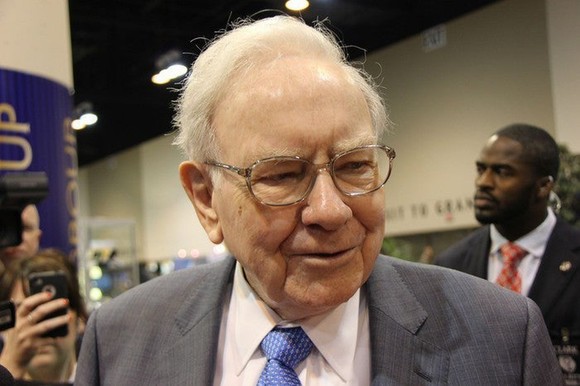

Looking to put money to work in the new year? You may want to peruse Warren Buffett's portfolio for ideas. After all, Buffett and his investing colleagues Todd Combs and Ted Wechsler at Berkshire Hathaway (BRK.A +0.79%) (BRK.B +0.54%) only seek out competitively advantaged, cash-producing companies that trade at reasonable valuations.

That is not to say Buffett doesn't make mistakes; he does. However, scanning through the nearly 50 holdings in the Berkshire portfolio may be a good place to start. Out of the list, the following three look like the promising picks heading into 2025.

NASDAQ: AMZN

Key Data Points

Amazon

There aren't many artificial intelligence stocks or even big tech stocks in the Buffett portfolio. But Amazon (AMZN +0.27%) is, albeit in a relatively small 0.7% allocation. Berkshire bought Amazon in the first quarter of 2019, a good time in general to buy tech stocks, and it's had a great run, nearly tripling since then. But that doesn't mean Amazon's stock isn't still a good purchase.

In 2024, Amazon was able to tamp down two big fears; one over the profitability of its e-commerce operations, and the other over whether Amazon was behind in the generative artificial intelligence race.

On its recent earnings reports, Amazon showed progress on both fronts. Over the past year, Amazon expanded its North American e-commerce operating margins from 3.9% to 5.9%, while its international e-commerce business showed an even bigger profit inflection from a (3%) operating loss to a 3.6% positive operating margin.

Meanwhile, the all-important Amazon Web Services segment is back, accelerating its growth to 19% last quarter from a mere 12% five quarters ago, all while the segment's operating margin has ballooned from 24.2% to 38.1% over that time.

It seems Amazon is clearly getting its share of artificial intelligence workloads. This may have been spurred by Anthropic, the AI start-up run by the former head of research at OpenAI. After first investing $1.25 billion in Anthropic in September 2023, Amazon greatly increased its investment in the start-up with another $2.75 billion in March 2024 and then another $4 billion in November.

Amazon got confidence in Anthropic after seeing the adoption of its Claude models on its Amazon Bedrock platform in AWS. Not only will Amazon participate in the upside of Anthropic with its investment, but Anthropic also agreed to use Amazon's Trainium chips to train its models going forward, instead of the more expensive chips from Nvidia.

That will save a huge amount for Anthropic while also boosting revenue for Amazon, in what looks like a win-win that positions Amazon and Anthropic as a serious combined AI challenger.

Chubb

Insurance leader Chubb Limited (CB +0.48%) is the premier brand in the property and casualty insurance sector worldwide. Thanks to its reputation for paying claims quickly and fairly, Chubb is able to charge somewhat higher premiums and make somewhat higher margins than a typical insurance company. That brand reputation is a competitive advantage, and no doubt why Buffett was attracted to the name.

It's also a good time to be an insurer. While several years of inflation and highly damaging natural disasters may seem like a headwind, these events have decreased competition and allowed most big P&C insurers to raise prices to maintain profitability. Even in a heightened catastrophe environment in the third quarter, Chubb posted a stellar P&C combined ratio of 87.7% and return on tangible equity of 21.7%. Being able to maintain margins at higher prices has led to substantial earnings growth for many insurers.

Image source: The Motley Fool.

Not only that, but the higher inflation and interest rate environment of the past few years is actually good for insurers, who reinvest their "float" into fixed income portfolios. As the pre-pandemic maturities of its bond portfolio roll off, Chubb is now able to reinvest at higher rates, leading to adjusted interest income that grew another 16% last quarter.

So for those who anticipate inflation and higher interest rates continuing to be a risk, Chubb's stock is a great way to mitigate that, as its business can actually withstand and ultimately benefit from those trends.

Sirius XM

Another recent buy for Berkshire was an addition to its Sirius XM Holdings (SIRI +1.44%) stake. Berkshire has been invested in Sirius' Liberty Media tracking stock since 2016, but increased its stake in Sirius after its simplification merger with the tracking stock this past September.

Sirius fell a whopping 58% 2024, and Berkshire kept buying on the way down, perhaps anticipating a turnaround.

Sirius still operates a legal monopoly in satellite-based radio, but revenue topped out and began to decline over the past two years as new vehicle purchases slowed amid high interest rates. New vehicle purchases correlate with Sirius' growth, as Sirius comes pre-installed in many car models, which is a unique and efficient customer acquisition tool. The rise of internet streaming apps is also a concern, as was a cautious consumer generally.

But Sirius' vehicle pre-installation advantage isn't going away, and its exclusive content and premium vehicle experience make Sirius differentiated.

This summer, Sirius took a big step to counter the threat of internet-based apps by introducing a new free ad-supported tier. The new ad-supported tier could be a big deal in attracting new audiences. And on its own cost side, Sirius recently announced a plan to cut expenses and focus its business on the core vehicle market in the year ahead.

Trading at just over 7 times earnings, Sirius could be in for appreciation if management is merely able to stabilize revenue and earnings. And if the company can regrow subs due to a recovery in the auto market or with the new ad-supported tier, the upside could be substantial.

All in all, SiriusXM is a cheap stock navigating some recent headwinds, but could appreciate substantially if any of those headwinds ease.