Rewind to about 15 years ago, and China was the holy grail for automakers. Its market was beginning to boom, and foreign automakers paired up with joint ventures to begin selling vehicles in hopes the region would become another profit machine.

In fact, looking at how dire things are today (more on this in a second), it's hard to believe General Motors (GM 0.26%) sold more vehicles in China than it did the U.S. from 2010 until 2023. But after a nearly decade-long slide in profits and market share, and blossoming domestic brands, China is now a big problem for investors. However, some recent data gave a silver lining.

What happened?

To make a fairly well-known story short, the Chinese government heavily subsidized the electric vehicle (EV) industry. The strategy worked, and maybe worked too well. Now there's an entire domestic market of advanced and highly affordable Chinese EVs that have flooded the industry and created a brutal price war.

The price war has clobbered some domestic financials, and it has also clobbered sales for foreign automakers as it has become increasingly difficult to compete against Chinese brands. As of July, new-energy vehicles, which essentially includes full EVs, plug-in hybrids, and hybrids, accounted for more than 50% of China's automotive market.

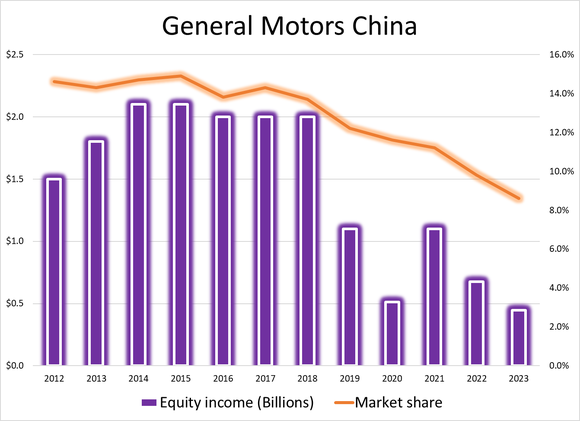

If you can't compete on prices with EVs in China, you're in a world of hurt. And that doesn't even account for the stumbling Chinese economy or trade tensions with the U.S. You can see in the graph below how dramatic the decline in China has been for General Motors.

Data source: GM presentations and filings. Image source: author.

China's price war is so vicious that some analysts are calling for a Detroit exit. According to Reuters, John Murphy, Bank of America Securities analyst, said, "I think you have to see the [Big Three] exit China as soon as they possibly can." Murphy made that statement at his annual presentation of Car Wars, a highly publicized industry report.

The silver lining

General Motors has lost money in China each of the past three quarters, and barring a shocker of a fourth quarter, it will lose money for the full year. There is a silver lining in recent sales data, though, and it shows GM's fortunes might be turning slightly in the region.

The automaker and its joint ventures witnessed a boost in momentum during the fourth quarter, with sales up over 40%, compared to the prior year. That was an improvement from the third quarter, which posted a 14.3% sequential sales gain. It's evident that things slowly improved during the back half of 2024, although GM still posted a full-year sales decline of 14% in China.

It isn't going to exit China without a fight. The automaker announced it would record two noncash charges totaling more than $5 billion on its joint venture there. For investors, that essentially means the restructuring costs will affect net income but not adjusted earnings before interest and taxes.

There was a silver lining as GM's sales rebounded in China during the fourth quarter. But make no mistake: This is a huge problem for automakers and their profits. Investors should keep a close eye on fourth-quarter results in China, and throughout 2025.