Shares in GE Aerospace (GE 0.34%) rose by more than 63% in 2024 after adjusting for the spinoff of GE Vernova in April, according to data provided by S&P Global Market Intelligence. The move comes as the commercial aerospace industry and GE, in particular, helped dispel fears of a slowdown in original equipment (OE) sales due to both Boeing and Airbus falling short of airplane production expectations and ongoing supply chain and parts availability issues at suppliers like GE.

GE Aerospace in 2024

In the end, OE production and sales were pressured. Still, the strength in the commercial aftermarket more than made up for the shortfall, as flight departures continued to grow and orders for engine equipment and services outpaced expectations. The following data points show these dynamics.

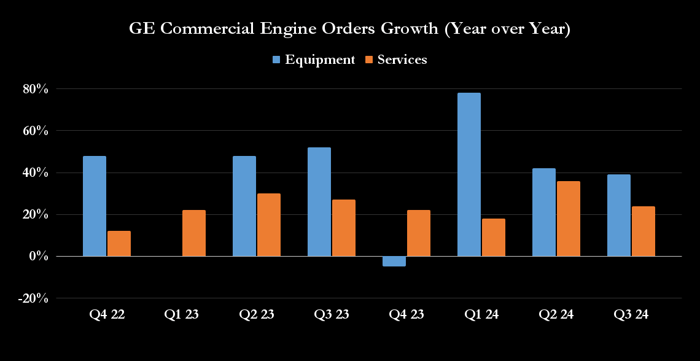

First, here's a look at GE's exceptional growth in commercial engine orders throughout the year. They held up well, even though GE had issues delivering engines last year. I'll return to this point in a moment.

Data source: GE Aerospace presentations. Chart by author.

The strength in service orders (which tend to have higher margins than OE) and better-than-expected margin performance led management to hike its earnings guidance progressively throughout the year. GE's management started the year by guiding toward $6.25 billion (at the midpoint of guidance) in operating profit, only to end it with an expectation of $6.8 billion.

|

Segment Profit |

January Guidance |

April Guidance |

July Guidance |

October Guidance |

|---|---|---|---|---|

|

Commercial Engines & Services (CES) |

$6 billion to $6.3 billion |

$6.1 billion to $6.4 billion |

$6.3 billion to $6.5 billion |

6.6 billion to $6.8 billion |

|

Defense & Propulsion Technologies (DPT) |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

|

Total GE Aerospace operating profit |

$6 billion to $6.5 billion |

$6.2 billion to $6.6 billion |

$6.5 billion to $6.8 billion |

$6.7 billion to $6.9 billion |

Data source: GE presentations.

What about GE in 2025?

As noted earlier, it wasn't smooth sailing in 2024. GE's joint venture, CFM International, produces the LEAP engine for the Boeing 737 MAX and the Airbus A320 neo. LEAP engine deliveries fell significantly short of initial expectations in 2024. While that's probably a positive for profitability (new engines sell at a loss), GE prefers growing its installed base of engines to support future service growth.

|

GE Aerospace Full Year Guidance |

January Guidance |

April Guidance |

July Guidance |

October Guidance |

|---|---|---|---|---|

|

LEAP Deliveries Growth |

20%-25% |

10%-15% |

0-5% |

Down 10% |

Data source: GE Aerospace presentations.

GE Aerospace in 2025

The company is in great shape with services in 2025. Still, margins could be pressured as it needs to ramp up LEAP deliveries. In addition, management's guidance toward the lower end of the defense segment profit guidance range on the last earnings call suggests some margin pressure. The company's guidance for 2025 could be mixed -- something to look out for.