Buying and holding high-quality stocks is arguably the best way to predictably generate wealth over the long term. But finding the best stocks the world has to offer isn't always easy -- especially if their underlying businesses are not widely followed on Wall Street.

So we asked three top Motley Fool contributors to each identify a promising stock that isn't on Wall Street's radar. Read on to learn why they like China Literature (772), B&G Foods (BGS -2.84%), and Secoo Holding (SECO -50.00%).

IMAGE SOURCE: GETTY IMAGES.

Curl up with a good (digital) book

Steve Symington (China Literature): You may not have heard of China Literature since its spin off from Chinese gaming and social media giant Tencent almost exactly a year ago. But with around 7.3 million writers publishing nearly 11 million online literary works on its platform, China Literature already enjoys an enviable network effect driving healthy growth. Revenue in the first half of this year climbed nearly 19%, including 13.3% growth from its core Online Reading segment, and 103.6% growth from IP Operations. The latter -- which comprised less than 14% of total sales -- showcased China Literature's knack for lending its enormous written library to the country's fast-growing number of content-adaptation opportunities to mediums like TV, film, and video games.

But shares also plunged in August after China Literature unveiled a roughly $2.3 billion cash-and-stock deal to acquire leading Chinese TV, web series, and film producer New Classics Media. The acquisition only just closed at the end of October, ushering in a new era for China Literature in which the company will be able to directly benefit from the adapted fruits of its content library.

For astute investors willing to buy shares of China Literature -- which trades on the Hong Kong Stock Exchange -- before those benefits materialize, I think it could offer enviable gains in the coming years.

Giving a little love to unloved brands

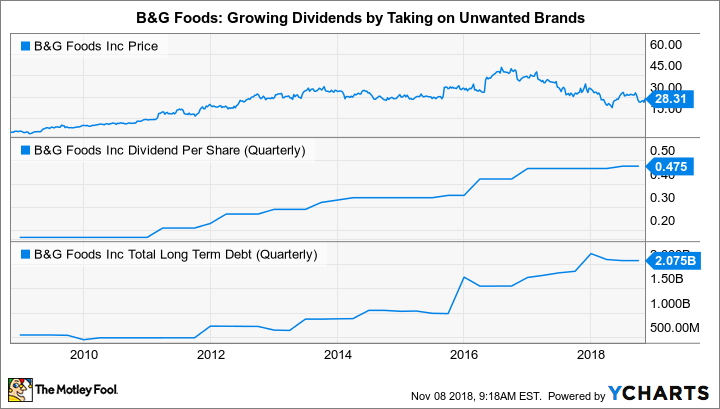

Reuben Gregg Brewer (B&G Foods, Inc.): The packaged food industry is dominated by giant names like Kraft Heinz and Conagra. By comparison, B&G Foods, with a $1.8 billion market cap, is a small fry to which Wall Street doesn't pay much attention. But that's not a problem for the company, which has generally focused on feeding off of the big players' scraps.

Its portfolio is filled with names you know but that were once castoffs and orphans inside larger companies, such as Cream of Wheat, Green Giant, and Ortega. Once B&G controls such brands, which have usually been neglected by previous management, it spruces them up. That can include bold moves like creating new flavors and varieties, or something as simple as updating brand imaging and marketing.

A recent success story for B&G was Pirate's Booty. It acquired the brand in 2013 for $195 million and recently sold it to Hershey's for $420 million. Longer term, the company's results have been showing up in a steadily rising dividend. It has increased the dividend annually for eight consecutive years, with annualized hikes of 12% over the past five years. The current yield is around 7%, following a nearly 45% drop from the stock's 2016 highs.

This isn't a low-risk company, with debt making up around two-thirds of the capital structure and solid execution a key factor in fixing the generally unloved brands it takes on. However, so far B&G has proven successful and has rewarded investors well. If you are looking for a high-yield stock in the out-of-favor packaged food sector, this below-the-radar company might be right up your alley.

A Chinese e-commerce underdog

Leo Sun (Secoo): Alibaba and JD.com dominate most conversations about China's e-commerce market, but plenty of smaller companies are still generating impressive growth. One such company is Secoo, an online marketplace for luxury goods, which went public last August at $11 per share.

Secoo's stock now trades at around $9 due to a broader sell-off of Chinese tech stocks amid escalating trade tensions, a weak RMB, and concerns about competition from bigger rivals like Alibaba and JD. Secoo is also largely ignored by Wall Street, with zero analysts issuing estimates for the small-cap company.

Yet Secoo's revenue rose 56% annually to 1.22 billion RMB ($184 million) last quarter, as its GMV (gross merchandise volume) climbed 45% to 1.65 billion RMB ($250 million) and its total number of orders jumped 50% to 455,900. Its number of active customers nearly doubled to 255,500. Those numbers seem small for a country with a population of 1.4 billion, but Secoo mainly focuses on a niche of higher-income customers in lower-tier cities that are underserved by Alibaba and JD.

Secoo is also profitable -- its non-GAAP net income rose 42% to 41 milion RMB ($6.1 million) during the quarter, and its GAAP net income grew 26% to 36.4 million RMB ($5.5 million). Secoo's stock seems cheap at 25 times trailing earnings and less than one times sales -- so investors might want to take a closer look at this unloved stock.

The bottom line

We obviously can't guarantee that these three little-known businesses will go on to beat the broader markets. But between China Literature's big growth potential and recent acquisition, B&G's high yield and history of success in a beaten-down sector, and Secoo's stellar growth and profitability from a small base, we think chances are high they'll do exactly that. And we think you would do well to invest accordingly.