Despite the recent stock market rally, the high-yield tech stocks CenturyLink (LUMN -0.54%), AT&T (T -0.09%), and International Business Machines (IBM -0.35%) remained close to their multi-year lows, which provides investors with an opportunity to lock in juicy dividends. But income investors should first consider the risks that could threaten these tech stocks' generous payouts.

1. CenturyLink

CenturyLink provides telecommunication services. The company is developing its fiber assets to try to offset the secular decline of its legacy businesses that consist of selling private lines to enterprises and voice services to consumers. Yet negative headwinds still prevail.

Revenue decreased to $22.4 billion last year, down from $23.4 billion the prior year. In addition, the company must deal with its important debt load of $33.4 billion.

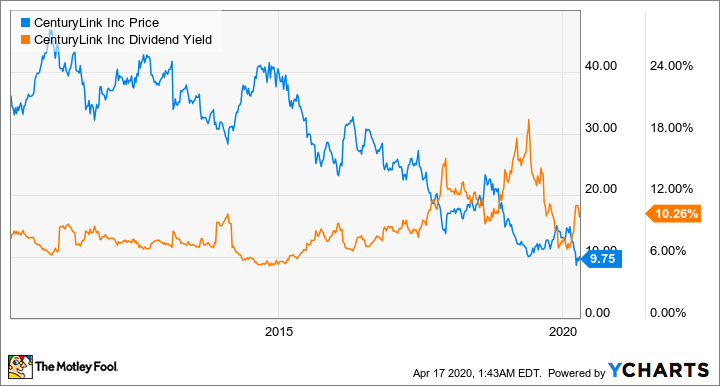

Given this challenging context, CenturyLink stock price is staying close to its multi-year lows, which drives its impressive dividend yield above 10%.

In the short term, the dividend seems safe, though. Thanks to the control of its expenses and investments, CenturyLink generated $3.3 billion of free cash flow in 2019. And management forecasted free cash flow to stay in the range of $3.1 billion to $3.4 billion this year. That level of free cash flow allows the company to reduce its net debt -- total debt minus cash and cash equivalents -- and pay its $1.1 billion annual dividends. In addition, the company will be saving $200 million in annualized interests as it refinanced approximately half of its debt -- $17 billion -- at attractive rates last year.

Thus, CenturyLink's main risk remains its successful transition to its fiber business to sustain its current level of free cash flow and keep on paying its dividend and reducing its debt load.

Image source: Getty Images.

2. AT&T

Since AT&T stock didn't participate in the recent market rally, its dividend yield close to 7% remains attractive.

The telecommunications and entertainment giant is facing the decline of its cable television businesses. The number of total video subscribers dropped to 20.4 million in 2019, down 16.7% year over year.

Last year, revenue increased by 6.2% to $181.2 billion, but that growth was due to the full contribution of the $85 billion acquisition of Time Warner in June 2018. And management's three-year plan forecasts revenue growth in the range of 1% to 2% annually by 2022, thanks to the upgrade of the company's network assets -- 5G and fiber -- and the launch of the video streaming service HBO Max in May.

If AT&T's growth initiatives succeed, free cash flow should increase from $28 billion this year to a range of $30 billion to $32 billion by 2022, according to management.

That level of free cash flow more than covers the dividend that represented a cash outflow of $14.9 billion in 2019. However, the company must also reduce its significant $151 billion net debt.

Granted, given the coronavirus-induced uncertainties, the company suspended its stock buyback plans to protect its dividend and still be able to reduce its debt load. And AT&T should profit from the growth opportunity 5G represents over the next several years.

Thus, the transition from the legacy television business to HBO Max remains the main threat to the company's free cash flow. The streaming service will involve significant investments for a result that remains to be seen in the context of intensifying competition. For instance, Disney reported its new streaming service Disney+ already hit 50 million subscribers, and Netflix keeps on generating abysmal negative free cash flow to enrich its catalog and grow its user base.

3. IBM

IBM stock slightly recovered from the market sell-off, but it stays close to its multi-year lows, and the dividend yield of 5.6% seems generous.

The company has been struggling with flattish revenue over the last several years as enterprises have been moving some of their on-premises IT infrastructure and applications to the cloud, which reduces the need for IBM's legacy products, software, and services.

But the company has been transitioning to cloud computing, and it acquired Red Hat in 2019 for $34 billion to accelerate this transformation. In addition, the nomination of the new CEO Arvind Krishna, who was IBM's senior vice president for cloud and cognitive software, confirms the importance of the cloud for the company.

Cloud computing represents an attractive market the research company MarketsandMarkets estimates will grow at an annual compound rate (CAGR) of 18% by 2023. But given IBM's resources and efforts to drive this transition, investors should keep in mind IBM's success with its cloud business will be key for the tech giant to sustain and grow its dividend.

Last year, free cash flow reached $11.9 billion, and management forecasted free cash flow would grow to $12.5 billion this year. The dividend seems safe as it represented a cash outflow of $5.7 billion last year. But the company must also reduce its net debt that increased to $53.9 billion because of its acquisition of Red Hat.

Looking forward

Since these three companies provide essential telecommunication and technology services, including during a recession, the effect of the coronavirus pandemic on the risks associated with their transformations remains uncertain. Thus, investors should pay close attention to any outlook update IBM and AT&T may discuss during their first-quarter earnings calls this week. CenturyLink will release its first-quarter results on May 6.