A new approach to health insurance

Brian Withers (CLOV): Clover Health is one of the recent SPACs (special purpose acquisition company) to be spun off as its own public company. Today, the shares are trading at an all-time low providing patient investors a great opportunity to get in on the ground floor of what could be an amazing long-term investment.

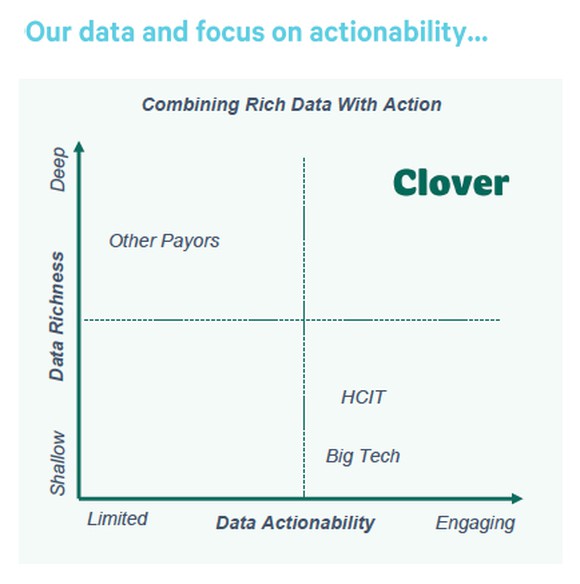

Clover sits in the sweet spot between tech and health care data. Image source: Clover health.

At its core, Clover Health is a health insurance provider focusing on Medicare Advantage patients. But it’s also a technology company. Where other health care information technology (HCIT) companies, big tech, and other payors have been unsuccessful, Clover sits in the sweet spot of having access to a tremendous trove of data as a health insurance payor and can help patients and healthcare professionals get access to that data in ways to provide better, more effective, and ultimately less expensive care. Here’s how that works.

The company has developed Clover Assistant, a software application accessed via the web or mobile devices, that enables physicians to get full access to patient records. With this access healthcare professionals can make better and more informed decisions about a patient's care plan. But the best part is that doctors who treat Clover patients can use the application and don’t have to pay anything for it. In fact, doctors who use the app can receive enhanced fees.

Investors may be skeptical as to whether this actually works. The company’s incredible track record of growth shows this concept is taking off. With every additional patient and healthcare professional who uses the software, it will become even “smarter” and more useful to all members. The table below the last three years of history that shows this company has been able to grow effectively and that its medical cost ratio is improving.

|

Metrics |

2018 |

2019 |

2020 |

2021 Estimated*** |

|---|---|---|---|---|

|

Members* |

31,000 |

41,000 |

57,000 |

69,000 |

|

YoY member growth |

N/A |

31% |

38% |

21% |

|

Revenue |

$358 million |

$462 million |

$673 million |

$835 million |

|

YoY revenue growth |

N/A |

29% |

46% |

24% |

|

MCR** |

97% |

99% |

88% |

90% |

Lastly, the strategy to focus on the growing aging population often who have multiple medical conditions at once is a solid way to collect more data to improve the platform. Interested investors should remember that this company is still tiny and has lots to prove. But for those willing to take a little risk, this is one stock that should be on your list to consider this month.