What happened

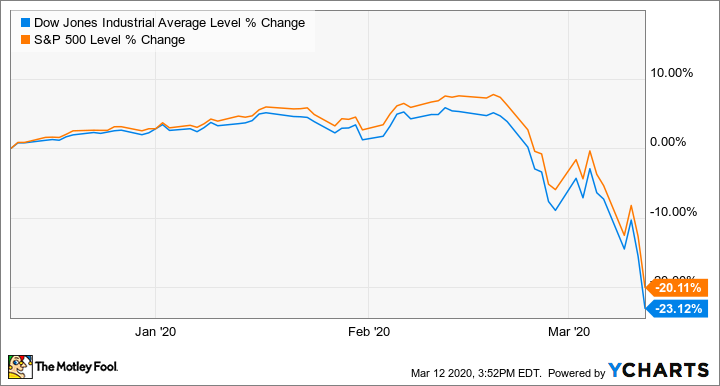

Shares of Watsco (WSO 2.02%), Tennant (TNC 0.19%), and Balchem (BCPC 0.11%) all declined more than 10% during Thursday trading as broader U.S. markets plunged over 7%, despite President Trump announcing new plans aimed at containing the economic effects of the COVID-19 coronavirus outbreak.

So what

Investors and consumers are beginning to come to terms with how disruptive the COVID-19 outbreak could be to the global economy, and the result has been markets free-falling like we haven't witnessed since the financial crisis. Flights to Europe have been restricted, the NBA and NHL have suspended their seasons, many NCAA college basketball conference tournaments have been canceled, and March Madness could be the next event on the chopping block. It's easy to understand why restaurant, travel, and entertainment stocks would be heavily punished as health officials advise against group gatherings, but there are negative effects on industrial companies such as Watsco, Tennant, and Balchem that many investors haven't yet had a chance to understand.

Image source: Getty Images.

For many global supply chains, the COVID-19 outbreak could set off a string of dominoes. Using Watsco as example, the company's top 10 suppliers account for roughly 83% of its 2019 purchases, and one large supplier, Carrier, sources many components from China. If even a small percentage of suppliers, or the components they need, are disrupted, delayed, or even shut down temporarily, it won't take long for global companies to feel the pain with a lack of inventory and finished products to manufacture and sell.

In addition to the outbreak itself, Tennant noted another potential hurdle in its recent 10-K: "Also, government actions to prevent further outbreaks could adversely affect our business operations and/or our financial results." Right now the effects are relatively unknown to most companies, but uncertainty alone is enough to send markets lower until the outbreak is considered under control.

Now what

It's difficult for investors to remain calm as headlines constantly remind them that stock markets are spiraling, and that's understandable. But it's important to avoid knee-jerk reactions and to remember that the markets and global economies have historically bounced back from other scary developments such as SARS, MERS, and other events such as Sept. 11 or the financial crisis. Rather than panicking, savvy investors have an opportunity to freshen up their investing thesis on companies and figure out if the long-term growth story remains intact.

COVID-19 will undoubtedly have a negative effect on businesses around the globe, but long-term investors should take these wild market swings with a grain of salt -- it will all balance out over the long haul.