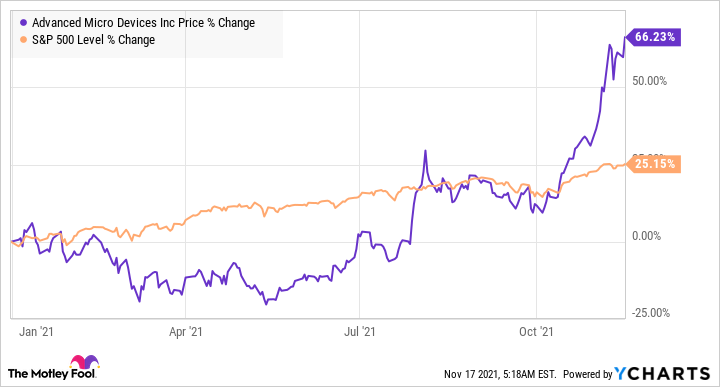

Advanced Micro Devices (AMD 2.55%) has turned in a fine performance on the stock market in 2021, with shares of the chipmaker soaring more than 66% so far and easily outpacing the broader market’s growth.

But what about investors who have missed the AMD gravy train and are thinking of buying the stock so that they don’t miss out on further gains? Does it make sense for them to buy this hot tech stock after its terrific rally in 2021? Let’s find out.

AMD stock has become expensive thanks to its terrific growth

The first thing that potential AMD investors may want to look at is the stock’s valuation. It has a price-to-earnings (P/E) ratio of nearly 47 and a price-to-sales ratio of 12.5. The valuation isn’t cheap when compared to the S&P 500’s earnings multiple of 28.7 and sales multiple of 3.2. Also, AMD was trading at cheaper multiples at the beginning of October, before an outstanding earnings report and a potentially lucrative contract sent its shares soaring and inflated the valuation.

AMD PE Ratio data by YCharts

However, AMD’s rich valuation seems justified as the chipmaker has been clocking outstanding growth quarter after quarter. Its revenue shot up 54% year-over-year in the third quarter to $4.3 billion, while adjusted earnings jumped 78% from the prior-year period to $0.73 per share. AMD raised its full-year guidance once again and now expects revenue to increase 65% in 2021, which would be a big improvement over the 45% annual revenue growth it had clocked in 2020.

So, the valuation shouldn’t be a concern for investors who are on the sidelines and wondering if it makes sense to buy AMD after the stock’s impressive run in 2021. The company is now trading at a much cheaper level when compared to 2020’s P/E ratio of almost 124, and it is on track to finish the year with stronger growth. This makes AMD stock practically a bargain right now.

Image source: Getty Images

The chipmaker is set for growth in 2022, and beyond

Analysts expect AMD’s revenue to increase nearly 19% in 2022, while earnings per share are anticipated to jump 26%. However, there are several reasons why AMD can easily outpace those expectations and match the growth it has clocked in 2021.

One of the reasons why AMD can sustain its high growth rates is because of its market share gains in the server and personal computer (PC) processor markets. Mercury Research points out that AMD’s share of the x86 processor market (which includes server processors, desktop processors, and mobile processors) increased to 24.6% in the third quarter, an increase of 2.1 percentage points over the second quarter. This was AMD’s second-highest share of the CPU market after the 25.3% it controlled in the fourth quarter of 2006.

AMD is expected to continue gaining market share in the CPU space. Vivek Arya of the Bank of America, for example, expects AMD to corner 25% of the server market by the end of 2022. That would be a huge increase from the 10.2% server market share that AMD had at the end of the third quarter, as per Mercury Research, up 1.8 percentage points over the year-ago period.

It won’t be surprising to see AMD achieve such an impressive market share in servers as its chips have gained impressive traction. The company recently pointed out that its chips now power 73 supercomputers as compared to 21 a year ago. Additionally, AMD has been selected by Meta Platforms to power its data centers that will be used to build the metaverse.

All of this points toward AMD’s growing dominance in the server market, which could substantially boost its top line as the chipmaker sees an addressable revenue opportunity of $19 billion in this space by 2023.

On the other hand, AMD is expected to launch 5-nanometer (nm) CPUs late next year for deployment in desktops and notebooks, which could deliver a 20% to 40% increase in performance as compared to the current generation of chips. With Intel expected to launch its Raptor Lake processors by the end of 2022 on an enhanced 10nm platform, AMD looks set to extend its technology lead and gain more share.

And finally, the gaming hardware space will continue to be a big tailwind for AMD. The company seems to be gaining ground in the multibillion-dollar graphics card market, while consoles present another long-term growth opportunity. That’s because AMD’s semi-custom chips are used by Sony and Microsoft in their latest consoles that are expected to see a massive spike in sales in the coming years.

It isn’t too late to buy the stock

In the end, it can be said that AMD has multiple growth drivers that should help it sustain its strong pace of growth in 2022 and beyond.

It still has a lot of room for growth in the PC and server markets where it can capture more share from Intel. Also, the addition of new catalysts such as the metaverse makes it easier to see why buying AMD stock right now looks like a good idea, especially considering the valuation that is relatively cheaper than last year.