Iconic donut maker Krispy Kreme (DNUT 0.51%) announced its second-quarter financial results, which showed progress in the company's implementation of its hub and spoke business model. However, the market frowned on the report, and the shares fell. They're now down 37% from its IPO last year. What gives?

Business model transition

For years, Krispy Kreme operated bake shops where customers could go to get their donut fix. The company found that the primary reason customers didn't buy more donuts was that they had to travel too far for the treats.

Image source: Getty Images.

A few years ago, Krispy Kreme devised a plan to transition the company to a Hub and Spoke business model. The new model would convert bake shops into hubs that used excess capacity to furnish fresh donuts to spokes located in easy-to-access grocery and convenience stores in the hub's area. Inside each spoke, Krispy Kreme placed warming cabinets adorned with the iconic logo where customers could buy donuts more conveniently.

Krispy Kreme started its rollout in its international markets, which is now in full swing. During the quarter, the company added over 200 international spokes, bringing its total points of access (hubs plus spokes) to 3,400. The premise of the new business model is that low-cost new spokes would increase sales and incremental margin expansion to each hub.

Trailing 12-month revenue per hub increased by 14.4% from $8 million in Q2 2021 to $9.8 million in Q2 2022. In addition, adjusted EBITDA margin increased to over 25% from 22% last year.

Krispy Kreme's biggest market is in the U.S, where it currently has about 5,800 points of access. The company is still in the early stages of installing the hub and spoke model there. During the quarter, Krispy Kreme added 112 new points of access, and improved sales per hub to $4.4 million from $3.6 million a year ago. Adjusted EBITDA margin improved from 11% last year to over 15% in the quarter.

Its U.S. business is significantly larger than its international one, but it has a long way to go in catching up with the international market's profitability -- which should happen as it rolls out its hub and spoke model. That could provide Krispy Kreme with a long growth trajectory over the next several years.

Is Krispy Kreme stock a buy right now?

Despite the progress in Krispy Kreme's transformation strategy, the stock cratered after the company released its earnings report. Considering the low capital requirements to expand the hub and spoke model, Wall Street analysts forecast $0.06 in earnings per share, but the company missed that mark by a penny.

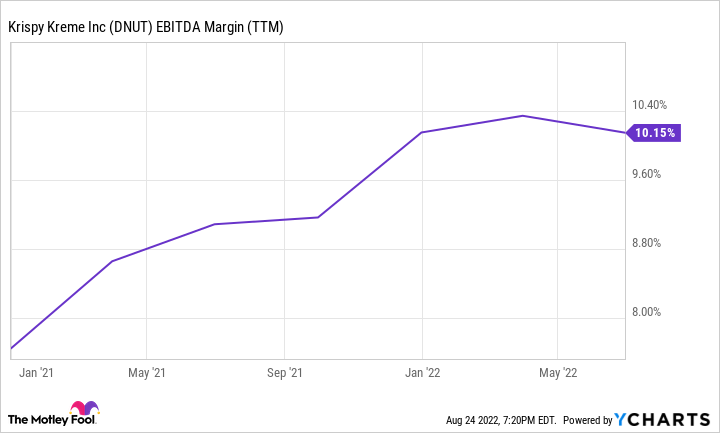

Quarterly EBITDA fell 10% to $47.4 million, and management blamed a strengthening U.S. dollar, inflationary pressures, and a pandemic-related bump in last year's comparable quarter. These issues appear to be unrelated to the business, and before the quarter Krispy Kreme's overall EBITDA margin had been moving toward that of its hub and spoke stores.

DNUT EBITDA Margin (TTM) data by YCharts

Krispy Kreme still has 118 U.S. hubs without spokes to develop in the coming years, which could keep the company's EBITDA margin expanding over time. The company could experience some growing pains in its transition. So investors will require patience on this one. But if the company can continue to implement its strategy profitably, long-term investors should be rewarded handsomely.