When the curtain closed on 2024, investors were all smiles. The mature stock-driven Dow Jones Industrial Average, benchmark S&P 500, and growth-fueled Nasdaq Composite ended last year higher by 13%, 23%, and 29%, respectively.

A number of catalysts powered year two of Wall Street's bull market rally, such as Donald Trump's November victory (stocks soared during his first term in the White House) and excitement surrounding stock splits. But at the top of the list is the euphoria associated with the rise of artificial intelligence (AI).

Image source: Getty Images.

Empowering software and systems with AI so they can become more proficient at their tasks and potentially learn new skills gives this technology a stratospheric ceiling. In Sizing the Prize, the analysts at PwC forecast a $15.7 trillion boost to global gross domestic product from AI by 2030.

No company has been a more direct beneficiary of the AI revolution than semiconductor giant Nvidia (NVDA -7.03%). Since 2023 began, Nvidia stock has added roughly $3 trillion in market value, with shares up a cool 830%, as of Jan. 10.

But is this breakneck climb for Nvidia too good to be true? Let's allow history to be the ultimate judge of whether or not Nvidia stock can fall below $100 per share in 2025.

Nvidia's operating expansion has been textbook

Before digging into the details of what's to come, it's important to understand the dynamics of how we got here. Nvidia's ascension to briefly becoming America's largest publicly traded company is all about its leading role as the "brains" of high-compute data centers.

Based on a study conducted by semiconductor analysis firm TechInsights, data-center graphics processing unit (GPU) shipments in 2022 and 2023 respectively totaled 2.67 million units and 3.85 million units. Nvidia's GPUs were responsible for all but 30,000 GPUs shipped in 2022 and 90,000 GPUs shipped in 2023. Businesses simply can't get enough of its Hopper (H100) chip and next-generation Blackwell GPU architecture.

NASDAQ: NVDA

Key Data Points

Insatiable demand for the company's hardware has led to tangible benefits. With demand swamping supply, Nvidia has been charging between $30,000 and $40,000 for its ultra-popular Hopper GPU. For context, this is well above the $10,000 to $15,000 price point Advanced Micro Devices (AMD -8.57%) was netting for its Instinct MI300X GPU. A higher price point translates to a notable uptick in Nvidia's gross margin.

Furthermore, the company's CUDA software platform has played a key role in keeping customers loyal to its ecosystem of products and services. CUDA is the toolkit developers rely on to maximize the computing potential of their Nvidia GPUs and to build large language models.

Lastly, Nvidia has benefited from being the preferred AI-GPU supplier of America's most-influential businesses. It's top customers by net sales include many members of the "Magnificent Seven," such as Microsoft, Meta Platforms, Amazon, and Alphabet.

Image source: Getty Images.

History weighs in on Nvidia's parabolic move higher

Now that you have a better idea of where Nvidia has been and how we got to this point where it's trading at nearly $136 per share, let's lean on history as a guide.

Regardless of how promising the next game-changing technology, innovation, or trend has been over the last couple of decades, there has always been competition waiting in the wings for its chance at a piece of the proverbial pie.

For the time being, Nvidia is the undisputed provider of GPUs in AI-accelerated data centers. However, its monopoly like market share is virtually certain to ebb as new competition enters the arena. AMD, for example, is ramping up output of the MI300X and newly introduced MI325X, which are notably cheaper than Nvidia's chips and likely more accessible. Businesses that aren't interested in waiting for Nvidia's backlog to clear may consider less-costly alternatives like AMD.

Additionally, Nvidia's top customers by net sales are all developing AI chips to use in their data centers. Although the chips Microsoft, Meta, Amazon, and Alphabet are internally developing won't match the computing speed of Nvidia's Hopper and Blackwell GPUs, they'll be cheaper and more readily available. In other words, it begins minimizing the AI-GPU scarcity that's fueled the lion's share of Nvidia's pricing power and gross margin improvement.

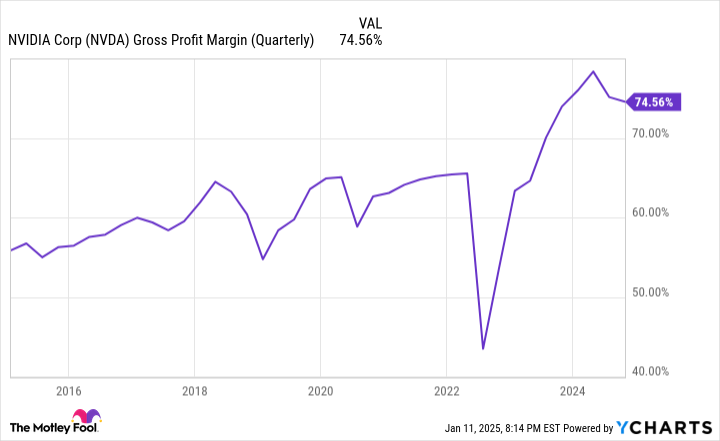

An end to AI-GPU scarcity would likely weigh on Nvidia's gross margin. NVDA Gross Profit Margin (Quarterly) data by YCharts.

On top of history telling us that competition is inevitable, a worrisome precedent has been set by market leaders of next-big-thing investment trends over the last three decades.

In the mid-1990s, the proliferation of the internet began offering new ways for businesses to connect with customers. However, it would be many years before most companies realized how best to monetize their online storefronts. Although the internet positively changed the growth trajectory for corporate America, this didn't occur until after the dot-com bubble burst.

Bubble-bursting events and next-big-thing investment trends have gone hand-in-hand, without exception, for decades. Though not a comprehensive list, we've witnessed bubbles burst for genome decoding, business-to-business e-commerce, nanotechnology, 3D printing, blockchain technology, and the metaverse.

The trait all of these high-dollar addressable trends have in common is investors overestimating the adoption and early stage utility of a technology or innovation. Every game-changing technology/innovation needs time to mature, and it doesn't appear artificial intelligence has hit this point as of yet. Most businesses still lack a clear game plan of how they're going to generate a positive return on their AI investments.

Based on what history tells us, market leaders of next-big-thing trends typically lose 80% or more of their value on a peak-to-trough basis when the bubble bursts. Thankfully for Nvidia, it has well-established operating segments -- e.g., GPUs used for gaming and cryptocurrency mining, as well as virtualization software -- that may be able to stunt its fall.

Nevertheless, history is quite clear that parabolic early stage moves higher for market leaders of next-big-thing trends aren't sustainable, which makes a move below $100 in 2025 for Nvidia stock a very real possibility.