Illumina (ILMN 0.23%) leads the genome sequencing industry with a 90% market share in the U.S. and a 75% share globally. It has been this way for more than a decade, and the company is making investments to build on that advantage. But doing great science doesn't necessarily lead to great stock returns. Here are a couple of reasons why investors might want to pick up shares of Illumina, and one issue that might give them pause.

Image source: Getty Images.

Reason to buy No. 1: It is ramping up research and development

You might suspect a company that dominates the genome sequencing market would invest heavily in research and development. You'd be right. But last year, Illumina accelerated the pace and is promising to reveal revolutionary new technology as the payoff.

Data source: Illumina. Chart by author.

CEO Francis deSouza has revealed two projects that should excite investors. First is what he is calling "chemistry X". It represents an advanced method for reading genomes that results in much higher accuracy and shorter cycle times. In fact, deSouza says it could eventually cut the cost of sequencing by more than 70%. That's a bold statement considering the cost to sequence a single human genome has dropped from about $100 million to less than $1,000 in just 20 years.

"Chemistry X" would make new experiments possible for its customers. In discussing the technology, deSouza offered examples such as researching gene expression in diseases like Alzheimer's and Parkinson's, as well as the ability to study the DNA of individual tumors. It would be another step toward a future in which genetic testing would help support personalized medicine -- something the healthcare industry has been moving toward for years.

Reason to buy No. 2: The company is channeling its inner Steve Jobs

DeSouza offered an interesting analogy when discussing Illumina's second looming catalyst. He said the upcoming rollout of the company's new Infinity sequencers reminds him of the introduction of the iPhone. Just as Apple's device neatly combined the functions of an internet browser, a phone, and a digital music player, he believes Infinity will be able to address the market's needs for both short-read and long-read genome sequencing and analysis.

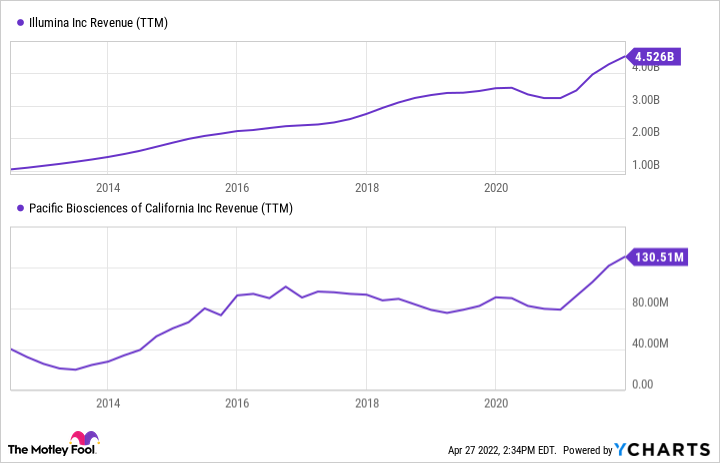

That may not sound as cool as a revolutionary smartphone. But it promises to plug a hole in Illumina's portfolio -- one it previously tried to seal when it attempted to buy Pacific Biosciences of California (PACB -3.63%) in 2018. That deal was finally scuttled in 2020 when it couldn't get regulatory approval in the U.S. or Europe. With Illumina already generating 35 times the sales of its smaller competitor, the product could make PacBio management and shareholders rue the day that acquisition fell through.

ILMN Revenue (TTM) data by YCharts

A reason to sell: Another regulatory headache and a lofty valuation

The company is facing pushback over another deal even though it is technically already closed. In 2016, Illumina founded a cancer-detection business called Grail, then spun it off as a separate entity while retaining an ownership stake. Then in 2020, it announced it was buying back the whole business for $8 billion. That might seem straightforward. But it wasn't to regulators.

The company proceeded with the acquisition last year, though it has kept Grail operating independently as it seeks approval of its deal from regulators. The Federal Trade Commission is suing to undo the deal, and the European Commission recently said it remains unconvinced the acquisition should go through due to antitrust issues. The uncertainty around this may be a drag on the stock price.

Illumina's share price is currently near the low point it touched shortly after the pandemic began.

The same is true of its valuation, although when viewed through a wider lens, it's elevated compared to its historical range. That's best illustrated by tracking the company's enterprise-value-to-earnings-before-interest-and-taxes ratio. It's at a worryingly high level, even though it's also near a 52-week low.

ILMN EV to EBIT data by YCharts

Illumina has been the trailblazer in making genome sequencing more accessible to clinical and academic researchers. That has translated into real-world applications that healthcare is just scratching the surface of. But antitrust obstacles on two continents are impairing its efforts to consolidate the industry and provide an end-to-end solution.

If the company' delivers on the innovation its CEO is promising, it may be able to build that solution itself. Investors will get more details this fall at its annual investor day. Until then, the stock looks expensive even with the share price down significantly.