In late 2017 Silver Wheaton changed its name to Wheaton Precious Metals (NYSE: WPM) because of its shifting production mix. The upshot of this move is that silver is no longer the streaming company's main focus. The bigger takeaway here, however, is that Wheaton's name change is really just a symptom of a bigger trend in the silver space. For investors it means that finding a silver stock is getting much harder. Here's what you need to know before buying a company that has historically been viewed as a silver stock.

The streamer

Wheaton Precious Metals isn't actually a miner. It provides cash up front to miners in exchange for the right to buy commodities in the future at reduced rates, which is known as streaming. Historically Wheaton focused on byproduct silver. Since mining for commodities like copper and gold often unearths smaller amounts of silver too, many miners often choose to sell the silver to help offset the costs of building and running a mine that's focused on another metal. It was a unique focus that helped Wheaton grow into one of the largest publicly traded streaming companies.

Image source: Getty Images

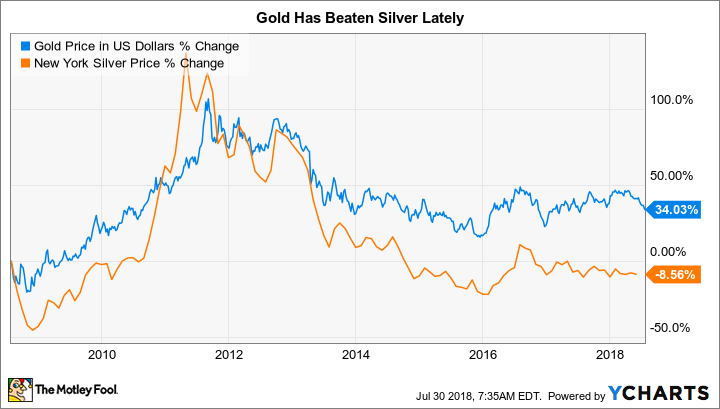

However, gold has been outperforming silver in recent years and Wheaton's heavy focus on silver turned into a liability for its stock. So management started to shift gears in a big way. As recently as 2010, Wheaton's business was almost exclusively silver related, with eight silver streams and just one investment in a gold streaming deal. On a silver equivalent ounce basis, that gold stream provided just 3% of Wheaton's production.

Fast forward to 2017 and Wheaton's gold and silver production were running at about 50/50 each as management worked to ink more gold streaming agreements. More recent deals, meanwhile, have added cobalt and palladium to the mix, which will push production of silver down to just 46% of the mix with gold sitting at 49%. Although Wheaton is still more exposed to silver than gold-focused rivals like Franco-Nevada and Royal Gold, it's hard to suggest that Wheaton is a silver stock anymore.

This silver stock is not alone

The shift toward gold, however, isn't unique to Wheaton. For example, Silver Standard Resources also changed its name in 2017, shifting to the less metal specific SSR Mining Inc. (SSRM 2.03%). In 2010, the miner had one major mine operating that was primarily focused on silver (it also produced zinc, but that metal was not a material contributor to financial results). Through asset sales and acquisitions, SSR's is now highlighting that it is leveraged to gold. The yellow metal is the primary product of two of the company's three mines and represents 90% of its projected 2018 gold equivalent ounce production. Clearly, SSR is no longer a silver miner.

Coeur Mining, Inc. (CDE 1.96%) still calls itself a "primary silver producer" but when you look at the numbers it doesn't seem to live up to that statement. In 2010 Coeur reported that silver was 64% of its production mix with gold at 36%. In 2018, however, silver is down to just 34% of the mix and gold is up to 58%, with lead and zinc filling out the rest of the portfolio. At this point, I would call Coeur a gold miner that also produces silver.

Gold Price in US Dollars data by YCharts

Hecla Mining Company (HL 1.03%) describes itself as a leading silver producer and a growing gold producer. Once again, however, the company's production profile suggests that it isn't really a silver miner. In the first quarter gold accounted for 50% of gross margin, silver 24%, zinc 20%, and lead the remainder. In 2010, silver was the main story with gold, lead, and zinc playing just bit roles. Although silver is important at Hecla, it is far from a silver miner today.

What's going on here?

There's a clear trend here of silver miners shifting their focus more toward gold. In some cases this is a diversification issue, but one likely driven by the divergent performances of the two metals. The companies, in essence, are increasingly backing the hotter metal. So far that's been the right move. Since roughly 2010 the gold:silver ratio, or the amount of silver ounces required to equal the price of a single ounce of gold, has generally expanded. The long-term gold:silver ratio average is roughly 56.5 according to the Silver Institute, a silver trade group. The ratio was below that level in the early part of the decade but ended 2017 at roughly 77, which is quite high on a historical basis.

The Silver Institute notes that this level of discrepancy often happens when investors are worried about an economic crisis or stock market correction. With the market near all-time highs lately and trade tensions high, that sounds like a reasonable view here. The problem for silver miners that have shifted more toward gold is that a reversal of the high gold:silver ratio could leave them backing the wrong metal. This is particularly true for a company like SSR Mining, which has made a particularly aggressive shift.

In fact, some believe a wide gold:silver ratio is a signal to buy silver because it is underpriced. That's something of a market timing decision, of course, and most investors should avoid market timing. However, every time the gold:silver ratio has reached extreme levels it has eventually reverted back toward the mean. In the end, it isn't unreasonable for a miner to want a production mix that's balanced between silver and gold. But for silver miners that have moved aggressively in the direction of gold it looks like there are potential risks in that decision about which investors need to be aware -- History suggests that gold won't outshine silver forever.

The best way to focus on silver

Getting exposure to silver simply isn't as easy as it was just eight years ago. Companies once focused on the metal have shifted gears and now have materially more exposure to gold (and other metals). That may not be a bad thing financially speaking for these miners today, but there are risks in the shift toward gold. Streamer Wheaton provides the most silver exposure of this quartet, and a nice balance between the two metals overall, so it's probably the best choice for silver bugs today. Note, too, that as a streaming company it should be able to more quickly adjust its gold to silver mix if the current gold to silver relationship changes.

That said, an exchange traded fund focused on owning silver bullion, like iShares Silver Trust (SLV -0.38%), is probably the best option if you want a pure silver focus. The problem with this is that iShares Silver Trust pulls you out of miners, which can expand production via capital spending, and puts you into a direct investment in the metal itself. The only upside in this case is from an increase in the price of the commodity. That's a vastly different proposition from owning a miner or a streaming company like Wheaton.