If you've got a crisp Benjamin, I have two growth stocks for you today. For $100, you could buy one share of home-improvement retailer Floor & Decor (FND -1.16%) and have some money left over. Or you could use all the money and buy two shares of sports retailer Academy Sports and Outdoors (ASO -1.83%).

But don't take my advice when it comes to buying these two growth stocks. The advice of billionaire investor Charlie Munger is far more valuable. And I believe he'd approve of either purchase, as I'll explain.

1. Floor & Decor

In a recent interview, Munger said that Floor & Decor stole its business model from one of his all-time favorite businesses: Costco Wholesale. Considering Costco runs a membership-based retail chain focused on groceries, Floor & Decor's home-improvement business couldn't look more different on the surface. But there's an important similarity that Munger's pointing out.

The playbook is the same for Costco and Floor & Decor: Open a limited number of large, warehouse-style stores that can support impressive sales volume and deliver robust profitability.

For the record, Floor & Decor doesn't aspire to be as big as The Home Depot. The Home Depot has over 2,300 locations, whereas Floor & Decor only plans to reach 500 locations long term. This is because Floor & Decor's products are more niche and simply won't have as many places that can support the sales volume it's seeking.

Today, Floor & Decor has just 207 locations, but it plans to reach its goal within the next eight years or so -- that's plenty of growth to put this in the growth-stock category. And, to be clear, the company's stores are massive at 79,000 square feet on average. This is the warehouse-style concept Munger says is apt for strong profitability.

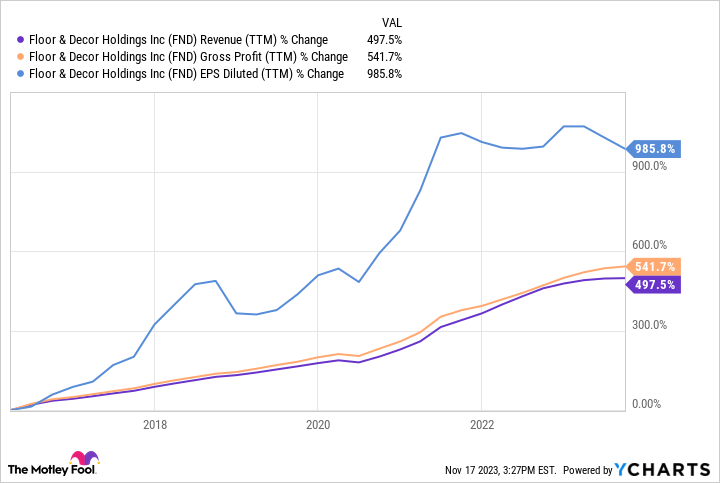

Since going public, Floor & Decor has grown revenue at an amazing rate by opening new stores and is experiencing same-store sales growth. But as the chart below shows, its gross profit and earnings per share (EPS) have grown even faster.

FND Revenue (TTM) data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

I believe this trend toward better profitability with scale will continue for Floor & Decor as it marches toward its goal of 500 locations.

2. Academy Sports

While not specifically called out by Munger, Academy Sports is another business implementing the warehouse playbook and, consequently, experiencing strong financial results that deserve investors' attention.

In its investor presentation, Academy Sports incidentally recognized Floor & Decor's high annual sales volume of around $22 million per location -- it, like Munger, recognizes how important this is. Of course, Academy Sports wasn't really pointing out Floor & Decor's excellence but noting that its sales volume is even better at $24 million per location annually.

Academy Sports is following the large retail space model, with stores averaging about 70,000 square feet. This is much bigger than top rival Dick's Sporting Goods, where stores average closer to 50,000 square feet. That said, Dick's has over 850 locations, whereas Academy Sports has only 270 as of the end of the second quarter of 2023.

Academy Sports is smaller than Dick's and will stay that way -- there are simply a limited number of markets that can support the high sales volume it's looking for. That said, the company is planning to grow nonetheless.

Through 2027, Academy Sports plans to open at least 120 new stores. And management hopes these new stores will perform comparably with its existing store base, boosting its top line past $10 billion annually.

High sales volume helps businesses gain operating leverage, and that's what Academy Sports is enjoying right now. Its track record as a public company is shorter than Floor & Decor's, but the chart below shows similarities to the Floor & Decor chart above.

ASO Revenue (TTM) data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

Academy Sports hopes to earn $1 billion in annual profits by 2027. If it can accomplish this, the stock is one heckuva bargain today, considering its market capitalization is just $3.7 billion as of this writing.

A fair word of warning with both stocks

Floor & Decor and Academy Sports share the business model that investor Charlie Munger loves. I like both stocks today and believe they will experience market-beating upside over the long term.

That said, the shorter term is a bit cloudier. It can be argued that both retail concepts fall under the discretionary category -- consumers don't need sports gear, and flooring projects can be postponed in a pinch.

With the economy already slowing, sales are down for both Floor & Decor and Academy Sports. And the drop in sales does hurt margins. Therefore, the economy could slow more, and sales could slump further, leading to worsening profitability. I'd expect both stocks to be laggards as long as this was true.

But to reiterate, I'm talking about the near term. Economies ebb and flow -- that's life. But long term, Floor & Decor and Academy Sports have the makings of market-beating investments, and that's why I highlight them now regardless of near-term economic uncertainty.