No matter your investing style, stocks that no one is paying attention to are often the best deals. Unpopular or lightly followed dividend stocks can become depressed in price, pushing up the yields and creating bargains for eagle-eyed investors. Three of our Motley Fool contributors think Vodafone (VOD 0.08%), Hanesbrands (HBI +0.00%), and Kronos Worldwide (KRO +1.49%) aren't getting the attention they deserve. Here's why these dividend stocks would make a great addition to your portfolio.

The wireless giant you've never heard of

Travis Hoium (Vodafone): In the U.S., Vodafone isn't a big-name company, but it's one of the biggest telecommunications companies in the world. It has a presence in Italy, Spain, the U.K., Germany, and South Africa, just to name a few, and provides wireless and broadband services depending on the market.

Image source: Getty Images.

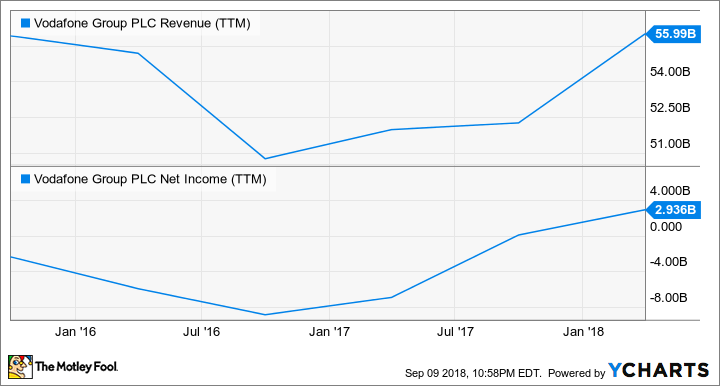

After adjusting the portfolio over the past decade, Vodafone has also become a growth company once again. It added an average of 553,500 mobile or broadband subscribers each quarter over the past year. Revenue and earnings are now on the rise as the portfolio begins to demonstrate growth.

Despite Vodafone's portfolio adjustment and recent growth, investors haven't been impressed with the company of late and are leaving the stock with a whopping 8.4% dividend yield. Telecommunications companies are trading at high yields in the 5% to 6% range, but 8.4% is an extremely high yield today, which I think is a reason to buy the stock. Wireless and broadband may not be a high-growth business, but it's highly profitable and generates a lot of cash for investors. That's why I like this dividend for the long term.

A high-yield value stock

Tim Green (Hanesbrands): Hanesbrands isn't exactly unknown -- Hanes is a leading apparel brand sold in big-box and department stores, as well as online. But as a dividend stock, it doesn't get much attention. That's a shame, because it offers a solid yield and a depressed valuation, perfect for dividend and value investors alike.

Hanesbrands stock currently yields about 3.35%. That yield was boosted in August, when the company disclosed along with its quarterly results that retailer Target planned to drop a popular line of exclusive Champion athletic wear starting in 2020. Investors didn't take kindly to the $380 million revenue hole that Hanesbrands now needs to fill.

Hanesbrands still expects Champion sales to reach $2 billion by 2022 irrespective of Target's decision, so the company doesn't believe this will hurt it in the long run. Investors aren't so sure, though, punishing the stock on the news. Trading for around $18 per share, Hanesbrands is now valued at just over 10 times the average analyst estimate for 2018 earnings. For a company with time-tested brands, that looks like a great deal to me.

Whether you're bargain hunting or looking for a nice dividend yield, Hanesbrands is worth a look.

A top titanium stock down on its luck

Maxx Chatsko (Kronos Worldwide): A healthy dose of misplaced pessimism from Wall Street has weighed on shares of titanium dioxide producers in 2018, including Kronos Worldwide, which now sports a healthy 3.4% dividend yield. Analysts are worried that the historically cyclical industry has already peaked, although first-half 2018 earnings reports from top manufacturers of the white pigment have indicated that there might be plenty of room to expand.

There's more to consider from a macro perspective. Global market dynamics have shifted since the last down cycle. China, previously the source of excessive supply, is now taking production facilities offline because they can't compete on cost or quality. Not wanting to let the opportunity go to waste, producers are now signing customers to long-term supply agreements to cut through pricing volatility and lock in customers. It's possible that recent market changes make wild top-to-bottom industry cycles a thing of the past.

That would create an intriguing long-term opportunity for Kronos Worldwide. While the stock is down 22% since the beginning of the year, that's through no fault of the business. The titanium dioxide manufacturer delivered an 11% jump in revenue in the first half of 2018 from the year-ago period, while operating income soared 74%. That's impressive, considering its manufacturing fleet missed a few days here and there for scheduled maintenance.

The solid performance in the first six months of the year, coupled with a tumbling stock price, means Kronos Worldwide stock trades hands at just 7.6 times future earnings and an EV-to-EVITDA ratio of 5. Given the strength of the individual business, and that of the broader industry, this 3.4% dividend yield may be too good for long-term investors to pass up.