Apple (AAPL 3.95%) is the world's largest company -- by about half a trillion dollars as I write this. So surpassing it in value is not a thing just any company can do. But I'm willing to make the bold prediction that there are stocks that could be bigger than Apple by 2030. In fact, considering the current state of Apple's business and the growth trajectories of some of its competitors, I think it's highly likely that Apple will lose its title of the world's largest company within the next few years.

There are four companies that could pass Apple in that time frame.

What's wrong with Apple?

The four stocks that I think could surpass Apple in terms of market cap by 2030 are Microsoft (MSFT 1.68%), Nvidia (NVDA 2.91%), Amazon (AMZN 2.01%), and Alphabet (GOOG 2.56%) (GOOGL 2.79%). None of these picks should surprise investors, as they are the world's second- through fifth-largest companies.

If each company maintains its current trajectory, and Apple revenue fails to take off, they should pass Apple in the coming years. Apple's revenue has barely budged since it peaked in 2022 following the COVID-era boom.

AAPL Revenue (TTM) data by YCharts.

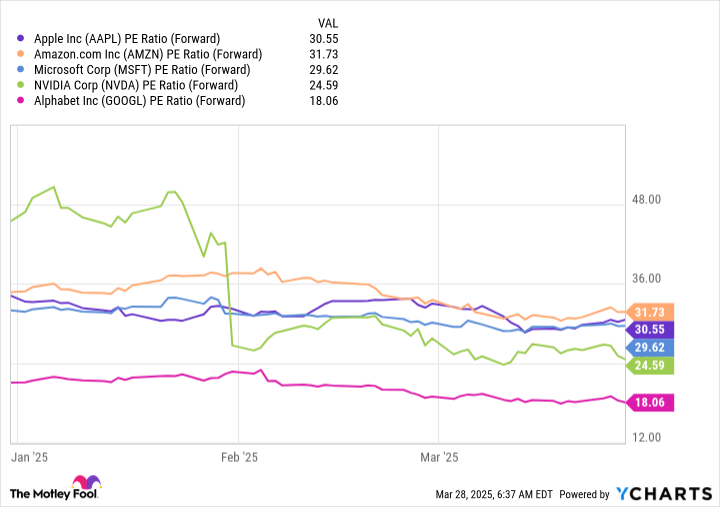

A direct line can be drawn between Apple's non-existent growth the fact that it hasn't launched a game-changing product in some time. Additionally, it is well behind competitors in rolling out artificial intelligence (AI) features. Apple Intelligence has underwhelmed many users and still hasn't been fully released. It's becoming clear that Apple is trading on past performance and brand value. That's a shaky path to be on, but I have no idea when or if the market will come to its senses, as Apple trades at the higher end of the valuations of its cohort using the forward price-to-earnings ratio, which is based on earnings estimates.

AAPL PE Ratio (Forward) data by YCharts.

Apple is the second-most expensive, following Amazon, and Microsoft is nearly the same price using this metric. But when we look at revenue growth rates, it's clear that Apple doesn't belong in this same conversation.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts

I didn't put Nvidia in the above chart because its growth rates in this time frame were above 100%, which would mess up the scale. Pundits might point out that because Apple is a mature company, investors should be focused on its earnings per share (EPS) growth, not revenue. I think that's a fair argument, but Apple falls well short of the competition by that metric too.

AAPL Normalized Basic EPS (Quarterly YoY Growth) data by YCharts.

This time, I removed Amazon and Nvidia from my chart because each grew their EPS around 80% this past quarter, which would make the chart hard to read. Apple is similar to Microsoft in this aspect, but it still isn't at the same level and even had a quarter of EPS shrinkage.

No matter how you look at it, Apple isn't a growth company anymore. With its expensive valuation, it's also not a value company. This just makes Apple an expensive stock, opening the door for these other four to surpass its market cap.

The competition has much more compelling growth prospects

So, what would it take for each company to surpass Apple by 2030? First, let's assume that Apple doesn't launch any innovative or game-changing products. While it has a history of bringing such products to market, it hasn't had a new one in some time, and its lackluster AI efforts suggest that it may have lost its edge.

Alphabet is by far the cheapest, and it could close the gap with Apple simply by trading at the same premium. If Alphabet had the same forward P/E ratio as Apple, it would be valued at $3.36 trillion, the same market cap as Apple. While I don't know if that will happen over the next six years, a combination of Alphabet growing faster than Apple and each company's valuations reverting to a more reasonable level should close the gap.

NASDAQ: GOOGL

Key Data Points

Nvidia's growth should easily propel it past Apple quickly. Wall Street thinks the chipmaker's revenue will rise by 57% in its fiscal 2026, and it could increase even more beyond that. CEO Jensen Huang sees a path to data center infrastructure spending reaching $1 trillion by 2028. With Nvidia likely to receive a large chunk of that money, it could easily blow past Apple.

Amazon should surpass Apple because of its earnings growth. The secret to Amazon's success is its cloud computing division, Amazon Web Services (AWS), which accounted for over half of the company's operating profits in 2024. With this division growing at nearly 20% in Q4 and benefiting from general AI spending, Amazon's profits will grow far faster than its overall revenue, pushing the stock much higher over the next few years.

NASDAQ: AMZN

Key Data Points

Last is Microsoft, which probably will have the hardest road to surpass Apple. It trades for nearly the same valuation and it's growing its EPS around the same pace. However, with its various AI investments plus a stronger revenue growth rate, I think it has what it takes to pass Apple over the next few years, as Apple only has a 16% market cap lead on Microsoft, even though Microsoft's growth rates are a few percentage points higher.

Apple is in a position that's ripe for disruption, and I wouldn't be surprised to see all four of these companies' market caps pass Apple's by 2030.