Furious investments in data centers are spurred by our growing need for data storage and processing power and the tremendous requirements of artificial intelligence (AI) programs. While some data centers are relatively small, others are larger than 100,000 square feet (often millions of square feet). Tech titans like Microsoft, Amazon, Alphabet, and Meta typically construct these hyperscale data centers.

For instance, in 2025, Meta will break ground on an $800 million, 715,000-square-foot campus in South Carolina, and Microsoft will begin a $1 billion project in La Porte, Indiana.

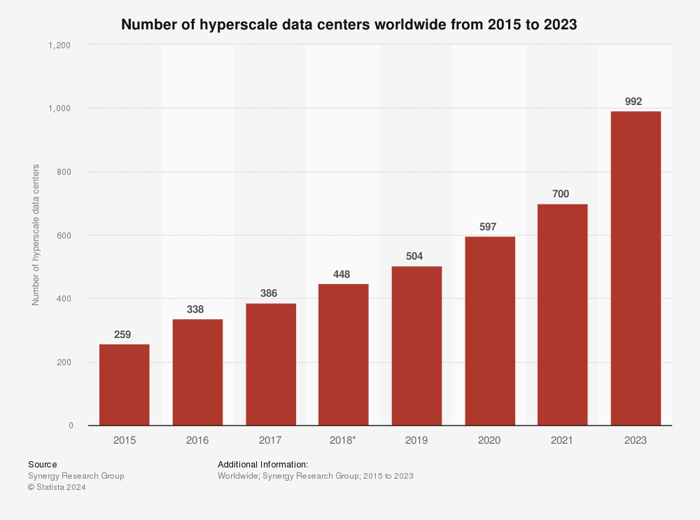

As shown below, Hyperscale centers have spiked recently.

Statista.

This number eclipsed 1,000 in 2024 and is forecast to grow by 120 to 130 annually. These centers require infrastructure like servers, storage, and racking, so investors should be excited about the opportunity.

Dell Technologies (DELL -1.64%) is a major supplier to the industry, along with Super Micro Computer. Supermicro has some well-documented challenges now, and Dell could be a key beneficiary. Here are some things to know.

Supermicro's challenges could be a boon for Dell

Supermicro's setbacks are well documented, so I won't dwell too much on them. Here is a brief timeline:

- August: Hindenburg Research released a scathing short report, and Supermicro delayed its annual 10-K filing.

- September: Nasdaq notified the company that it could be delisted for its delayed filing.

- October: Supermicro's audit firm, Ernst & Young, resigned.

- November: The company delayed its quarterly 10-Q filing.

As of this writing, the stock trades 84% off its 2024 high.

None of these are smoking guns alone; however, these are serious concerns.

It makes sense for a data center operator to avoid the noise and choose Dell for its infrastructure needs over Supermicro, which reported $5.3 billion in sales in the fiscal 2024 fourth quarter ($15 billion for the fiscal year), with 64% attributed to large data centers. Dell's Infrastructure Solutions Group earned $11.6 billion in its most recent quarter, so potentially picking up billions of dollars in revenue from a competitor would be an enormous boon.

Is Dell stock a buy now?

Dell's recent results are solid, but it's what analysts estimate for the next several years that is most exciting. Revenue grew 9% in the second quarter of fiscal 2025 to $25 billion, while diluted earnings per share (EPS) rose 86% to $1.17. As expected, the Infrastructure Solutions Group, which serves data centers, hit record sales of $11.6 billion on impressive 38% year-over-year growth.

Analysts expect $7.87 in EPS this fiscal year and then even more:

DELL annual EPS estimates; data by YCharts.

This is why 20 of 25 analysts rate the stock a buy or strong buy with an average target of $145 per share, or 10% above the stock's price at the time of this writing. However, analyst estimates may not yet account for the potential of Dell to take market share from Supermicro. This gives the stock more room to run.

Dell is also attractive because it pays dividends and repurchases stock. The company intends to return 80% of adjusted free cash flow to shareholders and grow the dividend, which currently yields 1.3%, by 10% annually. Adjusted free cash flow hit $5.6 billion in fiscal 2024 and $3.7 billion through two quarters of fiscal 2025. Free cash flow should grow significantly along with earnings.

Data center infrastructure needs are exploding, and Dell looks like the company in the best position to benefit over the next several years. Tech investors should consider a long-term position in the stock.