Roblox (RBLX 0.41%) made a red-hot debut on the stock market in March 2021 via a direct listing. Investors piled into shares of the online video game platform operator, with its market capitalization hitting nearly $40 billion on the day of its initial public offering.

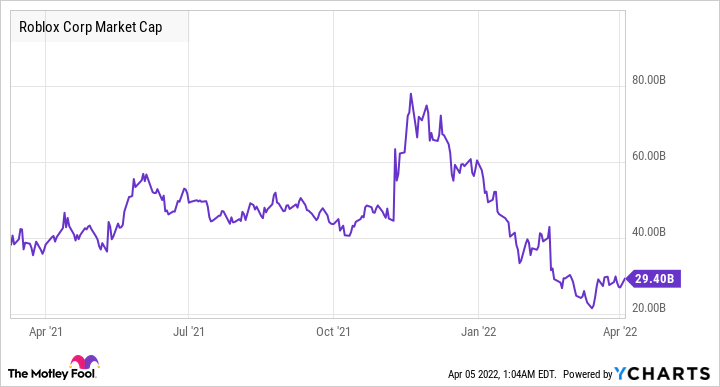

Roblox stock has been on a wild roller-coaster ride since then. The company hit a market cap of nearly $80 billion in November 2021 following an outstanding set of results and investors' excitement about Roblox's metaverse prospects. But it has all been downhill for the company since then, as Roblox's market cap has dropped below $30 billion as of this writing.

RBLX Market Cap data by YCharts

The broader sell-off in technology stocks, a bigger-than-expected loss in the fourth quarter of 2021, and concerns of a slowdown in Roblox's growth in a post-pandemic scenario have weighed heavily on the stock in recent months. However, a closer look at Roblox's end-market opportunity indicates that the stock's troubled times may not last forever, and it could regain its mojo once again. Let's see why.

Roblox's slowdown should be temporary

Roblox finished 2021 with $1.9 billion in revenue, a terrific 108% jump over the prior year. The company also reported a 40% year-over-year increase in daily active users (DAUs) to 45.5 million. User engagement was also strong, as evident from a 35% year-over-year increase in hours engaged to 41.4 billion.

Image source: Getty Images

However, the company's January guidance sent alarm bells ringing. Roblox pointed out that its January 2022 revenue was up 65% year over year at the midpoint of its guidance to $204.5 million. The growth in daily active users dropped to 32% over January 2021, while hours engaged increased at a relatively slower pace of 26%. Another alarming metric was the drop in average bookings per daily active user (ABPDAU), which fell between 22% and 23% in January 2022.

The metrics for February 2022 showed a further slowdown. Revenue growth for the month was between 60% and 63%, while estimated ABPDAU was down between 24% and 25% over the same month last year. However, the company continues to add new users at a nice pace to its platform, with daily active users increasing 28% year over year to 55.1 million in February.

Roblox management points out that the company is facing tough year-over-year comparisons. Its growth received a terrific bump amid the pandemic as people stayed at home. But as things have opened, Roblox's eye-popping growth rates are normalizing. However, investors shouldn't forget that Roblox's current pace of growth remains quite solid.

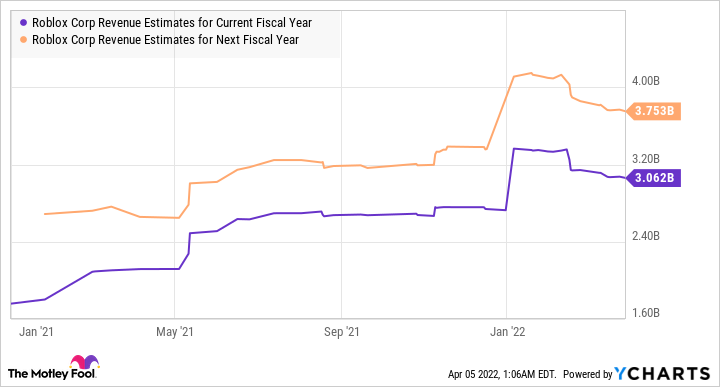

Assuming the company maintains the $200 million revenue run rate that it has clocked in the first two months of 2022, it could end 2022 with $2.4 billion in revenue. That would still be a nice increase of 26% over last year. Analysts, however, expect Roblox to grow at a faster pace this year and clock 61% revenue growth, followed by another strong showing next year.

RBLX Revenue Estimates for Current Fiscal Year data by YCharts

More importantly, the market that Roblox operates in could help it sustain its high revenue growth rates for years to come.

Tremendous long-term growth is in the cards

Roblox provides a platform that allows people to "play, learn, communicate, explore, and expand their relationships in millions of 3D digital worlds that are entirely user-generated, built by our community of millions of active developers." This concept of people engaging with each other in a 3D virtual world is now formally known as the metaverse.

Roblox can be accessed by users across different platforms, including Apple iOS, Alphabet's Android, personal computers, Mac, and Microsoft's Xbox gaming console. Additionally, customers can consume virtual reality content from Roblox on Meta Platforms' Oculus Rift and HTC Vive headsets. Meanwhile, the Roblox Studio tool allows creators and developers to create, publish, and operate 3D experiences.

So Roblox is in the middle of a terrific growth opportunity, as the metaverse will require the creation of millions of virtual worlds where users will interact. Not surprisingly, the virtual reality content market is expected to clock terrific annual growth of 77% through 2029 as per third-party estimates, generating nearly $260 billion in revenue at the end of the forecast period.

What's more, Roblox's solid base of users has helped it attract big names looking to develop their presence in the metaverse. For instance, the National Football League (NFL) partnered with Roblox in February to build an NFL-specific metaverse. The NFL plans to hold virtual live events in the metaverse to keep fans engaged.

Meanwhile, Formula 1 racing team McLaren unveiled its 2022 race car on Roblox earlier this year, while Warner Music hosted a virtual DJ party featuring David Guetta in February. All of this indicates that Roblox is on track to benefit from the metaverse, which is not surprising as the company has a terrific base of 29 million developers who create content and immersive experiences on its platform.

As such, it wouldn't be surprising to see Roblox maintain a terrific pace of revenue growth in the long run. But will its growth be enough to turn it into a trillion-dollar company?

Can Roblox become a trillion-dollar company?

Roblox is enjoying outstanding revenue growth right now, which analysts expect to continue. If we conservatively assume that Roblox clocks a 30% annual revenue growth rate for the next nine years, then its revenue at the end of 2030 could increase to $20 billion. The stock is currently trading at a price-to-sales ratio of 13.2. A similar multiple at the end of the decade would translate into a market cap of $264 billion.

While that's a far cry from the $1 trillion mark, it is worth noting that Roblox could be on track to deliver huge upside in the long run, as it currently has a market cap of $29 billion. However, a faster pace of growth over the next decade thanks to catalysts such as the metaverse should help the company get closer to the $1 trillion mark, which is why investors should consider taking advantage of the recent drop in the company's shares to buy this potential growth stock.