For the last two years, technology stocks have generated some pretty generous returns. Since ChatGPT was commercially released on Nov. 30, 2022, the Nasdaq Composite (^IXIC -1.63%) and S&P 500 (^GSPC -1.54%) have boasted total returns of 70% and 47%, respectively.

Among some of the technology sector's biggest gainers are semiconductor stocks. Semiconductors play a critical role in the development of generative AI -- from running complex algorithms on graphics processing units (GPU), training and inferencing models, and providing memory and storage for data workloads. Given this array of features, you might be wondering which area in the chip realm is the best to invest.

In my opinion, Taiwan Semiconductor Manufacturing (TSM 0.60%) is the best-positioned name in semiconductors over the next decade. Below, I'll detail what makes Taiwan Semi such a compelling long-term opportunity and assess if shares are worth a buy right now.

Why Taiwan Semiconductor is unique

As I alluded to above, there are many different pockets of the chip realm. Companies such as Nvidia and Advanced Micro Devices focus on designing GPUs whereas Broadcom plays an integral role in providing networking equipment for data centers. Moreover, Micron's chips specialize in data and storage management for data workloads. Indeed, there are legitimate arguments to be made for investing in any of these companies.

However, none of the businesses outlined above is immune to the cyclicality of the semiconductor industry nor the rising competitive landscape among various aspects of the chip landscape.

While Taiwan Semiconductor may not be completely immune from these factors either, I see the company as far more insulated and less vulnerable. The reason is because Taiwan Semiconductor's fabless manufacturing processes play an important role for a variety of chip applications and AI systems.

According to the company's filings, TSMC makes products for Nvidia, AMD, Broadcom, Amazon, Qualcomm, Sony, and many more. Furthermore, considering Taiwan Semi has acquired an estimated 90% share of chip production, I think this underscores how influential the company is for the world's largest semiconductor players.

Image Source: Getty Images

Investment in AI infrastructure is a long-term tailwind

This year, Nvidia is launching its long-awaited Blackwell GPU infrastructure. Industry analysts are reporting that Blackwell is already sold out for the next year; meanwhile, Nvidia is already heads down on a successor GPU called Rubin, which could launch sometime in 2026. In addition, AMD is scheduled to launch two new GPUs called MI325X and MI400 between 2025 and 2026.

To me, Nvidia and AMD represent TSMC's two most obvious near-term tailwinds. However, there are some other subtle clues that indicate why TSMC is positioned well for the long haul.

Hyperscalers such as Microsoft, Amazon, Alphabet, Oracle, and Meta Platforms have all indicated that rising spend in AI infrastructure is going to be a theme over the next several years. I see these investments in capital expenditures (capex) as a major catalyst for TSMC as more AI data centers and GPU architectures begin to enter the market.

Is Taiwan Semiconductor stock a buy right now?

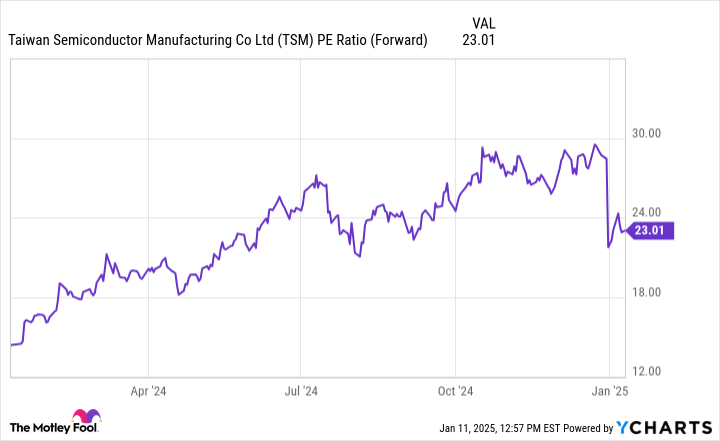

Over the last 12 months, shares of Taiwan Semi have gained 107%. And yet despite this market-beating performance, the company trades at a modest forward price to earnings (P/E) multiple of just 23. To put this into perspective, this is identical to the average forward P/E of the S&P 500.

TSM PE Ratio (Forward) data by YCharts

While TSMC has witnessed a high degree of valuation expansion over the last year, the company's earnings are accelerating at a faster rate than the share price. Given how important TSMC is going to be as AI infrastructure spend continues to rise over the next several years, I think the company's earnings power is positioned to compound in a material way.

To me, Taiwan Semi is a stock to buy hand over fist and one to hold onto for years to come as the AI story continues to unfold.