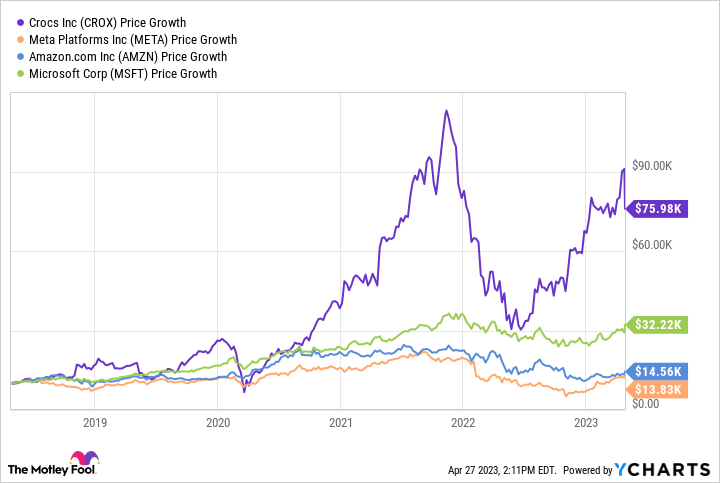

When you think of the best-performing stocks on the market, companies like Microsoft, Meta Platforms, and Amazon come to mind. But would it surprise you that clog-style shoe company Crocs (CROX +1.09%) has outperformed all of these over the last five years? Well, it has.

Indeed, if you invested $10,000 in Crocs stock in April 2018, you'd have over $76,000 now, as the chart below shows.

Crocs has been a fantastic investment for several concrete reasons, as I'll explain. And I'll also explain why it could still be a good investment for those who buy today.

Why Crocs is a winner

Stocks don't go up over the long term arbitrarily. I believe that there are four primary reasons Crocs stock has been an outstanding market-beating investment. I also believe these reasons are best illustrated by looking at the business over the past decade.

- Revenue growth: In 2012, Crocs generated revenue of $1.1 billion. In 2022, the company generated revenue of nearly $3.6 billion. It's expanded beyond foam clogs into other lines of footwear, including sandals. It's also collaborated with celebrities to increase brand recognition. And it's acquired other companies, including HEYDUDE for $2 billion in 2022. All of this has helped bring Crocs to the forefront of consumers' attention, tripling revenue over the past decade.

- Margin expansion: As it's grown, Crocs has become more profitable. The company exited low-margin geographies and closed underperforming stores, and it turned its focus to direct-to-consumer e-commerce. Because of this, Crocs' operating margin was an impressive 23.9% in 2022, compared with just 13% in 2012.

- Lower share count: At the end of 2012, Crocs had 90.6 million diluted shares outstanding. At the end of 2022, the company had 62.5 million. By reducing its share count by over 30% through share repurchases, the value of each remaining share has increased, which is good for ongoing shareholders.

- Higher valuation: Finally, Crocs stock traded at a price-to-sales (P/S) ratio of about 1 at the start of 2013. Now the stock trades at a P/S of about 2.1. In other words, the stock's valuation has roughly doubled during the past decade. This reflects its higher profitability and better revenue growth. But it also suggests that the market has higher expectations for Crocs' business now than it did in times past.

Crocs' revenue has tripled, its operating margin has doubled, its share count is down more than 30%, and its valuation has doubled. These four factors explain why Crocs stock is up almost eightfold over the past five- and 10-year periods (five-year returns are nearly identical to the 10-year returns).

Why Crocs can still be a winner

On April 27, Crocs reported financial results for the first quarter of 2023, showing that much of what's transpired in the last decade is still present in the business. That's why I believe the stock can still be a winner from here.

For example, management raised its full-year revenue guidance for 2023, now expecting 11% to 14% year-over-year growth. Only a limited portion of this growth is due to the acquisition of HEYDUDE; most of the growth is organic. Consider that revenue for the Crocs brand was up an organic 19% in Q1.

In addition to ongoing revenue growth, Crocs' profit margins continue to improve. In Q1, its gross margin jumped from 49.2% to 53.9%, and its operating margin was at 26.6%. For the year, management expects its operating margin to stay between 26% and 27%, which is an improvement from its operating margin of 23.9% in 2022.

For now, share repurchases are on hold for Crocs. The company took on a lot of debt to acquire HEYDUDE, and management is committed to paying this down. However, it won't take long to get to a place where management is comfortable because the business is so profitable. At this rate, management expects to have paid down debt enough to start repurchasing shares again later this year.

Therefore, Crocs is still growing revenue and improving profitability, and share repurchases should kick back in soon. These are three of the four factors that contributed to its impressive stock performance.

The final factor I wouldn't count on going forward: A higher valuation. With a market capitalization of $7.6 billion as of this writing, Crocs stock trades at about 7 times its expected operating income for 2023. Compared to some stocks, that's dirt cheap. But that's a fairly common valuation among shoe stocks.

For this reason, I wouldn't invest in Crocs stock today thinking the stock is undervalued. I believe it's fairly valued. However, I would invest in Crocs stock today under the assumption that the business is performing well enough to deliver market-beating stock performance over the next few years, at least.