If you're an income-oriented investor, then it's hard to go wrong in betting on telecom giant Verizon Communications (VZ -2.11%). The company isn't the world's fastest-growing by any means -- analysts expect sales to increase by just 3.9% in 2018 and 1% in 2019 -- but it's a large, stable business that generates a significant amount of cash. Cash, I might add, that it generously distributes to its shareholders through its dividend program.

Here, I'd like to go over three reasons dividend stock investors should love Verizon's dividend.

Image source: Verizon.

A great yield

One metric that income-oriented investors generally care about is the dividend yield, or the percentage of the company's current share price that the dividend represents. That figure changes on a daily basis depending on the movements in the share price, but when deciding whether to buy a stock, the yield at which you purchase it is important.

As of this writing, Verizon pays an annual dividend of $2.41 per share, translating into a yield of 4%.

Since Verizon isn't a fast-growing business, the odds that you're going to get a huge return on your investment in the near to medium term from share-price appreciation alone don't seem high, which is why paying a significant dividend that translates into a high dividend yield is key to attracting investors. (Although it's worth noting that the stock price is up more than 8% year to date, outpacing both the Dow Jones Industrial Average and the Nasdaq Composite.)

A sustainable yield

The next thing to check is the sustainability of the company's current dividend. After all, trying to bring investors in with an attractive dividend only to be forced to cut it at the first sign of trouble isn't exactly great capital allocation policy.

Fortunately, Verizon passes the dividend sustainability test.

The company's current annual dividend of $2.41 represents about 64.4% of the company's 2017 earnings per share (EPS) and roughly 51.6% of what analysts expect the company's 2018 EPS to be.

Now, Verizon is quite a capital-intensive business, so it needs to make significant investments in capital expenditure (capex) in its wireless networks. On the company's third-quarter earnings call, CFO Matthew Ellis said that "[we] now expect capital expenditures for the full year to be between $16.6 billion and $17.0 billion."

That large capex, Ellis said, "reflects the benefits from our business excellence program which has allowed us to make all of the planned investments while aggressively advancing the 5G ecosystem and transforming our structure to deploy the Intelligent Edge Network."

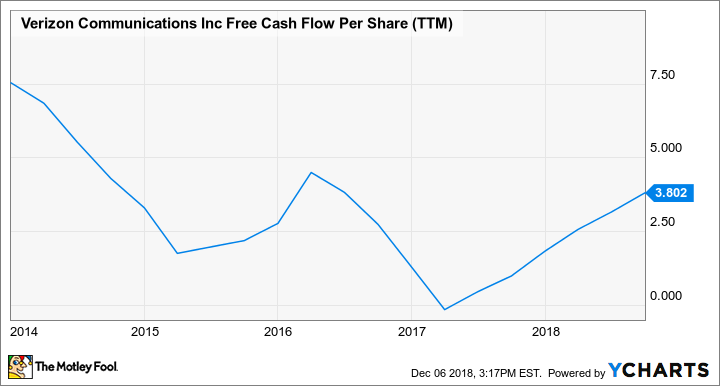

This means that in addition to looking at EPS, it's also worth checking out the company's free cash flow generation, since dividends are ultimately funded with free cash flow. The good news is that, over the last 12 months, the company's free cash flow per share has worked out to just north of $3.80 -- more than enough to cover the dividend.

VZ Free Cash Flow Per Share (TTM) data by YCharts.

It's also important to keep in mind that Verizon has a significant amount of debt (it's common for telecom companies to carry debt), so it not only needs to generate enough free cash flow to cover dividend payments, but also to service its debt load.

VZ Total Long Term Debt (Annual) data by YCharts.

Over the last 12 months, the company's total interest interest expense has been about $4.77 billion, translating into interest expense of $1.15 per share during that time. Fortunately, Verizon's trailing-12-month interest expenses per share coupled with its annual dividend per share combine to yield $3.56 per share. Verizon's free cash flow per share over the last 12 months is more than enough to cover the dividend and interest expenses.

A history of dividend increases

Verizon also has a history of regularly giving its shareholders dividend raises, as you can see in the chart below:

VZ Dividend data by YCharts.

In fact, on the company's most recent call, Ellis pointed out that "last quarter, our board approved the 12th consecutive annual increase in our dividend."

Those annual dividend increases often aren't huge (remember that the company's yield is already quite high and it's giving back a lot), but investors often tend to prefer the stability and reliability of slow and steady increases. Additionally, the fact that the company has been able to consistently boost its dividend year in and year out is an encouraging indication that -- barring some unforeseen catastrophe -- those dividends will continue to rise over the long term.