Tesla (TSLA 4.39%) reported its first-quarter 2023 results on April 19. On its earnings call, CEO Elon Musk talked about what everyone already knows -- that the poor macroeconomy negatively affecting demand for large purchases like cars. Additionally, he spoke about the company's pricing strategy in this lower-demand period for electric vehicles (EVs).

Investors were disappointed in Musk's decision to cut EV prices, and the company's first-quarter results were weaker than expected. Consequently, the stock dropped nearly 10% the day after the earnings release. But, considering that Tesla's long-term prospects are still bright, should you buy the post-earnings dip or wait out any short-term concerns on the sidelines?

NASDAQ: TSLA

Key Data Points

Tesla has the strongest brand in the EV industry

Musk and Tesla didn't invent EVs, but Tesla raced ahead of the crowd and has done more than any other company to make purchasing an EV mainstream. As a first mover in the EV space, Tesla has a significant lead in branding within the U.S. market. As a result, when people are ready to buy EVs, Tesla is often the first thought that comes to mind -- a considerable advantage.

Establishing a solid brand that engenders a loyal customer base that gains repeat customers is just as important as acquiring new customers to increase car sales over the long term. So even when a car company is highly successful in taking customers from other car brands, it means nothing if that brand keeps hemorrhaging customers it won over previously. The last thing a car company wants is a one-and-done type of buyer.

Thus, customer retention is very important. According to recent S&P Global research titled "The Trouble With Nomads," Tesla is the most successful at turning first-time buyers of its brand into loyal repeat buyers. In other words, Tesla has the highest customer retention rate in the car industry.

Additionally, unlike most car companies, Musk sees Tesla as more than another car brand. He eliminated "Motors" from the Tesla name in 2017. The Tesla brand has already evolved into a multi-product energy and technology company. For instance, its energy generation and storage revenue segment is its fastest-growing portion, growing quarterly revenue 148% year over year to $1.5 billion in Q1 2023.

What should excite investors is that Musk can put the Tesla brand on any number of future energy or technology products, and have a significant advantage in producing sales in those new categories due to the brand's strength. The cherry on top is that Musk established the brand without significant spending on marketing and advertising.

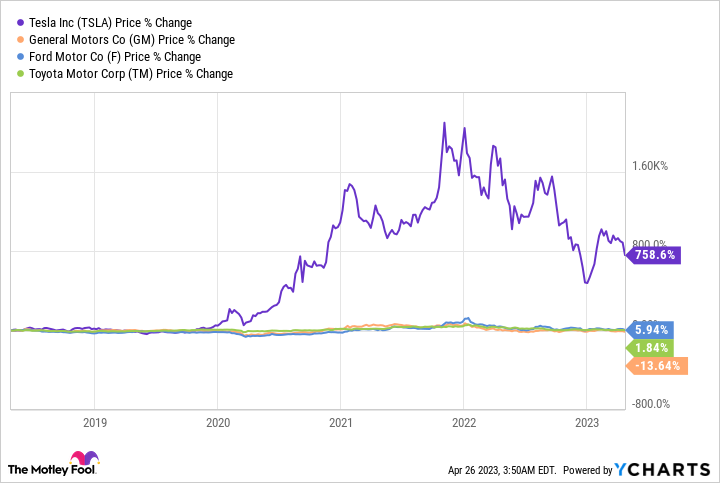

The market recognizes that Tesla is more than just another auto company. There is a reason that its stock far outpaces the rest of the auto industry.

But despite its strong brand, there are reasons to be cautious about investing in Tesla today.

Disappointment with short-term results

Although Tesla is still the most dominant EV brand, its market share has declined rapidly over the last year. According to S&P Global Mobility, its EV share dropped steeply from 77.8% in November 2021 to 57.1% in November 2022. Moreover, a terrible economy slowing big-ticket purchases like high-end EVs exacerbates investor disappointment with the market share loss.

In response, Musk strategically cut prices multiple times in 2023 to expand its car fleet and maintain its market share. What investors dislike is that price cuts negatively affect the company's profitability.

The chart below shows gross and operating margins have tailed off in 2023.

TSLA Gross Profit Margin (Quarterly) data by YCharts

In this market environment, investors reward companies that increase profitability and punish companies with decreasing profitability. Unfortunately, this quarter Tesla is being penalized for falling profitability in a terrible economy.

The company is well positioned in the long term

Musk explained his strategy for cutting prices on the company's Q1 2023 earnings call:

And while we reduced prices considerably in early Q1, it's worth noting that our operating margin remains among the best in the industry.

We're taking a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However we expect our vehicles over time will be able to generate significant profit through autonomy. So we do believe we're like laying the groundwork here, and then it's better to ship a large number of cars at a lower margin and subsequently harvest that margin in the future as we perfect autonomy.

Musk is playing the long game. The chart below shows that since September 2021, Tesla has maintained the best operating margins in the auto industry.

TSLA Operating Margin (Quarterly) data by YCharts

It is now weaponizing its operating margin dominance. If competitors decide to engage in a price war with Tesla, they could lose profitability and have their stocks severely punished. Alternatively, some could cut back on costs to maintain margins. The problem with cutting costs is that many of those costs are critical investments needed to catch up to Tesla's EV prowess. In addition, legacy manufacturers have a heavy internal combustion engine ball and chain dragging them down.

While competitors languish, Tesla is still chasing its aspirational goal of selling 20 million EVs annually by 2030. However, suppose you view its ambitions as pie in the sky, since it only sold 1.31 million cars in 2022, and you assume Tesla only delivers a quarter of its aspirational numbers in 2030 (5 million vehicles annually). You might consider the stock's current valuation of 47.26 times its trailing 12-month earnings as undervalued, especially if you assume margin expansion from its autonomous vehicle initiatives.

Believers in Musk's renewable energy vision should buy the after-earnings dip in stock price.