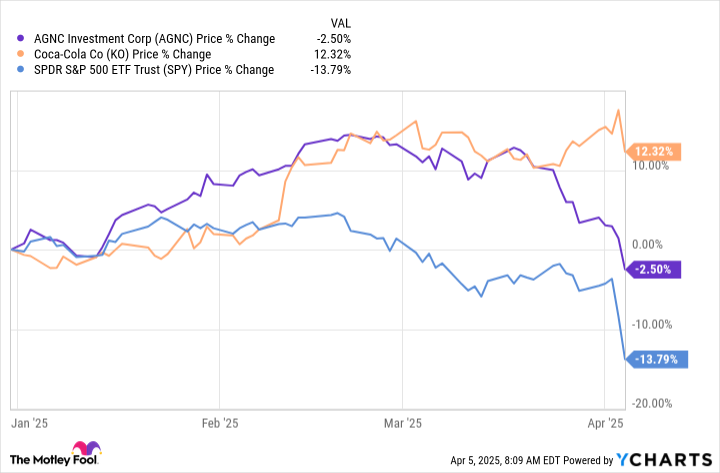

Wall Street is in an uncertain state right now, thanks to what looks like the start of a tariff-driven trade war of global proportions. Some investors are, quite reasonably, frightened and looking for a safe harbor, like Coca-Cola (KO 0.82%). That's why the stock has risen while the market has swooned.

Other investors are likely to see the market declines as an opportunity to get aggressive and buy, perhaps picking up an ultra-high-yield stock like AGNC Investment (AGNC 2.83%). This stock now has a massive 16% dividend yield. It's better to cut the middle and go with a different type of investment.

The cost of taking on too much risk and reaching for safety

AGNC Investment's gargantuan yield could be a siren call to dividend investors who think they are picking up a stock that will provide them with reliable income for the rest of their lives. Given that the yield alone is 60% higher than the 10% return most investors expect from the stock market, it seems like a no-brainer choice to sit back and collect a huge monthly dividend check during a market panic.

Image source: Getty Images.

The problem is that AGNC Investment's dividend is anything but reliable. It rose sharply after the mortgage real estate investment trust's (REIT's) IPO but has been in a long downtrend since that point. If you had used that dividend to pay for living expenses, you would have been left with less income, and since the stock price tracked the dividend lower, less capital. Taking on extra dividend risk with AGNC Investment today is probably a mistake.

But don't go too far to the other extreme, either. For example, Coca-Cola is a great company with an incredible dividend track record (it's a Dividend King). However, worried investors have chased the consumer staples giant's shares higher in the face of the market's turbulence this year. That pushed up Coca-Cola's valuation. The stock's price-to-sales, price-to-earnings, and price-to-book value ratios are all above their five-year averages. And the 2.9% yield is near its lowest levels of the past decade. Overpaying for a great stock can turn it into a bad investment.

This 6% yielding stock is down 33% from its 2022 highs

There's a middle ground on offer from high-yield net lease REIT W.P. Carey (WPC 1.92%). The company exited the office sector a couple of years ago and reset its dividend, a move that led to a notable decline in the shares. However, the dividend got right back onto the quarterly increase path that existed before the dividend reset. The office exit, while creating some short-term pain, should actually make W.P. Carey a better REIT over the long term.

It is now focused on the stronger warehouse, industrial, and retail property segments. It has a global footprint, with buildings in both the United States and Europe. In fact, W.P. Carey was among the first net lease players in Europe, and it also popularized the approach in the United States. The REIT is something of an industry pioneer, having long focused on providing investors with a reliable income stream backed by a diversified portfolio.

But what about that dividend reset? It was made after 24 consecutive annual dividend increases. Investors punished the stock by pushing it down by 33% since around the time the office exit was announced. Yet the office exit has really made W.P. Carey a better REIT. The fact that the dividend increase path resumed the quarter after the dividend reset is a clear sign that management is working from a position of strength.

NYSE: WPC

Key Data Points

The problem is that investors have taken a "show me" attitude. And now, with the market upheaval, this relatively low-risk turnaround stock's turnaround isn't being noticed. Buying it will allow you to collect a well-above-market yield backed by a financially strong REIT (its balance sheet is investment grade) that has a well-diversified portfolio. Meanwhile, the cash it raised from the office exit is being put to work growing the portfolio. If you think in decades and not days, high-yield W.P. Carey is the kind of investment you buy and hold forever.

Put money to work wisely in uncertain times

You can reach for yield with a stock like AGNC, which has a long history of dividend cuts. You can reach for safety with a stock like Coca-Cola, which is expensive today. Or you can find a happy middle ground with a high-yield stock like W.P. Carey. It has some warts, as do all investments, but the risk you are taking on here seems well covered by the reward of the high yield. Once Wall Street settles down, you might even get some price recovery thrown in for good measure as investors get more comfortable with the REIT's portfolio makeover.