It's been a tough year for stocks overall. But Altria Group (MO -0.71%) has bucked the trend, rising in value by nearly 10% even as broader market indexes dropped sharply in value.

Nervous about what's to come in 2025? There are five major reasons to believe Altria shares can be a safe harbor in nearly any storm.

Altria Group is a reliable stock in troubled markets

As a nicotine company, Altria's business model is well suited to handle volatility from both stock markets and the overall economy. Despite falling combustible cigarette use in the U.S., overall nicotine demand remains stable. In fact, recent years have seen consistent growth, moving from 53 million nicotine users in 2019 to 55 million in 2024. Importantly, those using "smoke free" methods like vaporizers or consumables have gone from 21% of the market to around 33% over that time period.

All in all, total nicotine demand has been growing by around 2% per year -- not overly impressive at first glance, but when you understand how much cash this generates for Altria, you'll quickly realize that 2% annual demand growth is plenty to generate impressive returns for shareholders. That's especially true when you consider that nicotine demand barely budges during economic downturns.

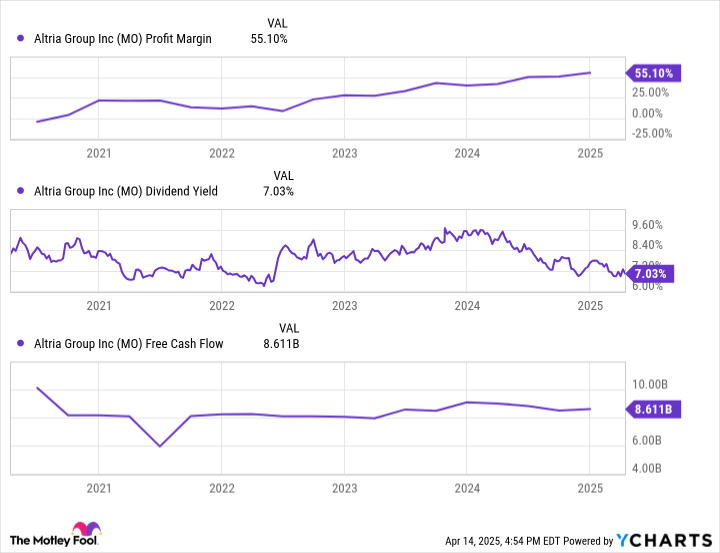

MO Profit Margin data by YCharts

With a market share of nearly 50% in the U.S., Altria has multiple scale benefits. First, it has economies of scale when it comes to the cost of capital and the cost of production. Second, it has greater bargaining power with retailers, given that it controls popular brands that customers remain extremely loyal to, like Marlboro and JUUL. Finally, it can out-invest the competition in emerging categories like smokeless nicotine.

In total, these advantages have given Altria impressive profit margins and huge levels of stable free cash flow -- both of which help support a 7% dividend. Yet shares trade at just 11.5 times free cash flow, equating to a free cash flow yield of 8.7%.

Yes, top-line growth is meager. However, with high profit margins, high levels of free cash flow, strong market shares, minimal exposure to market volatility, and a cheap valuation, Altria Group stock looks extremely attractive in today's market. But will the future look like the past?

Is Altria's success sustainable?

Altria's management team targets an 80% payout ratio. In recent years, its dividend payout has been roughly in line with that target. Given ample free cash flow levels, stable end market demand, and impressive profit margins, it's unlikely that Altria's dividend will become unsustainable anytime soon. The company even produced enough excess cash to repurchase $10.2 billion in shares last year.

All in all, Altria's financial stability looks extremely strong today despite the paltry valuation. Yes, there are long-term threats from non-combustible products. But Altria's ability to acquire emerging competition and grow its own products in that category provides a strong vote of confidence that it will manage this rare category conversion. And remember: Nicotine use is still on the rise; it's only the form of consumption that is changing, leaving Altria squarely in the driver's seat.

Altria shares have periodically gone out of favor with the market, often in periods of excessive exuberance. Despite a correction in early 2025, the S&P 500 remains priced at 27 times trailing earnings. As a slow-growth income stock, Altria isn't the trendiest investment right now. But it's a reliable safe haven for those looking to mitigate their downside risk without giving up long-term upside potential.