 billion, Archer Daniels Midland and Bunge are among the largest agribusiness companies in the world. They generate business from storing, processing, and transporting various agricultural products around the globe. While that includes sugarcane and soybean, among other crops, both depend heavily on corn harvests for substantial parts of their revenue and profits.

For instance, Archer Daniels Midland generated $592 million in operating income from its agricultural services and corn processing business segments in the first half of 2017, which represented 45% of total operating income. That would have been higher if not for weakness in the ethanol industry.

The company is one of the top three corn ethanol producers in the United States with over 1 billion gallons per year of annual manufacturing capacity. However, it recently announced that it will begin recalibrating at least one facility to focus on food ethanol (booze) instead of fuel ethanol. That could lead to higher margins and, perhaps, provide a low-risk way to address weakness in fuel markets.

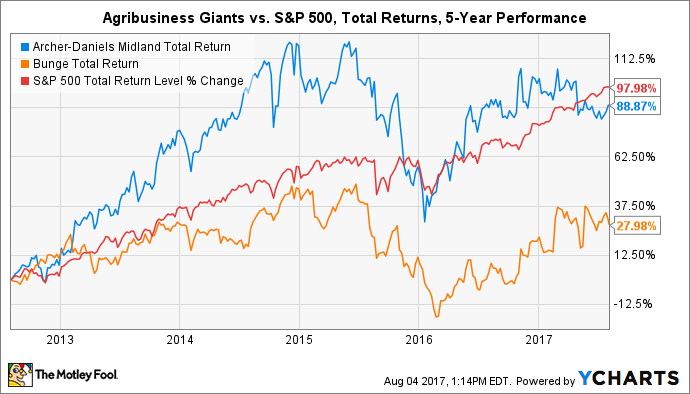

That's important. Global weakness and volatility in agriculture in recent years have kept both corn stocks below the returns of the S&P 500, but each has taken steps to bolster operating efficiency and gross margin for the long haul.

ADM Total Return Price data by YCharts.

Bunge has been forced to do more soul-searching than Archer Daniels Midland, mostly due to the former's international presence. The company is more exposed to the South American agricultural industry, which has been more volatile in the last two years for various reasons.

Bunge generates roughly 70% of its revenue and 60% of its earnings before interest and taxes from storing and transporting agricultural products, which is a high-volume and low-margin business. Nonetheless, the agribusiness leader has a formidable business empire that spans soy, corn, sugarcane, ethanol, and even fertilizer. It may not be pretty, but it should survive any down cycle and be a cash cow during any up cycle.

A leading ethanol producer

By comparison, the much smaller Green Plains has had no problem smoking the returns of the S&P 500 in the last five years. The world's second-largest ethanol producer has been punished for a weak performance during the second quarter this year, as have its corn ethanol peers, but the ethanol industry is still pretty strong at the moment. That hints it may have been a short-term hiccup instead of a longer-term concern.

GPRE Total Return Price data by YCharts.

For instance, America is on pace to export a record amount of corn ethanol in 2017 -- roughly 1.2 billion gallons. Green Plains has cashed in on swelling international demand by exporting approximately 20% of its production in the last 12 months. It sees that trend persisting.

The company is investing in two export terminals that will be completed by the first quarter of 2018, which will help the entire domestic industry move corn ethanol offshore. That should reduce inventories and increase prices while reducing all-in costs -- a win-win.

Additionally, Green Plains has invested in the full vertical of ethanol production. It has built an impressive rail transportation and logistics company to get product to customers or ports. It has invested in high-margin businesses, too.

Last year it acquired the world's largest manufacturer of food grade vinegar (the main input to vinegar production is food grade ethanol). This year it has been on a tear acquiring cattle feedlots, which provide a market for its corn byproducts from ethanol production (that become animal feed) and provide an alternative revenue stream by selling meat products. It's now the fourth-largest cattle feedlot owner in the United States.

All of these moves -- and the fact that shares are incredibly cheap -- easily make Green Plains a top corn stock for long-term investors to buy right now.

The food ingredient specialists

Food ingredients are among the highest-margin applications for corn products. That's where Ingredion -- formerly Corn Products International -- and MGP Ingredients specialize. It definitely shows in their stock performances, too. Both corn stocks have beaten the S&P 500 in the last five years, with the eye-popping returns of MGP Ingredients heavily distorting the chart below.

INGR Total Return Price data by YCharts.

Ingredion owns a large and stable business that specializes in starch ingredients, sweeteners, and corn co-products. It provides food ingredients that go into beverages, fat-free food products, and salad dressings you eat on a daily basis. And, of course, it's a top supplier of high-fructose corn syrup.

While large and stable, Ingredion has struggled to grow its top line in recent years. The company is focusing on long-term opportunities in consumer trends such as demand for clean labels and "natural" ingredients, but it may soon invest in more innovative ingredient manufacturing opportunities, such as those presented by industrial biotechnology. Either way, it's not going anywhere and remains a top corn stock to buy.

MGP Ingredients has taken the high-margin products strategy to another level entirely. A ferocious approach to new markets has allowed the company to claw its way from a market cap of under $80 million five years ago to $945 million today. How?

The company's bread and butter is manufacturing premium beverage alcohol within its distillery products business segment, which contributed 83% of revenue and 88% of operating income in fiscal 2017. Its ingredient solutions business comprised the balance. Despite the epic growth in recent years, this corn stock is still growing revenue at a 10% annual clip, meaning there's plenty of room to run despite its impressive stock performance.

What does it mean for investors?

Some of the stocks above have run laps around the S&P 500 in the last five years, yet they likely aren't on the radars of most individual investors. That could be a mistake, especially considering the importance of the American bioeconomy, which generated an estimated $233 billion in GDP in 2012 from biotech crops and industrial applications alone -- mostly from corn. If you're looking for stable, long-term growth and dividends, then give these corn stocks a closer look.