Palantir Technologies (PLTR -1.76%) has been one of the hottest artificial intelligence (AI) stocks on Wall Street, but it has become a bit overheated. This has caused the stock to sell off 30% from its all-time highs. However, there could be more pain to come, and some other companies could easily surpass Palantir in terms of market cap by the end of the year.

Two AI stocks that could achieve that are Advanced Micro Devices (AMD -7.28%) and Adobe (ADBE -1.43%). Both have much better financials than Palantir, yet they trade at a discount to this incredibly popular AI pick.

All three companies are exposed to the AI arms race

Palantir became a popular investment because of its exposure to both commercial and government clients. Palantir's AI-powered data analytics software has been in this industry for a long time and the company signed several critical contracts with governments around the world as well as commercial clients. Palantir represents a practical way to invest in AI, as it's making a sustainable income from the AI buildout right now.

NASDAQ: PLTR

Key Data Points

AMD is a key supplier in the AI arms race, as it provides multiple components for data centers, including graphics processing units (GPUs), the computing muscle behind many of these AI models. However, AMD is playing second fiddle to Nvidia, which has an iron grip on the data center GPU market. Still, AMD has a strong business that is growing quickly and is a great alternative to Nvidia hardware.

Lastly, Adobe's graphics design product suite is the industry standard in its field. While there was a potential for Adobe's business to be overrun by free AI image generation models, Adobe quickly pivoted by offering its own version of this software: Firefly. While there still are concerns about disruption, Adobe continues to post quarters of strong growth.

NASDAQ: ADBE

Key Data Points

While investors jumped into Palantir stock with enthusiasm, they are more reserved about AMD and Adobe stock, despite the latter companies continuing to deliver solid growth every quarter.

Whether Palantir's stock sells off further or Adobe and AMD achieve respectable valuations, I think it's incredibly likely that both of these companies will be worth more than Palantir before 2025 is over.

Palantir's premium valuation doesn't make a lot of sense

Right now, Palantir's market cap is hovering around $200 billion. AMD and Adobe are less than that, with AMD at $172 billion and Adobe at $169 billion. However, when you look at the revenue and profit picture for these three, it's hard to understand why Palantir is worth more.

PLTR Revenue (TTM) data by YCharts

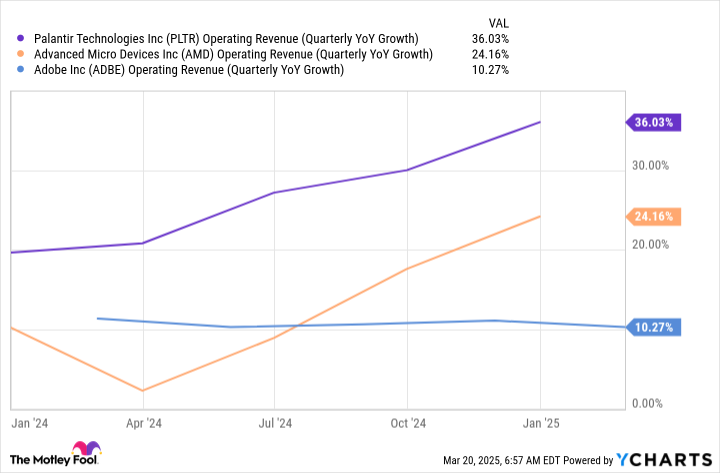

AMD and Adobe produce significantly more profits than Palantir, but there is another factor as well: growth rate. Growth is certainly part of the equation, and Palantir has both of these two beat by a decent margin.

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts

Still, Palantir would have to grow for an incredibly long time just to match Adobe's profit levels. If Palantir grew its revenue at a 40% pace over the next six years and achieved a 30% profit margin (similar to Adobe's), it would generate $21.6 billion in revenue and $6.5 billion in profits. That means Palantir would need to grow for over six years just to reach the level that Adobe is at now, yet it is already valued higher.

That is a gross mismatch, and it doesn't make sense for Adobe to be valued less than Palantir.

The same could be said for AMD, but AMD is also growing fairly quickly and is expected to grow at around the same pace as Palantir over the next few years.

| Company | 2025 Projected Revenue Growth | 2026 Projected Revenue Growth |

|---|---|---|

| Palantir | 32% | 27% |

| AMD | 23% | 21% |

Data source: Yahoo! Finance.

While Palantir still has an edge over AMD, AMD has a much higher revenue and profit base, which once again warrants the question: Why is Palantir worth more than AMD?

I think the market will come to its senses in 2025 and likely sell off Palantir stock even further, as it has obtained an incredibly high valuation for its performance. While AMD and Adobe have some questions surrounding their market leadership, they still have rock-solid fundamentals and plenty of growth to warrant having a higher valuation than Palantir.