Utility stocks provide products and services that consumers not only want but basically need to survive. The list includes electricity, clean water, and natural gas, among other things. But building the systems to make, acquire, process, and/or deliver these vital resources is expensive, which means that size and scale can be a huge benefit.

If you are looking at the utility space, you'll want to start by examining the biggest names first. Here's a quick look at the 10 biggest utility stocks, including some that may surprise you.

What is a utility stock?

Although most investors think of electricity when the phrase "utility stock" comes up, the sector is far more diverse than that. Yes, electric utilities are a big component, but utility stocks also deliver things like clean water and natural gas.

Image source: Getty Images.

Another word that often comes to mind when defining a utility stock is "regulation." Although not all utility stocks are regulated, most are. Because utilities effectively get monopoly-like control in the regions they serve, they have to ask local, state, and federal regulators to approve the rates they charge customers. In fact, if you expand the definition of utility to include energy infrastructure with a notable regulatory component, then you can even add oil and natural gas pipelines into the utility stock mix of potential companies. Many diversified utilities do, in fact, own such midstream energy assets.

Using such a broad definition of a utility, the core businesses here tend to involve long-lived assets that are stable and reliable, with solid fundamental demand underpinning revenues. Which is one of the key reasons scale is a big benefit to utilities. Getting bigger is the quickest way to grow a company's top and bottom lines. That can be accomplished through acquisitions or new construction, but usually it's a combination of the two. And the bigger a company gets, the easier it usually is for that company to buy and build additional assets. So if you are looking at the utility space, you'll want to get to know these 10 industry giants.

What are the 10 biggest utility stocks traded on U.S. markets?

There are different ways to look at size when it comes to the utility space, including things like the number of customers served and amount of power generated. That can make comparisons a bit complicated, so this list is being broken down by market cap, or the stock price multiplied by the number of shares outstanding. Other prominent factors that will be considered include capital spending plans, which gives an indication of a company's growth plans, and dividend yield, since generating income is one of the core reasons investors add utilities to their portfolios.

Here are the 10 largest U.S. utility stocks:

| Company |

Market Cap |

Dividend Yield |

Type of Utility |

|---|---|---|---|

|

1. NextEra Energy (NEE 1.62%) |

$108 billion |

2.2% |

Diversified |

|

2. Duke Energy (DUK 1.69%) |

$68 billion |

4% |

Diversified |

|

3. Enbridge (ENB 0.23%) |

$67 billion |

6.4% |

Pipeline/Diversified |

|

4. Dominion Energy (D 1.11%) |

$63 billion |

4.7% |

Diversified |

|

5. The Southern Company (SO 2.22%) |

$63 billion |

4.3% |

Diversified |

|

6. Enterprise Products Partners (EPD 0.16%) |

$62 billion |

6.1% |

Pipeline, Limited Partnership |

|

7. Exelon Corporation (EXC 1.40%) |

$46 billion |

3% |

Diversified (nuclear focused) |

|

8. Kinder Morgan, Inc. (KMI +0.57%) |

$45 billion |

4.9% |

Pipeline, traditional corporate structure |

|

9. American Electric Power (AEP 0.94%) |

$45 billion |

2.9% |

Electric |

|

10. Sempra Energy (SRE 0.35%) |

$38 billion |

2.7% |

Diversified |

Data source: Yahoo! Finance, company reports. Data is current as of Sept. 9, 2019.

1. NextEra Energy

NextEra Energy is the biggest utility by market cap, weighing in at a massive $108 billion. It is the largest electric provider in Florida, a state that continues to see its population expand as people move to its warmer climate. That's a big benefit, as more customers mean more demand for electricity. The company actually expanded its footprint in its home state in January 2019 with the acquisition of Gulf Power from fellow top-10 name The Southern Company. NextEra plans to trim costs at Gulf Power and boost spending, which should enhance the utility's growth prospects over the next few years.

Although its regulated Florida electric assets are the core of NextEra, they are not actually the main growth engine. NextEra also happens to be one of the largest clean energy companies in the country, and possibly the world, via its NextEra Energy Resources division. This business sells power to others under long-term contracts and owns 24 gigawatts of generating capacity, 64% of which is wind, 11% solar, and 13% nuclear (the remainder is carbon based). It has an additional 12 gigawatts or so worth of capacity on the drawing board that it hopes to build over the next few years as well. Each new assets expands its revenue and earnings potential.

Across the entire business, NextEra Energy plans to spend as much as $55 billion between 2019 and 2022, with a hefty 55% earmarked for the unregulated renewable power business. That spending, in turn, should support annual earnings growth of 6% to 8% a year and dividend growth of as much as 14% (a low payout ratio allows for the difference here). The only problem is that investors are well aware of NextEra's past success and future prospects, so it is relatively expensive today, and the yield is just 2.2% or so (the average yield for the industry is around 2.9% using Vanguard Utilities Index ETF as the benchmark). But for dividend growth investors, it might be worth the price tag.

2. Duke Energy

With a market cap of $68 billion, Duke Energy comes in at a distant No. 2 on the list of largest utilities. Duke's business is broken down into three main parts. The largest is its regulated electric utility division, which provides power in six states. It also owns natural gas distribution assets in five states, a business that it largely acquired in 2016 when it bought Piedmont Natural Gas for nearly $5 billion. And it has a renewable power division that sells electricity to others under long-term contracts (it controls about 3 gigawatts of solar and wind power).

Duke is more of a tortoise to NextEra's hare, with a slow and steady approach to growth and a much higher 4% yield. Between 2019 and 2023, Duke plans to spend around $37.5 billion on growth projects, with roughly 95% of that earmarked for its regulated businesses. The rest will get spent on the renewable power operation, which helps explain why Duke is only looking for 4% to 6% earnings growth over the next few years. Dividend growth will continue, too, but likely at a rate no higher than earnings growth. The company's payout ratio isn't worrisome, but it is higher than NextEra's payout and puts a cap on potential dividend increases.

Duke is more of a widows-and-orphans stock: Investors own it because it mixes a relatively generous yield and a slow and steady approach to its business. It won't excite you, but it shouldn't leave you sleepless, either.

3. Enbridge

The next utility stock is something of an odd duck. Canadian-based Enbridge has a market cap of $67 billion, and you could easily argue that it shouldn't be included on this list because the bulk of its natural gas utility operations (around 15% of EBITDA) are located north of the U.S. border. That said, a portion of that business creeps into upstate New York, a material amount of Enbridge's renewable power portfolio (less than 5% of EBITDA) is located in the United States, and its midstream infrastructure investments (80%) span North America (these assets are usually regulated at the federal level). Its size, a notable amount of exposure to the U.S. market, and a big 6.4% yield (backed by a dividend that has been increased annually for 23 consecutive years) suggests that utility-focused income investors should at least consider the name -- which is why it finds itself on the top-10 list.

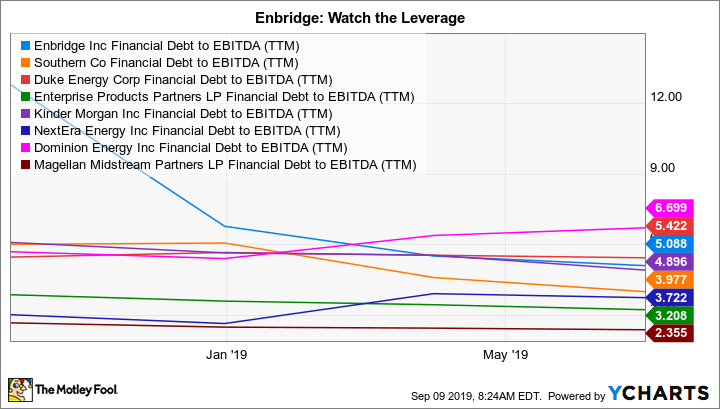

Enbridge recently worked through a big consolidation, in which it bought a number of controlled partnerships. This move vastly simplified the company's structure but required it to add notable leverage to its balance sheet. It has managed to lower its debt-to-EBITDA ratio from a peak of more than 12 times in 2018 to around 5 times. That's a much more reasonable number, but it is still toward the higher end of the utility space. That said, Enbridge is more midstream focused than utility focused, and 5 times debt to EBITDA is definitely high for a midstream company. This isn't unusual, either, as Enbridge has long made aggressive use of leverage. The extra risk that entails is a factor that investors should keep in mind when considering the high yield.

ENB Financial Debt to EBITDA (TTM) data by YCharts.

Looking at growth, Enbridge has 19 billion Canadian dollars in capital investments planned through 2022 across its portfolio. Over the longer term, it believes it has the capability to invest CA$5 billion to CA$6 billion annually in its business without seeking outside cash. That, in turn, should translate into annualized distributable cash flow growth of 5% to 7% per share. Dividend growth should roughly mirror that figure, though historically it has been a little over 10% a year. Income-oriented investors might want to put this company on their utility list, even though it isn't strictly a utility.

4. Dominion Energy

Diversified utility Dominion Energy has been shifting its business over the past 10 years or so, too. The general goal has been to exit more volatile businesses, like oil drilling, and refocus around regulated and fee-based assets that are more predictable, like electricity and pipelines. The change has been material, with the company selling around $25 billion worth of assets since 2007 and buying $20 billion while also continuing to invest in its core utility operations and strategic ground-up construction projects. Today, around 95% of Dominion's earnings come from regulated and fee-based operations, up from just 40% in 2006. It has a market cap of around $63 billion.

Its regulated utility business spans five states, it has pipeline operations (regulated at the federal level) in more than a dozen states, and it operates an unregulated renewable power business focused around selling power under long-term contracts. Essentially, it has become a pretty boring utility at this point. That said, it is in the middle of a spending binge and has an elevated level of leverage and a relatively high payout ratio.

Those last two facts help explain why Dominion's yield, at 4.7%, is toward the high end of the utility peer group. At this point, the company plans to slow dividend growth to the low single digits to bring down its payout ratio and has been selling assets to help keep leverage in check. It wouldn't be fair to call Dominion high risk, but neither would it be appropriate to describe it as low risk. And for a few years anyway, dividend growth will be weak at best as the utility works through its roughly $26 billion in spending plans through 2023. For income-focused investors, however, the relatively high yield might be worth a closer look.

5. The Southern Company

The Southern Company, already mentioned above because of an asset sale to NextEra Energy, has a roughly $63 billion market cap and has also been working through a big capital budget. It hasn't been going all that well, with Southern forced to give up on a clean coal plant (eventually turning it into a gas-fired plant) and massive delays and cost overruns on a nuclear build. Although the nuclear project appears to be back on track, there's still a long way to go before this costly project is completed in 2022.

So Southern still faces material capital spending needs (estimated to be around $38 billion through 2023). Funding this capital spending is complicated by a relatively high payout ratio and elevated leverage. That probably sounds a lot like Dominion's position, which helps explain the roughly 4.3% yield offered up by Southern's stock today. Southern's business is also similar in other ways, operating a diversified collection of assets, including three electric utilities, a natural gas business, and a renewable power company.

That said, Southern is capably working through what has been a pretty rough period. The asset sale to NextEra is one example of its efforts to balance spending with its financial situation, with the cash used to help reduce leverage. And management remains committed to increasing the dividend $0.08 per share per year (low single digits percentage-wise), further extending its 71-year streak of dividends at the same or higher level. Earnings are expected to grow in the mid-single-digit space. Once again, this is not a risk-free utility, but it's not a high-risk option, either. Investors looking to maximize the income their portfolio generates would do well to take a look at Southern.

6. Enterprise Products Partners

Now for a twist of sorts with midstream master limited partnership Enterprise Products Partners. Enterprise is not technically a utility, but a good portion of its business is fee based and/or regulated at the federal level by the Federal Energy Regulatory Commission (roughly 85% of its operating margin). That fact, combined with a robust 6.1% yield, helps to get it on this list. But what really seals the deal is the company's massive $62 billion market cap, which easily makes this midstream industry bellwether one of the largest energy companies in North America.

To simplify a little bit, Enterprise owns the pipes, processing facilities, storage, ports, and transportation assets that help move natural gas and oil from where they get drilled to where they get processed and eventually consumed. It has an two-decade-plus track record of success behind it, with a long history of increasing its distribution on a quarterly basis. Lately, that payment has grown in the low single digits as Enterprise looks to self-fund more of its growth plans (it currently has around $6 billion worth of projects under development).

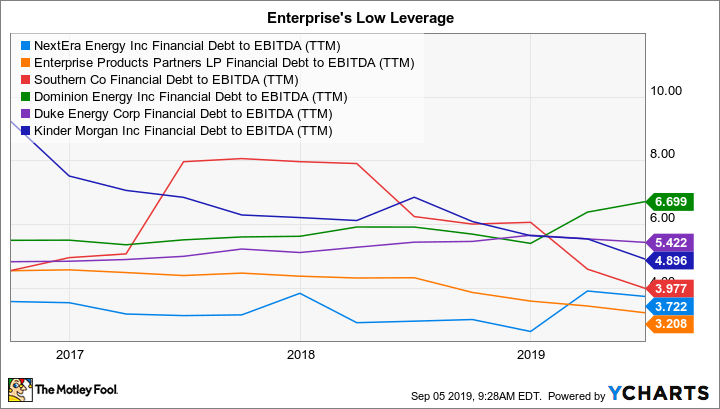

Slower near-term distribution growth, however, is a net benefit. For starters, it helps reduce the long-term need to issue dilutive units to fund capital projects. It also increases the strength of the current distribution, which was covered by an impressive 1.7 times in the first half of 2019 (1.2 times is considered strong coverage in the midstream space). Meanwhile, Enterprise has long made modest use of leverage, with its debt-to-EBITDA ratio toward the low end of the peer group (and well below many of the purer utility stocks on this list). If you are looking at utility names for yield, then you should branch out and take a close look at Enterprise and its focus on the same types of assets that many utility stocks own.

7. Exelon

With roughly $46 billion in market cap, Exelon operates six utilities, providing electric and natural gas services to customers in five states and the District of Columbia. It breaks its business up into power generation, transmission, and a business that sells power directly to end customers. Exelon's yield is roughly 3%, about the average for the utility space, and its payout ratio is a touch below the average.

Like many of its peers, the utility is increasingly building renewable power like solar and wind. But the one thing that sets Exelon apart is that it runs the largest fleet of nuclear power plants in the country. Nuclear power is a controversial topic. Since it doesn't emit carbon dioxide, it is technically a clean power source. But the risk of a nuclear accident, a rare but potentially highly dangerous occurrence, leads some to take a dim view of nuclear power. Exelon's heavy exposure to this power source pretty much means that it is always fighting with someone, be it regulators, environmentalists, or even customers. This single fact could be enough to make you pass it over for another utility.

The company expects earnings to grow between 6% and 8% a year through 2022. Near-term dividend growth is projected to be around 5%. Driving these projections is capital spending of as much as $23 billion on its utility business. With a reasonable balance sheet, Exelon's plans look attainable. It's not a standout in any way, but it's not a bad utility -- assuming you can get past the nuclear issue.

8. Kinder Morgan

In the No. 8 spot, with a $45 billion market cap, is another midstream-focused company, Kinder Morgan. Unlike Enterprise, Kinder Morgan is structured as a regular company, which avoids some of the tax complications that come with a limited partnership. Like Enterprise, it owns a massive portfolio of pipeline, processing, port, and storage assets that are often regulated at the federal level. Since the company sports a 4.9% yield, it is likely that income-oriented investors will have seen the name before.

The last few years have been very good for Kinder Morgan and its shareholders, particularly those that like dividend growth. The dividend has been increased from a quarterly rate of $0.125 per share in 2016 to a run rate of $0.25 per share in 2019. In other words, Kinder Morgan's dividend has doubled in less than four years.

But that requires a little more explanation. In 2016, the dividend was cut 75% versus the ending run rate in 2015. And that cut happened just a couple of months after management had been telling investors to expect an increase of as much as 10% in 2016. The cause of the cut was a tight capital market following the oil market downturn in mid-2014. That left Kinder Morgan to decide between cutting the dividend to free up capital for growth projects or pulling back on growth. It chose to cut the dividend, which, in the end, was probably the right choice for the company -- though investors who were relying on the dividend might not have been too pleased.

ENB Dividend Per Share (Quarterly) data by YCharts.

Kinder Morgan has a material business backed by long-term contracts (roughly 90% of revenues), sizable growth opportunities ($5.7 billion of capital investment plans through 2023), and a 25% dividend increase planned for 2020. However, the dividend cut should give income investors pause. There are other companies in the utility space that have a large yield and that haven't cut their dividends after telling investors to expect an increase.

9. American Electric Power

Coming in at a virtual tie with Kinder Morgan is American Electric Power, with a $45 billion market cap. AEP has operations across 11 states, with utility operations juxtaposed against long-haul transmission assets (high-voltage power lines). Like most of its peers, it also has a renewable power business. One thing that sets this utility apart, however, is that it is focused almost exclusively on electricity.

The company is targeting earnings growth of 5% to 7% over the next few years, with dividends expected to grow in line with earnings. Powering those numbers is $33 billion in capital spending plans that should take the company through to 2023. With a reasonable payout ratio and leverage, AES appears to be in a good position to achieve all of these goals. The yield at around 2.9% is smack on the average for the industry.

Over the past decade, AEP has worked to balance out its operations, shifting from a heavy weighting on generating assets to one that is more balanced across electricity generation, transmission, and distribution. That said, it is notable that roughly 70% of the business is focused on owning the wires that move electricity. This is an increasingly important segment of the market, since renewable power often gets created far away from where it is used. And also because regulators are often more willing to grant approval for rate hikes tied to improving the integrity and reach of power lines. It would be hard to say that AEP stands out as an investment (other than its focus on electricity), but it's not a bad utility by any means.

10. Sempra Energy

The last few years have been pretty active for $38 billion-market-cap Sempra Energy, which rounds out this top-10 list. There's been so much activity, in fact, that most investors would probably be best off taking a wait-and-see approach in this instance because there are so many moving parts. Basically, management is still actively adjusting the portfolio. Add in a 2.7% yield, which is slightly below the industry average, and there's even more reason to stay on the sidelines -- for now.

In a very short period of time, Sempra has sold renewable power, natural gas, and midstream pipeline assets while buying multiple electric distribution assets and building a liquefied natural gas (LNG) export terminal in Mexico. And that's just the last few years; the last decade has seen even more activity as Sempra works to transition its business to focus on regions (specifically California and Texas on the utility side) and businesses that it believes are going to be long-term winners (on the LNG side).

With so much going on, leverage has become a key issue to watch. That said, the debt-to-EBITDA ratio has fallen considerably over the past year or so, though it remains above the levels of five years ago. The reduction in leverage, however, just highlights that Sempra is still a work in progress. And it's not a simple change taking place. A lot of the movement has been on the acquisition and disposition front, with a big construction project thrown in for good measure. Caution is in order at Sempra today.

11. Bonus round

Although you can make a bad Spinal Tap reference about this list "going to 11," the truth is there were a few companies that maybe didn't fit perfectly. Because of that, it's worth quickly mentioning a few that didn't make the cut. For example, Canadian TC Energy, formerly known as TransCanada, has a $47 billion market cap (good enough for a seventh-place showing), an attractive 4.5% yield, and is very similar to Enbridge in many ways (including the elevated use of leverage). But TC Energy's power assets are basically all in Canada, and the assets it does have in the U.S. market are pipelines. It was a judgment call, but TC Energy was left off the top-10 list. You might want to take a look anyway.

Including some of the higher-yielding names that weren't exactly pure-play utilities (like Enbridge, Enterprise, and Kinder Morgan), meanwhile, pushed a few names below the top 10 that would otherwise have made it. That includes $36 billion-market-cap National Grid, $33 billion Xcel Energy, $30 billion Public Service Enterprise Group, and $29 billion Consolidated Edison. Down the line, the yields here are 6%, 2.5%, 3.1%, and 3.2%, respectively.

The clear standout is National Grid, which is kind of a unique entry, as it owns energy and gas transmission assets in the United States and the United Kingdom. The latter is dealing with a big problem of late, because there has been talk of the U.K. nationalizing some of the assets National Grid owns in the country. In other words, there's a reason for the current high yield. That said, the other three are worth looking at if you are interested in pure-play utilities. At recent prices, though, none really stands out.