Oil prices cratered earlier this year, which caused a wake of devastation as several companies filed for bankruptcy. While prices had stablized in recent months, they took a nasty tumble earlier this week. That decline put renewed pressure on financially weak oil stocks, causing fears of another wave of financial destruction.

Given the renewed weakness in the oil patch, we asked three of our Motley Fool contributors which stocks they fear might not survive another big crash. Topping their list were Callon Petroleum (CPE), Occidental Petroleum (OXY 1.96%), and Transocean (RIG 2.46%).

Image source: Getty Images.

Troubling moves

Reuben Gregg Brewer (Callon Petroleum): The U.S. onshore segment of the energy industry is getting hit particularly hard today, with one-time giants, like Chesapeake Energy, succumbing to bankruptcy. Callon Petroleum, with a tiny market cap of just $200 million, appears to be teetering on the edge as it tries to muddle through this painful downturn. Things could be going better.

For example, it completed a 1 for 10 reverse stock split on Aug. 7, a move companies generally only make so they don't get booted off of a stock exchange. The company's shares have fallen roughly 45% since that date. But that's not the least bit surprising, given that the exploration and production company was deeply in the red in the second quarter, as low energy prices hit its top and bottom lines. A $1.3 billion asset-impairment charge didn't help, either. It also materially reduced capital spending, which helps in the near term but isn't a great long-term sign.

Add to these issues the fact that Callon's debt-to-equity ratio is a troubling high of 1.8 (the asset write-downs exacerbated this number). It also recently canceled a planned debt exchange, possibly because things are getting better or, more worryingly, because few debt holders wanted to participate. If oil prices fall again, Callon could have a hard time holding on, especially if debt holders aren't willing to give it extra breathing room.

Drowning in debt

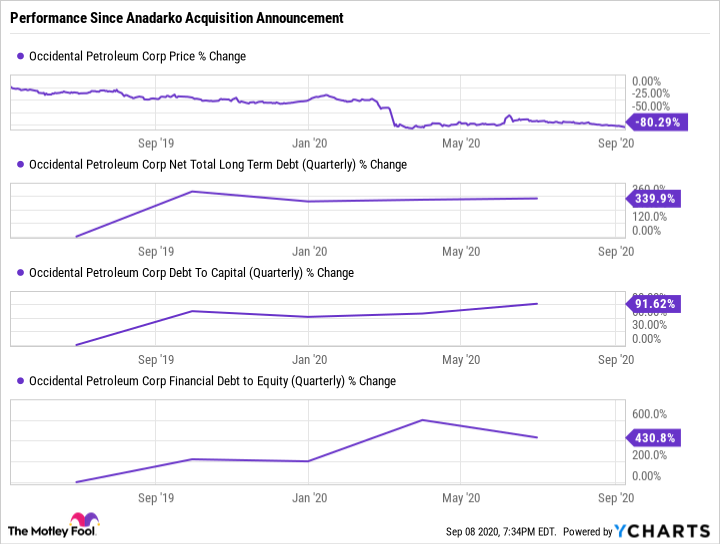

Daniel Foelber (Occidental Petroleum Corporation): Since announcing its acquisition of Anadarko Petroleum in May of last year, Occidental Petroleum (Oxy) has nosedived over 80%. And for good reason. Oxy's financial metrics have ballooned out of proportion, flashing warning signs that the company's balance sheet is drowning in debt.

Even with asset sales and cost reductions, Oxy still needs to spend nearly $3 billion in 2021 to sustain production at a West Texas Intermediate (WTI) oil price of $40 per barrel. Oxy hoped to be free cash flow positive in the second half of 2020. But with WTI currently around $36 per barrel, that goal is now in jeopardy.

The acreage and synergies that Oxy hoped to gain from the Anadarko acquisition mean little in a lower oil price environment. If anything, Oxy's aspirational advantage is starting to look more and more like a burden.

Oxy's quarterly dividend is now just a penny since its cut in late May. Even at its reduced stock price, Oxy's risks simply outweigh the hopes of a successful turnaround.

If you're interested in taking advantage of the crash in crude prices, you're better off with top oil stocks or other energy stocks with reliable and high-yielding dividends.

Already plunging toward the abyss

Matt DiLallo (Transocean): This year's slump in crude oil prices devastated the offshore drilling industry. With prices collapsing again, oil companies pulled back on new offshore drilling projects right as the sector was starting to recover from the last downturn. As a result, several drillers, including Valaris, Noble Corporation, and Diamond Offshore Drilling, filed for bankruptcy.

Those bankruptcies are putting the pressure on Transocean, which is struggling under the weight of $9 billion in debt. Because of that, the company has hired a financial advisor to help it evaluate strategic alternatives to improve its capital structure. It recently launched a $2 billion exchange offer to restructure some of its debt to get a little more breathing room.

While that move will help, Transocean still has a huge balance sheet problem that won't be easy to solve given the current weakness in the oil market. The company currently expects that it will only generate $600 million to $800 million in operating cash flow through the end of next year. That's not enough money to cover its capital investments of $1.7 billion, let alone the $1.1 billion of debt it has coming due during that time frame. Consequently, the company will likely burn through a significant amount of its liquidity, which currently consists of $1.7 billion of cash and $1.3 billion of available credit.

Given that already dire financial picture, Transocean won't survive if oil prices crash again. As things stand right now, the energy company might not make it through even if oil prices start bouncing back.