If you're an investor who likes high-yield dividend stocks, you probably already know that not all that glitters is gold. Companies sometimes distribute unusually high dividends to make their stock more appealing in the aftermath of a price collapse or a slew of bad news. Alternatively, some dividend yields can appear to be high after a company's stock craters when the company's management is making an intentional choice to not cut its dividend. Similarly, many companies offering high dividends do so as an intentional signal of their ongoing financial strength. Discriminating between these cases is thus critical for investors seeking yield.

When you're sorting through stocks with dividend yields above 5%, you'll need to tread carefully and pick companies with consistently high yields that have been growing sustainably over time, rather than those that only recently increased their payout to levels that they can't possibly maintain. It might also be worth considering stocks that have recently taken a beating without reducing their dividends, so as to purchase them at a bargain. That said, there are some solid companies whose dividend yields are routinely in excess of 5% despite quarterly fluctuations in the size of the dividend itself and substantial movements in the underlying stock's value. Here are three you may have heard of.

Image source: Getty Images.

Gaming and Leisure Properties

Gaming and Leisure Properties (GLPI -3.12%) is a casino holdings company with an impressively high trailing dividend yield of 7.14%. While its yield may fall over the next year, its dividend today is 10% higher than it was five years ago even after the company cut its payment in the second quarter. This suggests that GLP's management has consistently made returning money to shareholders a high priority.

Though the company is mature and no longer growing rapidly, it's remarkably well run, with a trailing profit margin of 36.9% and year-over-year quarterly earnings growth of 20.8% as of the second quarter. However, the pandemic has hit the gambling and leisure industry exceptionally hard by preventing patrons from visiting casinos and hotels, so don't be surprised if you see Gaming and Leisure Properties curbing its dividend even further in the next few quarters. Nonetheless, the company's earnings in the first and second quarters of 2020 were greater than its earnings in the third quarter of 2019, suggesting that the pandemic may not have affected it as much as what one might expect. As lockdowns are lifted and revenue returns to normal, the company's dividend will likely grow once again, provided that the company can get its $6 billion of debt under control in the long-term.

Rio Tinto

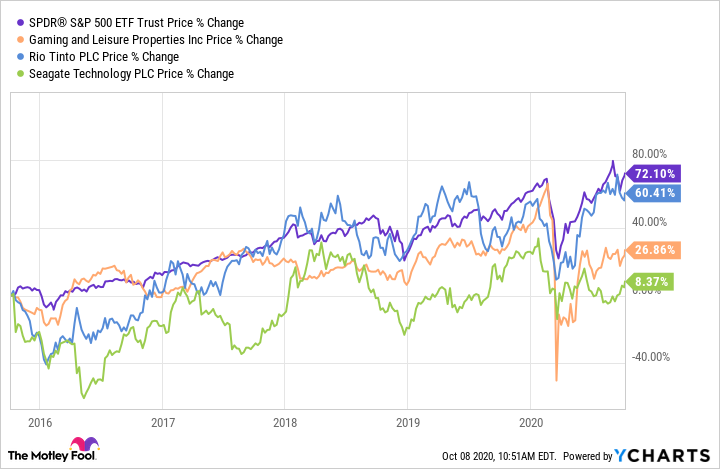

As one of the world's largest mining and refining companies, Rio Tinto (RIO -6.45%) has a reputation for paying out sizable dividends, including most recently when its yield was at 6.35%. Though Rio Tinto's dividend yield fell from a high of nearly 10% earlier this year, its stock price has gained upwards of 78% in the last five years, beating the overall market's growth of nearly 70%. As a result, the company is a great choice for investors who want a combination of equity growth and dividend payouts. In terms of the dividend itself, Rio's payments have grown 116.6% in the last five years, though they sharply contracted in early 2019 as demand ebbed.

There are a few concerns that investors should be aware of, however. First, Rio Tinto is a cyclical business whose earnings are reliant on high demand for mineral-based commodities. The current economic contraction may reduce this demand, thereby leaving the company with shrinking earnings until the recovery is proceeding with gusto. Rio Tinto has survived previous downturns by curbing its dividend payments, so it's reasonable to suspect that it will bounce back despite economic issues. The other issue is that the company's payout ratio is at 86.68% and rising, so it may need to curb its payments if they start to look unsustainable in light of temporary economic conditions. Even with the economic disruption of the pandemic, Rio Tinto isn't going anywhere thanks to its $8.95 billion in cash and trailing revenue of $41.81 billion against operating expenses of only $10.93 billion.

Seagate Technology

Digital storage manufacturer Seagate Technology (STX) may appear to be an unlikely contender on a list of the top dividend stocks as a result of its substantial research and development costs. Furthermore, because its stock price has only grown by 11.08% from late 2015 to the present, cautious investors may think that the company may not have the competitive positioning it needs to beat the market. Though there may be a grain of truth to this sentiment, it shouldn't totally dissuade investors. Seagate's dividend yield of 5.11% is higher than it was five years ago, and its revenue grew last quarter at a year-over-year rate of 6.2%.

There's plenty of life left in this company, but Seagate still has work to do. Its total revenue has fallen from the peak of $14.9 billion in 2012 to $10.51 billion over the last 12 months. Thus, despite the impressive growth in its dividend yield, the amount of each dividend payment has barely increased compared to 2015, rising from $0.54 per share to $0.65 per share. On the other hand, its operating expenses have also dropped from a high of $2.34 billion in 2015 to $1.47 billion in 2019 as part of an intentional strategy to shift the company toward lower volume and higher efficiency. As part of this strategy, Seagate has shifted its emphasis to providing high-capacity hard drive products for enterprise clients with cloud computing businesses rather than for the consumer market. This strategy appears to be working so far, as in fiscal year 2020 the company grew its high-capacity storage revenues by 25%.

If Seagate's ongoing evolution toward a stable business model takes longer than expected, the company may need to lower its dividend or reduce its stock buybacks. For the time being, Seagate's dividend appears to be sustainable based on the scale of its dividends paid compared to its free cash flows, which totaled $673 million and $1.13 billion over the last 12 months. If the company is successful in reducing its costs and increasing its revenue, shareholders may soon enjoy rising dividends once again.