The stock of SoFi Technologies (SOFI -2.28%) has been crushed this year after doubling last year. It's down 20% year to date despite what seems like pretty solid performance.

However, the tide might turn, and soon. Let's see why SoFi stock could soar over the next five years.

Expanded business, lower interest rates

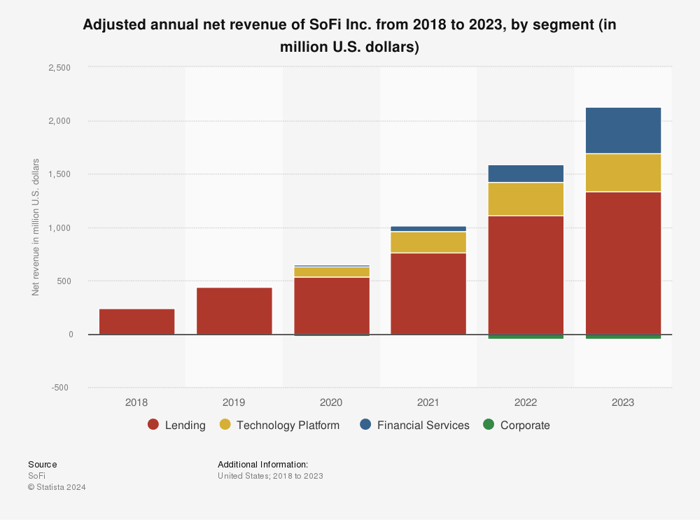

SoFi's main business is lending, but it has expanded into a large array of financial services like bank accounts and investments. Offering other services provides several benefits for SoFi.

It gives it new revenue sources, it creates greater cross-platform engagement among current members, it can attract new members, and -- what stands out now -- is that it shields the business from the changing effects of interest rates.

Lending can be a lucrative business, but it's highly sensitive to interest rates, and SoFi's lending segment has been under pressure as rates remain high.

Now that interest rates look like they're going to start coming down, the pressure should begin to ease. Meanwhile, the other segments are still in growth mode, and they continue to account for a higher percentage of the company's overall business.

Image source: Statista.

The lending segment continues to grow, but the non-lending segments are growing much faster. They accounted for 45% of the business in the 2024 second quarter, up from 38% a year ago. As the other segments outpace lending growth, SoFi will become a more stable business, with lower exposure to interest rate movement.

If the lending segment picks up with lower rates, which is how the segment works, investors' current concerns about the business will fall away. When you combine that with the strength in the company's expansion model, SoFi stock could explode over the next five years, and now could be a great time to buy in.