As the COVID-19 pandemic swept across the U.S. beginning a few months ago, airline traffic dried up. By mid-April, the TSA was screening fewer than 100,000 people a day, down 96% year over year.

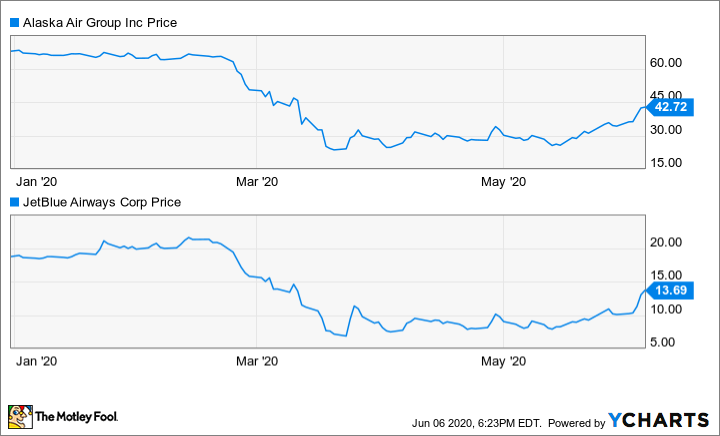

Investors responded by dumping airline stocks indiscriminately. Despite the likelihood that business will eventually recover, even airlines with strong balance sheets like Alaska Air (ALK -10.07%) and JetBlue Airways (JBLU 1.42%) lost about two-thirds of their value in the span of a few weeks. This probably represented an overreaction.

Data source: YCharts.

Now, the pendulum has swung the other way. Investors have been pouring back into airline stocks in recent weeks, betting on a relatively speedy recovery. Many are doing so through the U.S. Global Jets ETF (JETS 1.82%): the only major ETF tracking the airline industry. The diversification provided by the U.S. Global Jets ETF seems to be a major attraction for bullish investors. However, the kind of diversification offered by this ETF is not desirable -- and comes at a high price to boot.

A profitable bet, so far

Three months ago, the U.S. Global Jets ETF had just $33 million of assets under management. Since then, money has poured into the fund at a breathtaking pace, thanks to investors making a contrarian bet that airline stocks would bounce back. By the end of last week, the ETF's assets under management had swelled to $1.5 billion.

Younger investors appear to be a driving force behind this trend. On the millennial-focused Robinhood trading platform, between 200 and 400 investors were holding JETS shares at any given time in the two years prior to the COVID-19 pandemic. The number of Robinhood users holding the stock has exploded since then, growing from 364 on March 1 to 7,944 on April 1, 17,769 on May 1, and 34,603 as of June 5, according to Robintrack.

Most of these investors have done very well for themselves thus far. After a period of extreme volatility between mid-March and mid-May, airline stocks have taken off. As a result, the JETS ETF's share price has surged 67% over the past three weeks, rising from around $12 to just over $20.

Data source: YCharts.

However, past performance isn't a guarantee of future results. Upon closer examination, the U.S. Global Jets ETF looks like a poor investment choice -- even if you're relatively bullish about airlines (as I am).

Bad diversification

Diversification seems to be a key reason why some people are using the JETS ETF to bet on an airline revival. One 23-year-old Robinhood client recently told The Wall Street Journal, "I didn't want to make the mistake of buying one airline company or two airline companies where they're not running a tight financial ship. ... The natural diversification of the ETF is gonna allow me to kind of spread out my risk a little more."

This logic represents a mistake, albeit an understandable one. An index fund following the S&P 500 provides excellent diversification, as it provides exposure to a wide array of industries and business models. Furthermore, such ETFs have their assets weighted toward the most valuable (and presumably most successful) companies in the index.

By contrast, the U.S. Global Jets ETF has 70% of its assets invested in the top 10 U.S. airlines, with another 5% held in cash. Fully 25% of the fund's assets are invested in just two airlines: American Airlines (AAL 2.95%) and United Airlines (UAL 1.46%). These airlines have above-average debt loads and below-average historical profitability: particularly American. Furthermore, their exposure to long-haul international travel -- especially United -- and business travel makes them likely to recover more slowly than airlines focused on the domestic market and leisure travel.

The U.S. Global Jets ETF has 14% of its assets in American Airlines stock. Image source: American Airlines.

Meanwhile, Alaska Air and JetBlue have two of the best balance sheets in the industry, trailing only Southwest Airlines. They also have strong track records for profitability, a focus on the domestic market and leisure travel, and better long-term growth prospects than their larger rivals. Yet each of those companies account for just 4% of the U.S. Global Jets ETF's assets.

In other words, investing in this airline ETF doesn't provide meaningful diversification away from the U.S. airline industry. And among U.S. airlines, its assets are weighted toward riskier, less-successful companies that are arguably "not running a tight financial ship." Over the long term, the fund is likely to underperform shares of better-positioned airlines like JetBlue and Alaska.

High fees, too

Aside from the JETS ETF's subpar asset allocation, the fund charges a relatively high 0.6% expense ratio. That's more than four times the expense ratios of many prominent sector-specific ETFs. (ETFs following the broader market tend to have even lower expense ratios.)

The U.S. Global Jets ETF thus charges investors fees nearly on par with an actively managed mutual fund, while passively investing its assets in the airline industry, with a weighting toward the most troubled companies in the sector. Clearly, that's not a good deal for investors.

Investors who want to actively manage their holdings -- and bet on an eventual airline industry recovery -- should take the time to research individual airlines and pick the ones most likely to be long-term winners. The JETS ETF charges holders for the privilege of diversifying away from the best companies in the industry. Investors who don't want to take the time to research the sector would do well to stick to low-cost ETFs that track the broader market.