Climbing more than 19% year to date, the price of silver has more than rebounded from its 9% fall in 2018. Many investors with a mind for investments in precious metals, consequently, are wondering if now's still a good time to pick up shares of silver stocks like First Majestic Silver (AG 4.15%), or if that ship has sailed for the time being. It's not a misguided thought, after all, considering First Majestic Silver's stock has skyrocketed more than 78% year-to-date -- far outpacing the market price of the metal. But mining silver isn't the only way in which this company proves its mettle, for it's also involved in the production of gold and base metals.

While taking note of the movements in the stock and commodity are insightful, savvy investors know that there's plenty more to consider before determining if now's the time to pick up shares of this metal miner, so let's take a closer look at the bull and bear cases for the stock.

Image source: Getty Images.

The positive perspective on this precious metals miner

With the addition of San Dimas to its portfolio following the acquisition of Primero Mining in May 2018, First Majestic Silver celebrated a record performance last year, reporting silver equivalent production of 22.2 million ounces. According to a recent investor presentation, that record may not stand for very long as the current forecast for silver equivalent production in 2019 stands at 24.4 million ounces to 26 million ounces. While the company hasn't provided guidance for the years ahead, the fact that the company expanded its mineral reserves from 120 million ounces of silver-equivalent to 170 million ounces of silver-equivalent at the end of 2018 suggests that the company may continue to glitter in the years to come.

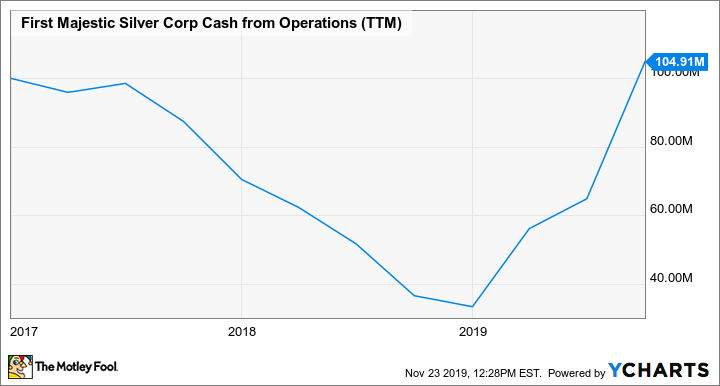

In terms of the company's financials, bulls will point to the First Majestic's recent improvements in generating strong operational cash flow. Whereas the company had reported ebbing cash flow from 2016 to 2018, the company's performance over the past three quarters suggests that 2019 will represent a notable turnaround.

AG Cash from Operations (TTM) data by YCharts.

Eschewing a conventional ball mill for a high-intensity grinding (HIG) mill, First Majestic has improved silver and gold recoveries at Santa Elena which has contributed to the rise in cash flow; moreover, the company plans on installing HIG mills at La Encantada and San Dimas mines as well, suggesting that cash flow will continue to increase in the coming quarters.

Some see no silver lining to these clouds

Despite First Majestic's recent achievements in growing mineral production and cash flow, skeptics will draw attention to the company's lackluster results on the income statement. In 2018, for example, the company reported EBITDA of negative $158 million according to Morningstar. Taking into account the depressed price of silver last year, some investors may not be as concerned with the company's lack of profitability; however, with the price of silver rebounding in 2019, First Majestic has continued to report an EBITDA loss -- negative $90 million, in fact, on a trailing-twelve-month basis. The company's performance becomes even more alarming when considering how its silver-minded peers, Hecla Mining (HL 5.30%) and Pan American Silver (PAAS 4.15%) have performed.

AG EBITDA (TTM) data by YCharts.

Like First Majestic, Hecla Mining and Pan American Silver have also grown operational cash flow recently; however, unlike First Majestic, they have also reported positive EBITDA in line with the rising price of silver.

Another downside to First Majestic is the fact that its stock doesn't offer shareholders a dividend. Although Hecla Mining and Pan American Silver currently offer meager yields of 0.43% and 0.76%, respectively, they are better than the absent yield which First Majestic provides. Dividend hungry investors who are seeking exposure to silver, moreover, can also consider the stock of the royalty and streaming company, Wheaton Precious Metals, which offers a 1.3% yield.

Lastly, First Majestic may have some growth prospects on the horizon, but they hardly seem compelling enough to warrant the stock's rich valuation. Currently, shares are trading hands at nearly 6 times sales and 19.9 times operating cash flow, representing premiums to the five-year average sales and operating cash flow multiples of 3.9 and 16.7, respectively.

The final word on First Majestic

Although now doesn't seem to be the best time to pick up shares of this silver miner, it's not to say that First Majestic will never represent a glittering opportunity. In the months ahead, investors should look for the company's results of its exploration of Los Hernandez to see if it results in a significant increase to the company's mineral reserve, ensuring the company has organic growth opportunities. And in the coming quarters, it will be interesting to see if the company is able to achieve the same turnaround regarding EBITDA which it achieved with its cash flow. If so, a re-evaluation of the stock will certainly be warranted.