TC Energy (TRP +0.13%) is one of North America's largest energy infrastructure companies. It's one of the biggest natural gas pipeline companies on the continent, transporting a quarter of the gas used each day. The Canadian company also has a meaningful liquids pipeline business and a large-scale power and energy solutions operation.

The company recently revealed plans to split into two by spinning off its liquids pipeline operations into a separate publicly traded company. TC Energy believes the move will unlock new growth opportunities, enabling both companies to continue paying a growing dividend.

NYSE: TRP

Key Data Points

Splitting up to unlock value and capture new opportunities

TC Energy has spent the past two years undergoing a strategic review to determine the best path forward amid the ongoing transition to lower-carbon energy. It decided that spinning off the liquids pipeline business was the optimal choice. The company plans to complete that spin-off in the second half of next year.

The split will result in the creation of two independent, investment-grade, publicly traded energy infrastructure companies:

- TC Energy: Post transaction, TC Energy will be a leading natural gas pipeline and energy solutions company. It will focus on lower-carbon energy, including gas, nuclear, and renewables.

- Liquids Pipelines Company: The independent liquids pipeline company will operate over 3,000 miles of oil pipelines across the U.S. and Canada, including the Keystone Pipeline system.

TC Energy believes that the spit will enable the two independent companies to focus on enhancing and growing their operations. That should unlock value for shareholders while opening new growth opportunities.

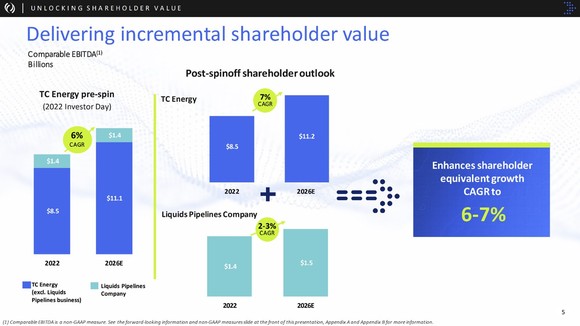

Before the spin, TC Energy expected to grow its combined comparable EBITDA at a 6% compound annual rate through 2026. However, it believes that by going their separate ways, the two entities will grow faster:

Image source: TC Energy.

The streak should continue

TC Energy also expects to maintain its elite record of dividend growth following the spin. The company has increased its payout for 23 straight years.

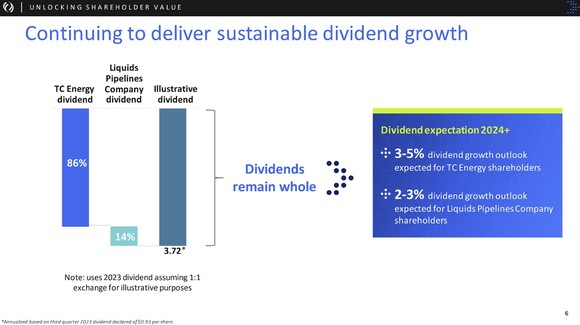

It anticipates that the separate entities will combine to continue paying the same total annualized dividend payment post-spin. That payout is currently 3.72 Canadian dollars ($2.81) per share (an 8.4% yield at the recent stock price):

Image source: TC Energy.

Each entity plans to continue increasing its payment following the spin. The post-spin TC Energy will grow its dividend by 3% to 5% annually. That's slower than expected earnings growth, allowing the company to retain more cash to fund capital projects while steadily de-levering its balance sheet. Meanwhile, the liquids pipeline business will aim to grow its dividend at a rate matching its expected earnings growth, or by 2% to 3% per year.

This dividend income should also grow safer over time. TC Energy anticipates its dividend payout ratio will steadily improve, averaging around 50% of its adjusted funds from operations through 2026. In addition, that entity's leverage ratio will fall as it completes growth projects. It expects leverage to decline from 5.4 last year to 4.75 by 2024. Post-dividend free cash and balance sheet capacity will provide CA$6 billion-CA$7 billion ($4.5 billion-$5.3 billion) of annual investment flexibility to support its continued expansion.

Given the transition from oil to lower carbon energy, the liquids pipeline company will have a higher dividend payout ratio because it will have fewer expansion opportunities to fund. However, it will also have a lower leverage ratio of 4.5 to 4.75. That will still provide it with about CA$350 million ($264 million) of annual funding flexibility that it can use to invest in additional growth projects, further strengthen its balance sheet, and repurchase shares.

The complications of a breakup

TC Energy believes spinning off its liquids pipeline business is the best option for shareholders. The move will create two independent companies that should grow a little faster. That should give them the fuel to continue paying growing dividends.

While the move makes sense on paper, the spin creates more complexity for investors since they'll need to hold two companies instead of one to get the entire benefit. That makes TC Energy a less attractive option for income-seeking investors when several rivals offer similar income and growth potential from a single entity.