The world after COVID-19 is likely to look a bit different from the one before it. While it's clear the actions taken to prevent the spread of the novel coronavirus are going to severely impact the economy in the first half of the year, the key question is, what stocks could be set to benefit in the long term?

Potential answers include: cleaning supply company Clorox (CLX 0.61%), corporate uniform services company Cintas (CTAS -0.53%), and food safety, clean water, and hygiene company Ecolab (ECL -0.09%). Here's why.

Image source: Getty Images.

The assumptions behind buying these three stocks

The case for buying these stocks rests on two underlying assumptions.

First, the novel coronavirus will eventually be contained -- meaning that global economic activity will return to normality in due time. This is an important point because Cintas benefits from employment growth (no jobs means no demand for corporate uniforms). Similarly, Ecolab, which provides water, hygiene, and energy technologies, relies on industrial activity as well as growth in the food and lodging sector. Clorox's personal care products and disinfectants also rely somewhat on recurring spending by households and businesses.

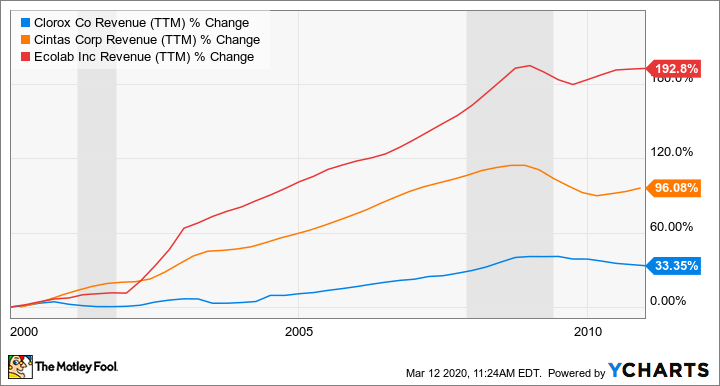

As you can see below, all three companies saw revenue declines around the time of the Great Recession in 2008-09, so these companies are still reliant on a positive overall economy for growth.

CLX Revenue (TTM) data by YCharts

The second assumption we have to make is that the shock created by the COVID-19 outbreak will lead to a heightened sense of awareness around the need for cleanliness in public and private spaces. That could add some long-term growth to recurring demand for Clorox's disinfectants, Ecolab's food safety and hygiene solutions and Cintas facilities services businesses.

That said, it's important not to underestimate the impact of the outbreak on economic growth. The fact is that the number of new daily cases worldwide has been on the uptrend since the end of February and the preventive measures taken to deal with the situation -- travel bans, corporate and government shutdowns, etc. -- are going to have a significant effect on the economy and company earnings. As such, investors should brace themselves for some potential near-term earnings disappointments, and that could include disappointments at Ecolab, Cintas, and Clorox. So, buyer beware.

But with all that said, here's more detail on why these three stocks stand to benefit and why you should buy them this month.

1. Clorox

Clorox is one of the few stocks that's actually held up well through the crisis. With its portfolio of home care and professional cleaning products, household products (cat litter, bags, and charcoal), and an odd assortment of so-called lifestyle products, the company's prospects are improving in an environment where clean hygiene is paramount.

Clorox's current P/E valuation of 26 times earnings is not exactly cheap. However, another way to look at it is to focus on its dividend yield of 2.7% -- as you can see below, its dividend payout is well covered by its free cash flow -- and consider that the 10-year treasury yield is less than 1% at present. If the economy is headed for an extended slowdown due to the novel coronavirus, then interest rates are likely to remain low and Clorox's dividend is likely to remain sustainable and a valuable source of income for dividend-seeking investors.

CLX Free Cash Flow data by YCharts

2. Cintas

Another boring (but super) dividend stock, Cintas' claim to be a beneficiary of a post-COVID-19 world comes from the idea that there will be an extra emphasis on cleaning corporate apparel and on maintaining cleanliness in the workplace. As such, more corporations may decide to rent Cintas' corporate uniforms and have them regularly cleaned by the company -- its core business.

Moreover, Cintas is also growing its facility services business, which includes cleaning services and restroom supplies. That's another market set to do well in the post-COVID-19 world. As you can see in the chart below, the recent market declines have taken the company's price-to-earnings valuation lower than it has tended to trade at over the last few years, but given an economic recovery from the coronavirus shock, Cintas is well placed to benefit in a post-COVID-19 world.

CTAS PE Ratio data by YCharts

3. Ecolab

The leading player in a highly fragmented market of food safety, water, and hygiene technology, Ecolab has long been seen as a company set to grow market share within its industry.

Ecolab's products and services help keep the food, hospitality, and healthcare industries hygienic and sanitized. In addition, its environmental and water and wastewater treatment solutions help industrial companies maintain quality and meet environmental standards.

In common with Cintas, Ecolab's valuation has now moved down to levels it hasn't seen in a while.

ECL PE Ratio data by YCharts

The company is already set to benefit from long-term growth in urbanization, and an increase in demand for protein and processed food -- something usually associated with the growth in middle classes in the emerging world. Throw in the increased emphasis on public health issues in the aftermath of the novel coronavirus outbreak and the long-term future looks bright for this Dividend Aristocrat.